Technology is important, but trust is essential

Through a special arrangement, presented here for discussion is a summary of a current article from the Retail TouchPoints website.

We talk a lot about omnichannel retail and giving today’s shoppers every option when it comes to product ordering and delivery. But what is really at the heart of retail success is establishing a trusting relationship with customers. It sounds simple, but it’s not.

I recently attended the Money20/20 conference in Las Vegas where there were a lot of discussions and questions around data security and payment innovation. Are retailers implementing EMV? How can we make mobile payment work at the drive-thru? What are the steps to speeding the checkout process, both online and in the store? These are all great questions and need to be addressed, but when it comes right down to it, they all lead to trust.

"Trust is the cornerstone of commerce," said Patrick Gauthier, Amazon’s VP of external payments, in one panel discussion. "It is not about technology. It is not about product. It is about who consumers will trust" — with their hard-earned dollars as well as their personal information.

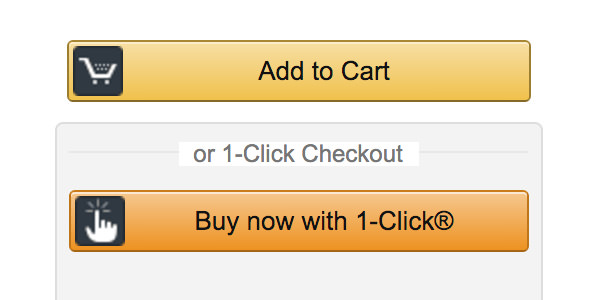

The path to building trust is different for every retailer. It is paved with the overall brand promise. Amazon, for example, is focusing on decreasing the friction during online checkout in order to increase the percentage of shoppers finalizing purchases. "On an average site, only 35 percent of shoppers who begin the checkout process will complete a purchase," Mr. Gauthier noted.

Source: amazon.com

To embolden shoppers to impulse click with a buy button, they will need to believe their personal information is secure and protected. To motivate shoppers to opt into the app that will sense them as they approach the drive-thru or identify where they are dwelling inside the store, retailers will need to build brand trust.

This trust will translate to easier and more seamless retail activities. In one example, Phillips 66 is testing a solution that will alert drivers when they are running low on gas. As the driver pulls up into the Phillips 66 station the mobile app will initiate payment upon fueling and record loyalty points — all without a swipe.

While retailers are in the process of implementing EMV, tokenization and end-to-end encryption, as well as other new customer service technologies, they are aware that there is never a 100 percent guarantee of security. Data breaches will occur. Criminals get smarter and trickier. Those are facts that will not change. To retain customer trust, it’s important for both consumer-facing and B2B companies to remain above board when it comes to questionable activities.

Keep working at building and securing a trusting brand relationship and your customers will keep coming back.

Discussion Questions

Which customer-facing technologies are most sensitive to trust issues? How can retailers build trust with their customers with regard to tech advances such as mobile pay and personalized offers?

For me this is an easy answer. Consumers have little-to-no skin in the game with regard to data breaches (the Target data breach was the only exception, which was handled horribly, but even that pain was temporary — limits on debit card transactions).

Personalization always runs the risk of intrusiveness, and consumers have a LOT of skin in the game when it comes to privacy. When someone says something to me like “beacons are the new cookies” and i think about how freaked out some of my less tech-savvy friends are about re-targeting, it makes me think we are really out of touch.

I would dial back the re-targeting a LOT … which means more than letting consumers know your site is using cookies, presuming shoppers know the implications. It’s like a EULA — just something most people click through. So my vote is strongly on the side of personalized offers.

Security of personal information and financial assets are always going to be an important ingredient for success as retailers dive deeper into private label payment systems and the collection of shopper data.

The good news is that the supporting banks and the current credit system have been far from perfect in that regard, and shoppers will likely not see much more inherent risk in working with proprietary retailer systems than they do with Visa, Mastercard, Discover and AMEX.

With that said, retailers who want to play in this area should understand that it is incumbent upon them to invest in the latest and yet most shopper-centric security technology. Cutting corners here would be disastrous. It only takes one “Target” type security breach to wreck the ship and undermine consumer trust, yet it will takes months and even years to regain.

