Photo: Getty Images

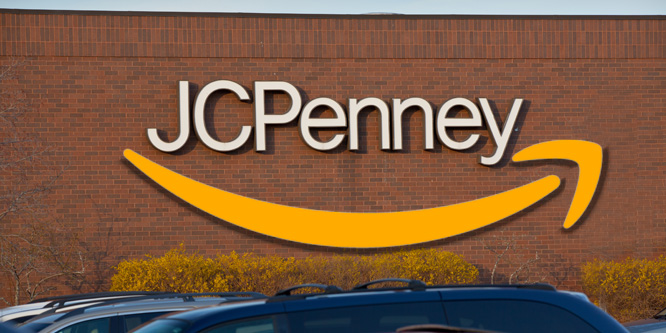

Is Amazon about to buy J.C. Penney?

Amazon.com has wasted no time in pursuing a possible acquisition of all or some of J.C. Penney’s business, according to news initially broken by WWD.

According to one unnamed source, Amazon already has a “team in Plano (TX),” where Penney is headquartered. Why Amazon might be interested in Penney remains unclear, although three potential factors have been raised in the reporting including the e-tailing and tech giant looking to:

- Grow its apparel and accessories sales;

- Turn some of the department store’s properties into distribution facilities; and/or

- Create “a new tech-driven” store model that would make use of its Just Walk Out cashier-free system.

Penney is also likely to be a relatively inexpensive acquisition after filing for Chapter 11 bankruptcy protection and having its stock sales frozen on the New York Stock Exchange.

The department store retailer made clear in its petition to the court that it would have to pursue a sale of its assets if it was unable to gain the support of lenders by July 15 for its business plan. Seventy percent of the chain’s lenders have agreed to date to support its restructuring proposal.

Penney announced it would close 242 of its 846 stores, spin off its real estate as a separate publicly-traded investment trust and push ahead with a turnaround plan put in place by CEO Jill Soltau that focuses on core categories such as women’s apparel along with improved customer service and low prices.

“Until this pandemic struck, we had made significant progress rebuilding our company under our Plan for Renewal strategy — and our efforts had already begun to pay off,” said Ms. Soltau in a statement. “While we had been working in parallel on options to strengthen our balance sheet and extend our financial runway, the closure of our stores due to the pandemic necessitated a more fulsome review to include the elimination of outstanding debt.”

Neither Amazon nor Penney would comment on discussions, if any, between the parties.

Discussion Questions

DISCUSSION QUESTIONS: Would a purchase of all or part of J.C. Penney by Amazon make sense for either party? Would Penney’s likelihood of future success be greater remaining on its own or as part of another company?

Amazon has been threatening to enter the non-grocery market for years, and the opportunity to do it has never been better with J.C. Penney. The fact is, despite good effort by capable people, J.C. Penney is stuck in the department store morass, with overwhelming debt and a bleak future. The pandemic has accelerated many trends, and the demise of the department store is one of them. Amazon acquiring J.C. Penney has the potential to transform the department store category and bring much needed excitement and shoppers to the mall. This appears to be a very interesting proposition for both Amazon and J.C. Penney.

Mark, see my comment: Buy it for the locations, not for the brand equity.

I agree Dick. I don’t believe Amazon should attempt to re-build or run the J.C. Penney brand — rather, re-imagine what’s possible with the physical footprint the J.C. Penney stores occupy.

Amazon is probably the only player that could make a strategic play with J.C. Penney. Who knows what they have in mind with the wealth of options and cash at their disposal. There are a lot of other players who can afford to buy, but may not be able to make much difference to J.C. Penney.

I agree. With cash on hand, Amazon can afford to buy, pick apart, retain and/or spin off. The only thing that I don’t think Amazon can do with the acquisition, is to try to continue to operate in most malls. Malls do not look like a hot prospect for J.C. Penney except for the very few, very good malls.

