What’s holding back data-driven supply chains?

A new study has found that the forecasting techniques most commonly used by wholesalers are often outdated and lack integration of more advanced data analytics.

Blue Ridge, a provider of supply chain solutions, surveyed more than 100 NAW (National Association of Wholesaler-Distributors) SmartBrief readers and Blue Ridge customers on their 2018 challenges.

Of those surveyed, 37.4 percent said their biggest challenge in the next three years would be complex demand patterns. That was closely followed the 30.6 percent who agreed that demand volatility from new competitors, customers and digital e-commerce would be their biggest challenge.

One finding was that increasingly complex demand patterns — largely caused to the expansion of online selling — are making it necessary for firms to hold more inventories. Unfortunately, while increasing on-hand inventories should address volatile demand, the increase is failing to translate into higher sales and at the same time increasing working capital.

“This could be driven by several factors,” Blue Ridge wrote in its report. “Because demand is more complex, supply chain managers simply can’t increase inventory across the board. Traditional approaches like rule of thumb and gut feeling normally lead to increased inventory and may not actually help improve sales.”

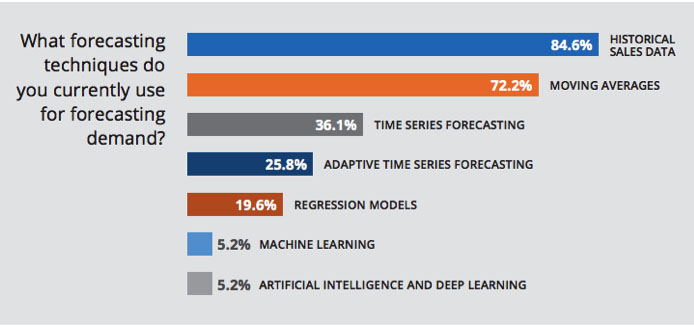

Another finding was that traditional demand factors, such as price change impact (used by 75.3 percent) and programs or promotions (71 percent), are still driving forecast models that are often critical to managing promotions. Only five percent use advanced machine learning techniques and artificial intelligence to forecast demand.

Asked which strategic capabilities they most valued in inventory planning and optimization solutions for their organization, the top answer was rich analytical capability, 39.4 percent; following by provides customer insights, 26.3 percent; automation, 20 percent; intuitive user interface and workflows, 16.1 percent; and tools to collaborate with suppliers, 12.1 percent.

Overall, less than 35 percent felt their organization was using analytics effectively to management inventory.

The study concluded that more sophisticated techniques, incorporating advanced machine learning and Big Data strategies, can better incorporate price changes, type of promotions, event dynamics and weather influences to enhance the accuracy of forecasting.

“Order promising, increased availability, reduced delivery or shipping time, and returns management are becoming less of a differentiator and basic expectations,” Blue Ridge wrote.

Discussion Questions

DISCUSSION QUESTIONS: Is demand volatility caused by online selling overwhelming retail’s traditional forecasting tools? Is infusing analytics into the inventory management process a bigger hurdle than into merchandising, marketing and other areas? What are the unique pain points in such implementation?

I don’t think it’s about demand volatility, so much as it is about demand granularity. Demand has always been volatile, it’s just that retailers had only so many channels (stores) to serve as aggregation points of demand. But now, more granular demand — not aggregated into stores, but at the individual customer level, expressed in many more channels than they had before — is much more highly visible.

The margin of the future is “in the margins” (ha ha) — if you’re forecasting to the aggregate, you’re leaving a lot on the table, and there is no tolerance in margins for the inventory and the mistakes it makes to operate at that summary level. The future is not analytics or AI — those are the tools. The future is understanding individual demands as closely as possible. Granular.

You mean understanding individual demands using analytics, right?

All data is historic, but actionable insights and reporting closer to real time must impact supply chain management as it integrates with marketing forecasts. While the big sweeps of consumer consumption can satisfy the larger requirement, special promotion, product buzz, consumer trends and even factors such as weather and consumer economic confidence levels must also be factored.