Trust and reputation are huge attributes that must be managed consistently. In addition, technology and touchpoints need to be consistent in the way they are delivered. In your example of the Phillips 66 pre-pay system, while technology speeds up the transaction safely, if the station itself is hard to get into and out of, if poor lighting or the neighborhood makes it too dangerous to get out of the car, or staff behind the glass wall are unpleasant, the best technology by itself won’t build trust.

Trust is irrelevant in the absence of risk. No risk, no need for trust.

If you really want to work on building trust, rank-order a list of things that are risky — from the customer’s point of view. Begin in the parking lot (or the home page) and examine every customer touchpoint right through selection to purchase (include mobile pay, privacy issues, etc.) and beyond to returns, from a trust perspective. How risky is each touchpoint to the customer?

Then, if you’re really serious about this, ask several customers in different demographics to rank the risks. I think you’ll find that we are defining risk and trust from OUR perspective, what WE think the customer thinks is risky. This article assumes the greatest risk for the customer is technology. That may not be so. The UX User Experience website notes: “our study revealed that participants felt there was little actual risk within their mobile commerce experience, regardless of true risk.” Of course that was in their own self-interest and they gave no actual data, but that conclusion sounds reasonable. Perceived risk is always more influential than actual risk.

If we can make the trust issue about technology, we can avoid the truth that trust is always about us, about people-to-people relationships.

I needed to have someone look at my new cell phone. But was the place busy? Would they actually help me if I drove the 20 minutes to where I got it? I discovered their phones are always answered by a call center which, of course, didn’t have a clue about how busy the place was. Up went my risk and I had a question about trust. Do I go or do I stay?

My therapy for stress is to buy a Cinnabon at the airport. The risk/trust factor is “Will my Cinnabon be fresh and warm?” I’ve missed flights waiting for the tray to come out of the oven. A simple sign “Guaranteed: Always fresh, always warm!” would be so reassuring and increase my trust level.

In summary, we have less trust in people than we do in technology. With technology we feel there is little choice. With people we are more in control of who we trust or do not.

Invasive and/or undisclosed tracking in retail via phone tracking or facial recognition, and anything that the customer isn’t allowed to initiate or asked to “opt in” will erode trust much faster than it can be built or rebuilt. Build trust by letting the consumer control the terms of engagement.

Trust and technology are related largely as a function of data collection, usage and yes, security. More than anything, customers are increasingly intolerant of brands collecting their data and failing to create value with that data.

As Gartner has eloquently stated: “Customers will not tolerate companies that have amnesia when it comes to remembering them and their preferences for recognition.

[They] …believe that they have a relationship with a provider once they have transacted with that provider…the experience should be mutually beneficial, and therefore designed with them in mind — similar to most relationships.”

The payback to customers for collecting their data has to be a better customer experience, more relevant communications and generally making customers feel that brands are paying attention to them. That all requires technology but more than anything, it requires leadership and customer commitment from brands.

I think anything involving a credit card often puts customers on high alert. This is mostly due to the constant news surrounding data breaches at retail stores.

I think the quickest way to build trust with consumers is to give them time, as paradoxical as that may seem. Ensure safe, secure databases and platforms — whether that is through the cloud or something else. As customers have pleasant experiences, word-of-mouth will do the rest.

Personalized offers need to be relevant and use data that consumers have given — knowingly given. A quick way for retailers or brands to appear sneaky or ill-intentioned is to use information about customers that was not clearly offered by the customers themselves.

Trust creates loyal customers — although this may seem obvious, technology and other trends are essentially useless to consumers without a foundation of trust.

Nothing could be impacted more by the trust-factor than digital wallets. The core business case of speed, convenience, security resonates with consumers, but how do consumers decide which of these apps to download and test?

Most consumers are not going to adopt and use multiple wallets on a regular basis. They may only try one or two. Downloading and trialing a payment app is unlike any other form of app that a mobile user will engage with.

The reputation of the brand offering the app, the breadth of acceptance at merchants, and ease of use all impact the trust factor.