Investors: McD’s turnaround plan lacks sizzle and steak

When Steve Easterbrook was named McDonald’s CEO in January, just about everyone paying attention agreed the company needed to reinvent itself to reverse slipping customer counts and comp sales. So what happened yesterday when the company went public with its "initial" plan to turn its business around? Mr. Easterbrook focused primarily on a reorganization that will save $300 million, leaving many investors asking, "Where’s the reinvention?" At the end of the day, McDonald’s stock was down 1.7 percent.

As to some of the specifics, Mr. Easterbrook emphasized McDonald’s new operating structure is intended to make the organization less bureaucratic and more responsive. The company will be grouped in four market segments:

- U.S., which accounts for more than 40 percent of the company’s operating income;

- International Lead Markets, which include Australia, Canada, France, Germany and the U.K., also representing about 40 percent of McDonald’s operating income;

- High growth markets, such as China, Russia, South Korea, and European countries, including Italy, the Netherlands, Poland, Spain and Switzerland that currently are 10 percent of the company’s business;

- Foundational markets that have room for development using McDonald’s franchise model.

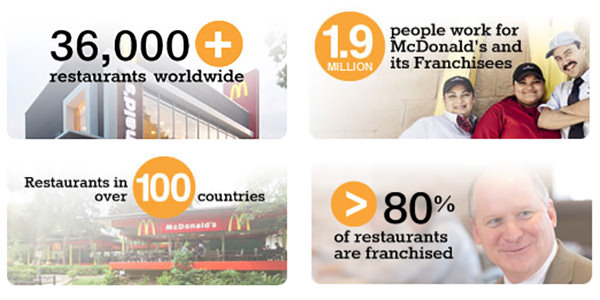

Source: McDonalds – “Quick Facts”

Speaking of franchises, part of the plan includes McDonald’s selling 3,500 company-owned restaurants to franchisees by the end of 2018. The company had previously set a goal of refranchising 1,500 restaurants by the end of next year.

McDonald’s chief administrative officer, Pete Bensen, said the company was looking for 90 percent of its global restaurant base to be franchised. "Our new, more heavily-franchised business model will generate more stable and predictable revenue and cash flow streams and will require a less resource-intensive support structure," said Mr. Bensen in a statement.

- McDonald’s Announces Initial Steps In Turnaround Plan Including Worldwide Business Restructuring And Financial Updates – McDonald’s Corporation

- McDonald’s Turnaround Plan Webcast – McDonald’s Corporation

- McDonald’s aims to save $300M annually through reorganization – Nation’s Restaurant News

- Why investors are disappointed with McDonald’s latest fix-it effort – Crain’s Chicago Business

- McD’s makes a change at the top – RetailWire

Discussion Questions

Do you think Wall Street was expecting too much from McDonald’s management considering the length of time Steve Easterbrook has been CEO? What are you expecting the company to announce next as it moves beyond these “initial steps” in the plan?

Wall Street always expects too much. In the long run I expect any moves McDonald’s makes will be lateral for the consumer. They might improve the financial situation but the consumer won’t be impressed. If McDonald’s wants to improve their image, forget about changing personnel at the top but start changing what the consumer sees at the bottom.

McDonald’s will have to do something unique to bring in more customers, and as of now it seems unlikely. They are huge, and even a 2 percent growth rate is enormous in terms of dollars, so unless they upgrade their burger line to attract foodies or add something really exciting to the menu, it will be difficult to get new faces in the door.

I went through the drive-thru Sunday to get my wife a Big Mac and a small fry and paid $5.35. To me that is another problem as the value proposition is no longer there, and the Steak and Shake down the road was packed, with their $4 meals. As costs for labor and meat go up all fast food chains will feel the pinch, as consumers could care less where they get the cheap food from for their kids. How about a half pound gourmet Angus burger with a delicious pretzel bun, or sweet potato fries and a better milkshake? I could go on but, to me, McDonald’s needs to upgrade their menu to get the real foodies back in, and I don’t see it happening.

No, I think investors were rightfully expecting a more comprehensive plan that involved improving the customer experience, menu selections and perhaps the deployment of new technology that might impact both.

One of the unique problems with large international companies like Walmart and McDonald’s is their ubiquity and familiarity. When the majority of the investor community has done business with you, even the investors have opinions about what ails the organization and expect something to change.

Re-organization is no longer enough for companies like McDonald’s to rescue stock prices or increase buy recommendations. To steal a phrase from a competitor, investors are asking — “Where’s the beef?”

If Wall Street believes they need some reinvention, restructuring isn’t it. Yes it may be good for the bottom line, and that’s not a bad thing, but none of this is going to bring in more customers.

If Wall Street was expecting a turnaround at all, they were expecting too much. McDonald’s has nothing to work with. While it has been one of the greatest banners for the value of a brand, it is now experiencing the downside.

Brands have value because they mean something. McDonald’s has a very, very specific meaning in the consumer’s mind. It spent billions over the years solidifying that meaning. Today, what McDonald’s stands for is “pass.” To turn that meaning around, it will take billions, yes, billions more in spending, and even then failure looms.

Seriously, what can this company do other than selling off franchises and making it someone else’s problem?

