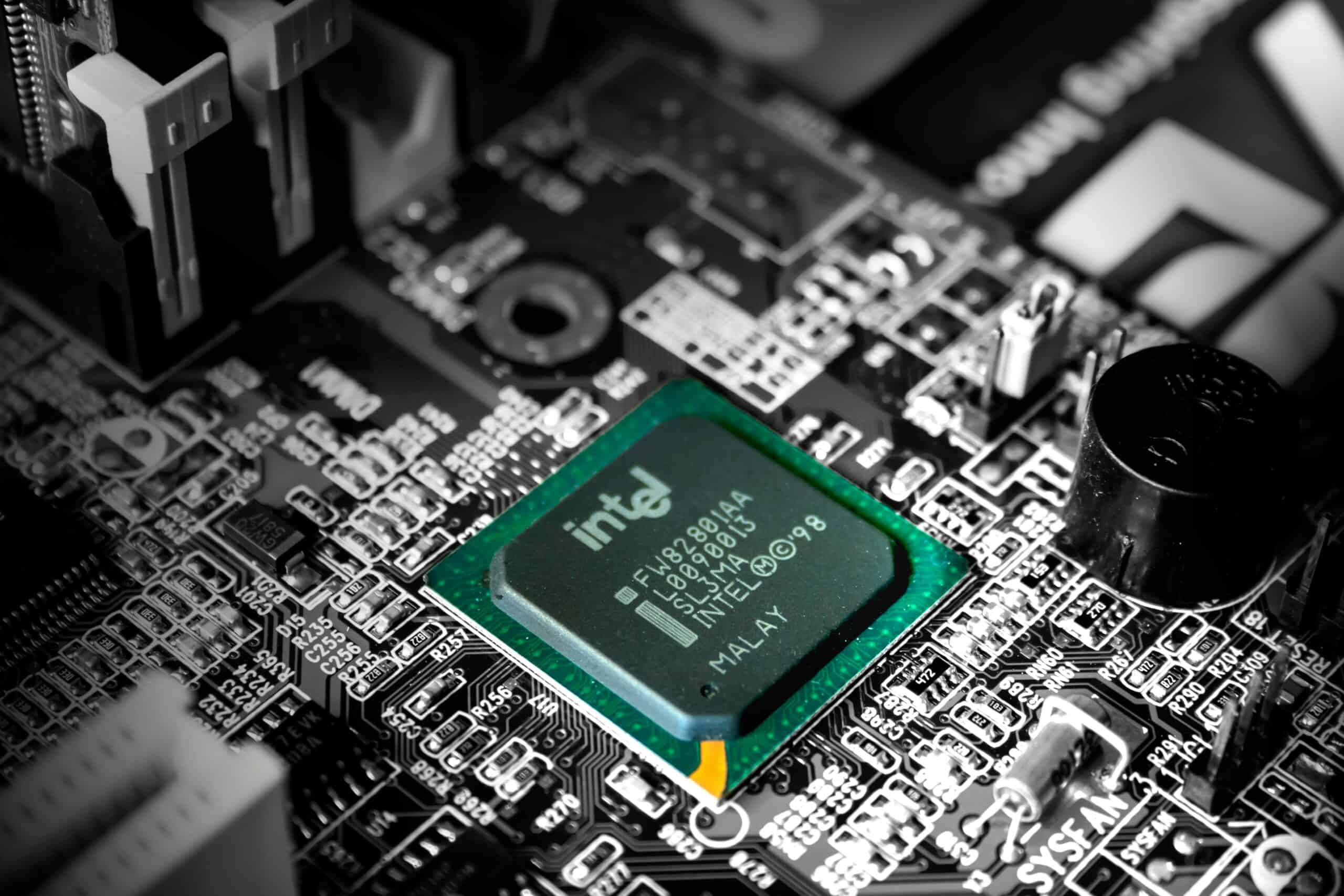

Photo by Slejven Djurakovic on Unsplash

Intel Releases New AI Chips as It Sets Out To Regain Market Share From Rivals

June 4, 2024

On Tuesday, Intel introduced its latest artificial intelligence chips designed for data centers, aiming to challenge competitors Nvidia and AMD. This announcement comes shortly after both rivals unveiled their own new chips earlier this week.

During the Computex tech conference in Taiwan, Intel CEO Pat Gelsinger announced that the new Xeon 6 processor will significantly enhance performance and power efficiency for demanding data center tasks, overtaking the capabilities of its predecessor.

The announcement follows Intel’s release of its 5th Gen Intel Xeon processors for data center tasks six months ago and the release of the Gaudi 3 processor for AI model training and deployment two months ago.

At the conference on Tuesday, Intel also stated that the price points for the Gaudi 2 and Gaudi 3 AI accelerators are less than the prices of competing chips.

Gelsinger said, “Customers are looking for high performance, cost-effective gen AI training and inferencing solutions. And they’ve started to turn to alternatives like Gaudi. They want choice. They want open software and hardware solutions and time to market solutions at dramatically lower TCOs [total cost of ownership].”

Intel is striving to close the gap with Nvidia and AMD, following a period of limited action in the AI boom. This surge saw major tech companies such as Meta, Google, and Microsoft acquiring a significant number of Nvidia chips.

Each year, Nvidia and AMD regularly release updates for their data center chips. Recently, Nvidia unveiled the “Rubin” chips, which will follow the “Blackwell” model launched in March. Similarly, AMD has announced plans to introduce new Instinct accelerators every year up to 2026.

In contrast to Nvidia and AMD, which focus solely on chip design, Intel both designs and manufactures its own chips. Despite this integrated approach, Intel’s factory division has faced challenges, reporting a significant operating loss of $7 billion in 2023, up from the previous year’s deficit.

Recent News