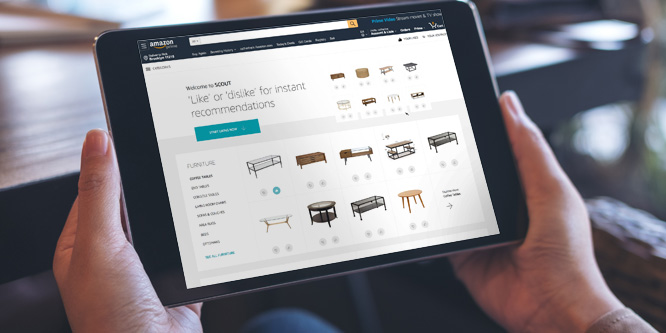

Is Amazon on the right path to improved product discovery with Scout?

Would a radical partnership help Walmart thwart Amazon?

Five pain points grocers must address to survive in an Amazon/Whole Foods world

Are retailers selling their souls and giving away customers to Amazon?

Is a ‘DARK’ cloud looming for brands over GMO labeling?

Rivals need to up customer experiences to compete with Amazon

Will UX methodologies bolster retail’s brick & mortar future?

Are Amazon’s ambitions flying too high for comfort?

Warning all megalomaniacs: There’s a precipice ahead