(Notably, my students think if there is one company that will not be in the DJI30 in five, 10 or 15 years, it will be McDonald’s.)

Maybe McDonald’s should work on rebuilding their brand by attacking their age-old menu and adding items that will attract new faces to their doors. There is not much value in what you get for the dollars spent anymore. Possibly restructuring from the inside out at the corporate level is seen as the more important priority in order to improve the face of the franchise. The old adage “you can’t turn the Queen Mary around on a dime” holds true here. McDonald’s is simply too large with too many bosses.

Perhaps Wall Street was expecting too much, but from the details cited, it sounds like the changes are “cosmetic” and not dealing with the real issues (as Mark Heckman says: “I think investors were rightfully expecting a more comprehensive plan that involved improving the customer experience, menu selections and perhaps the deployment of new technology that might impact both.”)

I have a strange feeling that this is Ron Johnson redux, only at McDonald’s instead of J.C. Penney.

The answer for the profit taking dilemma in the McDonald’s empire is simple. There is none. Streamlining is what you do when there is less and less money to pay the bills. This is something everyone, outside of government(s), knows by now thanks to a malignant economy. The most interesting news in this discussion article was how the company wants to divest to a store ownership of 10 percent or less from the current 20 percent. Maybe they don’t have much faith in the leadership either.

McDonald’s, a company built on offering consumer value, no longer offers consumer value. Pricing is too high, especially in relation to food quality. Years of focus on Wall Street’s need for short-term building of the bottom line has cost them the growth they need on the top line.

I do think Steve deserves more time. However as the new leader he needs to act boldly, not incrementally. It appears that his initial focus, reorganization and selling 3,500 units to franchises, will save millions of dollars. However, more needs to be done to address the changing competitive array and the needs of more demanding consumers.

The rise of better burger options, e.g., Five Guys, and the growth of the fast casual options like Chipotle with their emphasis on fresh, makes for a challenge to McDonald’s as well as the other traditional fast food operators.

In addition, McDonald’s needs to simplify its menu and address the changing consumer behavior of five smaller meals in place of the three traditional day-parts. To this end, the breakfast all day experiment may prove to be very successful. Likewise, the afternoon mini-meal is currently an open space for most foodservice providers.

Further, though late to the game, the Manhattan delivery test could be a critical piece of the puzzle going forward.

McDonald’s 75-year legacy of innovation and reinvention needs to move front-and-center if real growth in sales and profits are to return.

Maybe it’s just me—okay, with 2/3 of us giving “D” or “F” I know it isn’t—but there’s something counterintuitive about a plan which equates “less bureaucratic” with “group(ing) in four market segments.” As Wendy’s—that nimble competitor that represents a direction McD’s might want to take (but probably can’t)—once asked: where’s the beef?

They seem to be doing better internationally. Maybe they should focus more there. The US operation has lost its way. Quality is poor, fries often undercooked, prices outrageous. In the West, I see Big Macs $4.49 and Medium Fries $2.49.

These moves seem to be financial moves, not ones that will help operations or sales.

But keep in mind, they are a cash cow and still very profitable, with excellent real estate.

He needs to make changes, but it’s not like there is such a big hole in this ship that he has to worry about it sinking. He can afford to take the time to gain some knowledge and study the organization from within before making drastic changes.

This is a good move and yes, investors just look for news that increases share value, not necessarily building a better business. Let’s give him a year before judging.

Expect more benefits for shareholders. Don’t expect much soon (or later) in product innovation.

Looks like the financial side of Mr. Easterbrook is in gear well before his merchant side (if there is one).

All in all, not a bad plan to buy time.

I believe McDonald’s needs to get back to the basics. Their service is far below the “fast food” threshold in terms of speed, which is certainly a turn off to such a fast paced society. The quality of food they could brag about before is now a thing of the past. Their franchises need facelifts and remodeling desperately as many of them in my area contain the original tiling and wallpaper that is damaged or stained beyond belief.

At the same time, while they polish up the basics, they need to appeal to the young and upcoming. Perhaps a lounge area as a place to hang out or study would go ever well in heavily populated college areas. Customers would pay a membership fee and would have access to the lounge area and Wi-Fi.

As far as healthier foods go, I don’t see a healthier selection being the cure to their declining bottom line. People go to McDonald’s when they want to splurge; let Subway tend to the health gurus. I do believe McDonald’s needs to boost the quality of meat as well as the quantity. Naturally raised beef would likely go over well as an alternative option, but to focus on salads and wraps is a waste of money when you are classified as a fast food hamburger restaurant.

Unfortunately, the new generations require change. As the original McDonald’s generation shrinks, they need to capture new customers and refigure their target market.

The highly anticipated turnaround plan is simply underwhelming. If McDonald’s is committed to reinventing itself as a relevant brand for today’s consumers, the strategy needs to show courage. More importantly, it needs to show customer-facing innovation. Aligning stores into a reorganization is hardly customer-facing.

MCDs needs to focus on growing their customer base away from just new franchises, and increasing their reach through new foods (where are the hot dogs?), expanding their standardized foods which their competition keeps using against them (great burgers with lettuce, tomatoes, onions, etc.), and better understanding their customers (yes, they do want breakfast all day…or burgers all day…).