Outside of the physical store space that could be gotten for cheap and converted to local distribution, J.C. Penney has no assets of value to Amazon or anyone else. The brand has declined into irrelevance and there are no unique differentiators as with Sears’ Die Hard or Craftsman.

The stores are the value.

From a real estate and distribution perspective this makes a lot of sense for Amazon, particularly for last-mile fulfillment in more rural areas. I’d expect Amazon to be looking for lighter pricing reflective of that model, and looking to further develop what could be the retail format shortly thereafter.

YES, PLEASE! It’s a win in every way I can think of. J.C. Penney needs extensive re-invention. It mostly just duplicates other offerings in the mall. The mall, almost every mall, needs extensive re-invention and a new reason for being. I have long argued that Amazon should buy Sears, not for the brand, but for the space — and what Amazon could contribute to a re-purposed mall. Ditto J.C. Penney. Don’t need every single store? Instant warehousing and distribution points all over the country. This makes so much sense. Yes, please.

I believe this would be a good move for both parties. Amazon would get a big footprint in brick-and-mortar and J.C. Penney would get value for their employees and stockholders. The J. C. Penney locations are huge and could function as micro-distribution centers with a showroom atmosphere for popular and bigger ticket items. Given the acquisition of Whole Foods this acquisition would continue a move for dominance in the store arena as we shift from a scan and bag model to a distribution paradigm.

Strategically, this would thrust Amazon into the brick-and-mortar world and I’m confident in their ability to transform the experience to blend online/in-store strategies. From a financial standpoint, I believe Amazon could negotiate a favorable proposition and this may be the only possible pathway for J.C. Penney’s survival (although it would no longer be your grandmother’s J.C. Penney).

When Amazon bought Whole Foods, there was clear overlap between the two companies’ customers (and brand images) at the time and it enabled Amazon’s push into groceries. Further, it gave Amazon a physical footprint that it otherwise lacked. I don’t see the same advantage here, although it’s true that Amazon could buy J.C. Penney for a song.

Yes, Amazon would instantly gain hundreds of store locations around the country (many of them in secondary malls, however) and with an opportunity to reinvent the department store category. But is it a wise use of Amazon’s resources to buy a brand struggling with omnichannel and its own customer demographics? As to “reinventing” JCP, we all remember what happened when Ron Johnson tried to do the same — $4 billion in lost sales in one year, and the company never recovered.

Amazon’s tie-up with Kohl’s in the past couple of years (the return desks, etc.) got the same rumor mill moving at the time, and frankly it would be a better match. In any case, Amazon has the financial resources to do whatever it wants — including buying a bunch of shuttered anchor locations and starting with a blank slate. Maybe that’s the endgame here.

Amazon can get some decent real estate for a steal – they can take the best locations and turn them into laboratories to gain more insights about in-store customer behavior. If they do purchase it, would they keep the J.C. Penney nameplate on the front of the store? Doubtful.

Agreed. I could see a collection of Amazon businesses and “solutions” under one roof, from Amazon Go to books to food, and maybe apparel and home too — but not with the J.C. Penney nameplate when their own brand equity is so much stronger.

You’re absolutely right, Stephen. The J.C. Penney nameplate would only create a shadow from which Amazon could not brightly emerge.

Under no circumstances would I buy J.C. Penney. But I would sure be interested in the property if it were the right price. There is no resurrecting the department store as it is, but the use of the stores by a company like Amazon as mentioned in the discussion makes sense.

Throw that J.C. Penney name away — it is worthless. Forget the department store business model, it is worthless today. Look to the pieces that have value and strategically fit with the future of Amazon’s business.

Given that J.C. Penney was slowly dying pre-COVID-19, this is likely the best outcome for its emergence for bankruptcy other than liquidation. For Amazon, just consider one of the other RetailWire discussions today that posits whether Walmart is now unstoppable.