One cause of volatility is the growth of “ship from store” fulfillment of e-commerce orders (rather than shipping from a dedicated distribution center). This makes it harder to track sales and inventories at the individual location level, and makes replenishment more unpredictable. If e-commerce order fulfillment is totally randomized from one brick-and-mortar location to another (depending on who has the goods in stock and the costs of shipping), the customer looking for something on an actual store visit is more likely to be disappointed.

The short answer is YES, eCommerce demand volatility IS affecting demand planning and forecasting tools. The largest pain point is around the integration of enterprise, contextual and third party data sources to better inform the decisioning in product assortment and inventory from various systems across an enterprise (and outside the enterprise).

But not only is integration with other data sources tough, the speed and volume in which it needs to be managed and analyzed can be challenging for those that do not have a solid and agile “Data foundation.”

But, I believe it is easier to deploy solutions for improving forecasting and planning using new data and analytics technology because the data is fairly structured and can be automated, versus the marketing and shopper channels which are much more real-time and finicky (shopping behaviors and preferences captured analyzed and responded to in real time with the real risk of negative CX repercussions).

Not easy, but certainly doable with the right data and analytics solution partnerships.

It’s not just infusing predictive analytics into the inventory management process, but embedding machine learning into the forecasting and replenishment models applied by retailers.

Supply chain is an area of fast changing processes and introduction of new technologies. The rate of change in this area is high and historically, the core competencies here have been on optimization of existing processes and not on introduction of new processes. That makes it more challenging, but not materially different from merchandising or marketing in this age of the intelligent enterprise.

The tools do exist and have early adopters. They’ll become even more critical in creating new paths to success that protect the top line and deliver on bottom line efficiencies.

Yes volatility has gone up due to digital sales. They can drive your returns through the roof, and it is harder to peg demand sources, and signals. But one of the greatest challenges to adopting more sophisticated forecasting methods is a clear understanding among forecasters, category management, and supply chain analysts.

An approach to this analytics hurdle for intelligent demand planning systems, like that of JDA and BlueRidge, is to take small steps and educate one step at a time. It is shocking to see how little regression models are used, and these are NOT that difficult. The question also is how well do the AI systems forecast small run rate SKUs. Not all SKUs and business segments have thousands of shipments per month. Some are in the hundreds or even tens (for large ticket items). It is important to address both the major SKUs as well as the small ones. As a category manager, you don’t have a choice in your SKU sets … and you need tools to deal with both ends of the spectrum.

As long as retailers plan their assortments based on where demand was fulfilled rather than where it was generated, the best forecasting systems in the world will not help them.

Many trends are intersecting to make it more difficult to predict and respond to demand. Consumers are more fragmented, shopping patterns are more irregular, there is more competition including from niche players, and the number of distribution channels has exploded.

This leads to two main issues. First, having the right products is more challenging. Second, ensuring those products are in the right place is challenging.

The second difficulty can be remedied by systems that allow a single view of stock and that treat most locations as places that can act as fulfilment points. The first challenge is definitely helped by greater use of data and analytics; however, it also arguably benefits from more human creativity and innovation when buying, branding and promoting products.

Traditional assumptions about forecasting and consumption are holding back supply chains. Volatility is the order of the day because of changing consumer demands, fragmented consumer demands, new products, online or mobile shopping, and various delivery options. If forecasting algorithms do not factor in these new assumptions, they will be wrong. If inventory movement models are not quick and agile, they will not have product where it needs to be. If inventory cannot use replenishment models rather than over-ordering, they will be wrong. While better analytics will help, it is important to remember that analytics are only as good as the assumptions used to build algorithms. Assumptions needs to be updated first.

