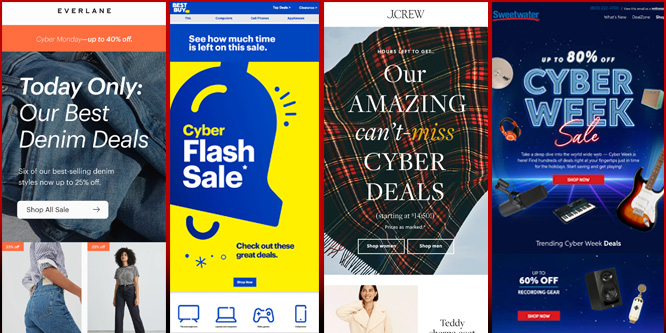

Sources: Everlane; Best Buy; J.Crew; Sweetwater

Did Cyber Monday hit its peak in 2020?

The good news is that the final figures from Cyber Monday show that it was the single biggest day for online shopping in 2021. On the other hand, the $10.7 billion in sales rung up by online merchants was down 1.4 percent from last year’s record performance.

A number of factors are said to have played a role in the final tally.

“With early deals in October, consumers were not waiting around for discounts on big shopping days like Cyber Monday and Black Friday,” said Taylor Schreiner, director, Adobe Digital Insights. “This was further fueled by growing awareness of supply chain challenges and product availability. It spread out e-commerce spending across the months of October and November, putting us on track for a season that still will break online shopping records.”

Consumers spent nearly 12 percent more online between Nov. 1 and 29 compared to 2020, according to Adobe. The company’s research finds that daily online sales have remained consistently high this year and have not had some of the same spikes seen in the past. Adobe has forecast online sales to grow 10 percent year-over-year and reach a new record when all is done and tallied for the holiday season (Nov. 1 – Dec. 31).

Retailers have reduced their discounts throughout the season and Cyber Monday was no different. Adobe is expecting merchants to further reduce discount levels as Christmas draws nearer.

Cyber Monday discounts offered on electronics were around 12 percent this year compared to 27 percent in 2020. Retailers discounted sporting goods eight percent compared to 20 percent last year. The closest category on discount percentage was apparel with merchants cutting prices by 18 percent versus 20 percent in 2020.

Out-of-stocks may have cost some retailers sales, as well. Adobe found that out-of-stock messages were up eight percent on Cyber Monday compared to the week before. Out-of-stocks messages for November were 258 percent higher than they were in the same month in 2019.

The vast majority of consumers chose delivery for their online orders, but curbside pickup remains a popular option. Eighteen percent of those placing orders chose to drive to a local store to get their merchandise. This compares to 20 percent last November.

Discussion Questions

DISCUSSION QUESTIONS: Are there lessons that retailers can take from Cyber Monday and the rest of the 2021 holiday season to help them going forward? What are your expectations for retail performance in December?

I wouldn’t say a peak has been reached, I am sure that in future years, we will see Cyber Monday sales grow again. However this year has been one of returning to some semblance of normality and that has meant more people returning to physical stores. That’s partly why online sales growth for both Black Friday and Cyber Monday were subdued. Shopping earlier also played something of a role – from our consumer tracking, holiday shopping completion is more advanced than it was in 2020 or 2019.

People forget – eliminating peaks is a good thing as long as you aren’t losing share over the entire holiday season. Everyone needs to take a deep breath.

By the way, Amazon grew during the same period, so there’s that.

Retailers’ lessons: Start promotions earlier in Q4, prioritize availability and offer a unique assortment.

Despite skimpy discounts so far, retailers may offer generous deals in December to clear out merchandise.

There are probably two (at least!) factors that impacted this year’s Cyber Monday sales figures. The first is a general sense of social unsettledness – from the pandemic, the economy, politics, etc. – which may be discouraging robust consumer purchasing. The second, which is probably a larger and longer-term force, is that e-commerce is becoming more common and not set aside for a single day. It looks like “Cyber Monday” shopping is not just for Cyber Monday anymore.