Amazon, if it does buy J.C. Penney, will be good for Amazon and at a sharp discount to any other combination, including Kohl’s. Kohl’s hasn’t benefited from its Amazon relationship and yet it has a much more viable business than J.C. Penney.

This is a terrific opportunity for Amazon to expand its brick-and-mortar presence at a relatively low level of investment. I view this potential acquisition more for its logistical reasons than for its desire to expand its apparel and accessories sales. BOPIS and BORIS issues confronting Amazon would allow it to expand its omnichannel fulfillment solutions. Walmart is surging, both in-store and online. I see Amazon watching this growth and wanting to participate. However, if Amazon buys J. C. Penney, I expect the stores’ look and operations to not resemble at all what a current J.C. Penney looks or operates like.

There are many potential reasons being thrown about for why Amazon would buy J.C. Penney, but the only one I see holding any water is a real estate play that could be used two ways:

What we’ve seen so far of J.C. Penney’s turnaround plan doesn’t demonstrate enough impactful change to do much more than drag out the inevitable conclusion, similar to Sears. Although I still don’t see this as an ideal scenario fo Amazon, it’s an interesting possibility.

Big stores just are not the future of apparel and home goods retailing. Amazon would be better served buying the post office.

J.C. Penney for Amazon? I don’t see Amazon tying itself to the J.C. Penney brand. It looks like Amazon via COVID-19 may finally have willing designer brands stocking the digital aisles of Amazon.com. Finally, possibly, courtesy of a partnership with Vogue and the CFDA. Designer brands — the final Amazon frontier in apparel. So back to the old J.C. Penney stores, many decked out with the vibe of a 1960s government institution. As it turns out Amazon has ensconced itself as Global Amazon, retailer to the world. If Amazon buys J.C. Penney, it can fix up the stores and sell to the masses. Designer fashion brands? Looks like a couple of retailers, laden with designer brands, may be on the chopping block — an opportunity for Amazon?

Over the last few years there have been multiple rumors about Amazon buying other retailers — Morrisons – a U.K. grocer was talked about as well as Ocado, but there were others.

Rumors are just rumors but there is rarely smoke without fire. What went wrong in those times is unclear — cost, or rather potential value from dollars invested, could have been an issue.

As for J.C. Penney — it has good sized stores, they’re strategically located, there’s space around them and there is some serious potential to combine physical browsing with local rapid fulfillment centers. If this is more than a rumor then that could well be the angle.

Amazon already made their intentions known that the physical retail space is an area of growth for the company — with their Whole Foods acquisition and the emergence of the Amazon Go convenience store model. However the department store segment has its own set of challenges and any conversations regarding acquiring J.C. Penney have to consider the struggles the sector has faced, the sheer amount of retail space, and the changing consumer behaviors away from the department store.

On the surface, this would be an interesting market penetration strategy for Amazon. However, J.C. Penney is a brand that has faced years of operational challenges, has a lack of brand equity, and while their store footprint is still significant, a fleet optimization exercise is necessary to right-size the organization, make the necessary technology investments, and bring the right talent and capabilities in-house.

Walmart just won the lockdown — which kind of proves that while we talk about “last mile” issues, Walmart has solved the “all the other miles” issue and, and has a really great supply chain. As necessary, for the short term, they can throw bodies at getting the last mile done.

So if Amazon is going to J.C. Penney for clothing and more, I think it’s a good idea. Stores matter. Dark ones and light ones. If they’re just doing it for the apparel, not so much.

One does wonder what happens to its Kohl’s deal if the buy happens, though.

Amazon has shown an interest in both brick-and-mortar and apparel in the last couple of years. From its Amazon Go stores to developing its own clothing brands, its interest in J. C. Penney could be a combination of that, or something else entirely. If there is anything Amazon has done extraordinarily well in its 25 plus years, it’s disrupt industries.