Ecommerce has just added a new wrinkle to an old problem. Volatility has always been a significant hurdle because markets don’t perform in totally rational — and therefore predictable — ways and because it’s all but impossible to accurately forecast the kinds of critical disruptions that can adversely impact supply chain performance.

Analytics clearly held — up to a point — but their benefits are often offset by the fact that they themselves are the products of bias and assumption, starting with the belief that historical forecasting is the best predictor of future demand. It seems to me that the foundational supply chain problems have stayed the same. What’s changed is the tsunami of data that is currently available and the compression of time to analyze it. Add an expanding number of demand or distribution nodes that require servicing and a less than predictable consumer mix into that stew, and the result is the problem set we face today.

So yes ecommerce is making things more difficult, but the difficulty is an exacerbation of existing problems.

Data analytics is the key to improving performance and more accurately forecasting demand, which is the main driver for a smart and efficient supply chain. The use of Big Data getting as close as possible to the customer is the best way to understand what the impacts are on a local level. The supply chain today is too complex to look at warehouse demand in its simple aggregated form and forecast from there. By understanding the data at the lowest level, breaking out the impacts of weather, specified demand channels and promotions you start to understand the drivers and enable more accurate forecasting that leads to better supply chain optimization. Moving on to the next level of mastering the supply chain, we bring in the store operations, the store layout, displays and inventory on shelf. Now we really begin to understand the physical and online channels we can start to build a better picture of the demand and future forecast.

To say that availability and optimization are less important or are taken as given is to fail to understand how the elements of the supply chain work together. The supply chain is all about getting the elements in balance — throwing stock at a problem is not the answer — that is why sophisticated supply chain solutions are vital to maintain the competitive edge needed when the pressure really mounts. If you ignore availability, customers satisfaction falls very quickly and inventory, if it is in the wrong place, is of no help.

Supply chains are becoming more complex but the solutions to understand the data needed to solve the equation are now available along with the ability to understand, react quickly and work with your supplier base to optimize the supply chain, deliver great results and have a positive impact on the bottom line.

I find it relatively surprising how many wholesaler/distributors, self-distributing retailers and D2C CPGers still use mostly manual forecasting tools today. This is not a matter of any new volatility. It is a matter of capturing all the relevant internal and external data sources. This is easier said than done because 80% of data is “dark” and not “seen” by most enterprise systems, regardless of the business function, e.g., inventory management, marketings, etc. You need the capabilities to see internal data that includes things like call center, and external forces like supplier data, weather, news, local events, etc. This need not be insurmountable because tools exist today that are literally increasing demand forecasting accuracy by 17%, which is somewhat unheard of. Solutions are out there.

Looks like we should add “holding more inventory” to the list of extra costs that come from ecommerce. It’s important to KNOW the costs and avoid undue enthusiasm from the hype.

Retails traditional forecasting tools were always difficult — because demand is not predictable via algorithm. As a result, there’s no way that adding more data will find a perfect solution.

Could better data analysis help? Some. But the best inventory management I’ve seen has been done by humans with smart data at their fingertips. Only humans can make the judgement calls effectively — but they’ll do that best when they have better data in hand.

What’s damaging in implication is the idea that inventory management should be “turned over” to big data systems. Retailers should be careful not to take the bait – keep people involved.

Demand volatility is likely overwhelming traditional forecasting tools. Better forecasts can be generated by real-time data collected with shelf-based RFID solutions. These use small batches of data delivered on a daily basis as opposed to trying to forecast based on historical Big Data with the demand volatility difficult to analyze. Small data is able to see the demand volatility more easily. Fusing inventory data is a bigger hurdle than other data since it hard to collect from the store and POS data is not close to being 100% accurate. Data must be collected from the store shelves on at least a daily basis to be accurate enough to meet demand volatility.

More than demand volatility, I would say customer-behavior driven demand which is the new standard in business today. Based on this, retailers need to re-focus their processes, systems, people and culture to be agile and flexible to accommodate this “volatility.”