The 1.4 percent decline is not such a bad number, for a couple of reasons:

Bottom line: What does total retail spending look like (physical and online) by the time we get to the end of December, and especially in comparison to 2019? Until then, it’s unwise to focus on single-day results.

A local peak happened in 2020 – it will take some time to catch back up to that level along the lines of organic (rather than pandemic-driven) growth. I will be curious to see if December continues to show slower growth in online – and how much of it is driven by consumers worried already that they may not be able to get things shipped in time. I know I bought things last year after Black Friday that, because of USPS slowdowns, didn’t arrive until New Year’s. I have an Etsy seller in my family who said this year was down 45 percent vs. last year – she sells mostly Christmas decorations, and we thought it may be that people are spending more on travel instead, so this may be something where we need to look at spending holistically, and not just on retail goods, to find the answers…

My comment when we spoke about Black Friday was a tongue-in-cheek “…everyday is Black Friday.” I have a similar comment for Cyber Monday.

There is a telling comment in the narrative — not earth shaking, but perhaps trending. “Eighteen percent of those placing orders chose to drive to a local store to get their merchandise. This compares to 20 percent last November.” Probably driven by the pandemic, more people will get more comfortable with delivery versus the less convenient pickup at the store.

The drop in traffic for both Black Friday and Cyber Monday is probably some of the healthiest news retailers have experienced lately. The spreading out of holiday shopping over the calendar makes execution for everybody, shopper and retailer alike, a little easier. If all we are missing is a couple of breathless headlines about those two days, that’s not a bad thing.

The new reality is one of blended spending, which will play out across the entire holiday season. Spending is increasingly being spread out, with retailers offering compelling deals early in the season and continuing straight through to the holidays, which will support total retail performance this year. Black Friday and Cyber Monday are great benchmarks, but are not the make-or-break of the season as they may have once been. With concerns about shipping timeframes this year, December could see more people headed to stores or using curbside or in-store pickup options.

We definitely saw a flattening of the holiday sales curve across clients and more sustained volume over October and November. Which from a customer experience perspective is great. It meant faster website response times. Moreover there were no big news headlines about performance issues at some big brands like there were last year.

The biggest winners? Probably the retail IT teams. They’ve really upped their game in terms of performance testing over the last 12 months. For those who sat on standby and got to binge on Netflix instead of fighting fires — good for you. The hard work paid off.

Will we break records again in the future? Of course. But if it happens in 2022 it feels like retail is ready.

On the other hand, the $10.7 billion in sales rung up by online merchants was down 1.4 percent from last year’s record performance.

Oh, George, please! You of all people should know that folly of comparing to last year … particularly something like online sales.

My prediction is the same as always: some will be thrilled, some will be disappointed, and some storied retailer — Sears? JCP? — will have its “last Xmas” … finally.

The issue is that Cyber Monday is not a one-day focused event any longer. It is a signpost of awareness for a month-long cyber fest of discounts and offers. Judging by my inbox (and I don’t think I’m alone in this), the offers started rolling in during October and there is nothing that convinces me they won’t continue up until the holiday.

Of course, ordering and receiving are two different matters and the impact of supply chain on fulfillment of cyber offers means anything ordered from Dec. 1 on is at risk for Christmas delivery.

More than anything, I think Cyber Monday 2021 showed us that both retailers AND consumers are ready to move on from a limited shopping window towards an ongoing event that delivers value to customers. People don’t need to get up at 4 am Eastern Standard Time—regardless of where they live in the country—with sleepy eyes, cups of coffee and a credit card in hand in the hopes of catching a deal. Instead, retailers did an exceptional job this year of spreading out the promotion window—pushing sales even earlier to offset supply chain issues and lessen the hype of one big discount “event.” By doing so (as the Adobe results show) they were able to reduce their discounts, which is better for their bottom line.

As consumer behavior continues to shift to mixed-mode shopping, the cache of “Cyber Monday” will evolve from a mandatory requirement for everyone to a nostalgic event that brands and retailers can merchandise and plan around to extend shoppers’ savings throughout the holiday season. Ultimately as a promotional event, Cyber Monday has cemented a place for itself in the annual calendar and will always be a good time for retailers to push sales.