A brilliant old department store retailer once said to me: “most of the time, when a big store goes bad, it has the same effect as a skunk does after it sprays, and it lasts a long time.” For Amazon securing J.C. Penney locations for distribution, it’s probably a cheap deal. To sell retail out of? It needs a big and expensive differentiation strategy. I don’t think this will/can affordably happen.

The only way J.C. Penney makes it through this bankruptcy is through acquisition. They just lost their seat in the latest round of “Department Store Musical Chairs.” That being said, the news that Amazon may be interested in a purchase of J.C. Penney is a little bit of a head-scratcher. I keep asking myself, What am I missing? I just can’t figure out what of value Amazon would be acquiring with the purchase. The J.C. Penney business model is broken. Their assortments are no longer relevant, the merchants are still married to a vendor support model to meet profit targets, the customer base is aging and shrinking and their distribution network is slow. The only value I can see for Amazon is an immediate physical footprint in largely undesirable retail locations that still have some value in the actual real estate. This isn’t like the Whole Foods acquisition where Amazon achieved instant entry into a growing business with valuable customers from which they could mine data. There is no room in the apparel business for another undifferentiated ”me too” mass retailer. Amazon better have a better proposition than a remade J.C. Penney if they want to win in the physical space against Target, Walmart, and the off-price three headed monster of Marmaxx, Ross, and Burlington.

At some price, the Amazon acquisition of J.C. Penney will make sense. Amazon could use the J.C. Penney stores for apparel and other retail items that shoppers would like to see or try on in the store. It would also provide them with additional distribution space. However there will be a limit to what Amazon will pay in order for the acquisition to make financial sense, and I suspect it will be on the low end of valuations. J.C. Penney is more likely to be successful as part of another company to provide a clean break with J.C. Penney’s current legacy image.

You know, we just haven’t seen Amazon really blow up in physical retail yet, even when they could (Whole Foods, 4-star, Amazon Books, Amazon Go, Amazon Fresh) — they seem more apt to test and learn from physical rather than having as many units as J.C. Penney has. Now if they want them for their new pick-up and deliver only model, that would be more in line with their culture. In any case, if they took action it wouldn’t be business as usual with J.C. Penney, which is OK by consumers apparently!

If it happened, it would be a win for almost everyone. Starting with employees, customers, and landlords. It is a loss for some vendors and the competition. It just makes Amazon stronger.

Wow, J.C. Penney is unfortunately done — but this gives Amazon a local position adjacent to MANY customers for last-mile fulfillment, and a pick-up opportunity also! It may give Amazon a few more large fullfilment center locations as well — More regional in relation to J.C. Penney warehouses. And they would be able to OWN and control a lot of the real estate as theirs –no rent. Also, J.C. Penney does actually have some well-liked private brands and there might be something salvageable there (St. Johns Bay, Claiborne) And YES — as others have said — a few of the stores in more tony areas (King of Prussia for example) could become Amazon hubs with Amazon offerings within! This has potential! And this would be an unbelievable bargain! Finally, perhaps Amazon could employ some of J.C. Penney’s 90,000 workers — that would be best of all!

Amazon does not need the J.C. Penney name. As a matter of fact (to me), the Amazon name is stronger these days. So what does Amazon want with J.C. Penney? The space in malls where they have to pay significant rent? Do they need J.C. Penney to jump in the retail clothing business? Both answers in my view are no. But what if Amazon changed all the store names to theirs and used the locations like a department store to show and sell merchandise that is hot on the internet or Amazon’s website? Here I see some value. If they choose to stay in the secondary malls they can use their name strength to renegotiate better lease terms. Probably the same in the higher end stores.

I think this is ignoring the anti-trust issues that are facing Amazon. Retaining the J.C. Penney name would at least provide some PR cover. Plus, the intention to license Amazon GO! technology to non-Amazon retailers would fit right into all this!

One of the only things Amazon is really missing is a legacy. The next-gen zeitgeist calls for apparel retailers with history and physical roots. This move could give Amazon the old bones the retailer needs to build a strong foundation in the fashion industry, but to appeal to nextgens, Amazon needs to prove its apparel offerings have heart. It should focus on showcasing some of the SMBs and artisans on the platform as well as its own (cheap but vapid) private label brands.

Opinions about what Amazon should do or will do are like… elbows — everyone has a couple.

An Amazon acquisition of J.C. Penney has another perspective: Sears. No one thought Sears would be around anymore and especially with today’s pandemic-driven world, Eddie Lampert is either panicked about burning up his cash or gleeful that the next phase of his strategy to gut Sears will accelerate(?).

Nevertheless, if Amazon acquires J.C. Penney for any of the postulated purposes, there is no doubt that it will hasten Sears’ demise.

Acquiring the real estate and top talent is a smart move at a bargain price. Sadly, the JCP brand and value proposition are valueless — so Amazon has carte Blanche to use sites for distribution and experimenting with new retail concepts.

Even a major-mall Penney’s location has only two dock doors and maybe two freight elevators? Without some serious remodeling/demolition + rebuild investment, I don’t see an easy path for turning store sites into micro-fulfillment centers, as appealing as it would look on a map. Even on a small scale, there would need to be some staging space for semi-trailers and docking areas for local delivery vehicles. These would also need to be 24-hour operations; for big malls this might not be a zoning problem, but for mixed developments there may be noise issues.

They’re also large — 100-200K gsf is common — spread over several floors and, as you note, configured to fit into a retail complex more that stand alone access. The argument to do this “for the real estate” brings to mind the same claim made for the Sears acquisition … and THAT went all so well, didn’t it?

There’s a big difference between “part” and “all.” The former would certainly make sense as there’s likely to be a property or two of interest among the hundreds of stores, distribution centers, warehouses and office buildings. “All” is another matter; it might be argued this would be a somewhat bigger version of Whole Foods — absent a headline grabbing former founder — but there’s the large difference that WF was generally doing pretty well, JCP obviously isn’t.

I’d have to know more about Amazon’s plans to comment if they make sense but from the view of Penney, it’s apparent any alternative (in which they remain independent) is fraught with peril.

Amazon hasn’t exactly done that well with Whole Foods (the stores had better quality control back when the company was on its own and the pricing seems as high as ever now).

So I am not exactly sure Amazon is exactly some kind of pro at physical store retail. There seems to be a lot of faith in them, but really what is their track record in physical store retail?

The only thing that may have some value with JCP for Amazon is some of the private label clothing brands. Even that, I am not sure, how much value it has. Given JCP’s huge missteps in the women’s clothing category over the past 5 years, I am not even sure how much value is there. For those who post here, how many women’s clothes have you bought from JCP in the past 5 years, 3 years, 2 years? Yeah, I thought so. And that is why the racks are overflowing in that department. Nobody is buying.

The JCP brand itself, store operations, and merchandising approach needs to be taken out back and burnt because it has been broken so long that it cannot be repaired. So with that said, if Amazon is planning anything here, they need to basically do a 100% renovation of the stores (including the exteriors) and rebrand them to something else.

I think JCP would be a distraction for Amazon more than a benefit.

Kohl’s would be a much better merger partner for Amazon. Kohl’s is closer to Amazon’s customers (families in suburbs). JCP’s mall locations, while many of these malls are centrally located, are not in a place where people go every day. Kohl’s average store size is smaller and a single floor footprint while JCP has many large 2 floor stores. I guess you can convert the second floor into a warehouse but warehouses need high ceilings and then there is the issue of moving items “up and down” — yes you can get a lift, but it adds time and inefficiency.

From a go-to-market and commercial perspective only (i.e. excluding all the back-end operations and logistics), there are several potential benefits to such a partnership.

It could end up being a win-win as Amazon broadens their range in categories, and J.C. Penney is given the ability to meet current consumer demands and needs.