How will I pay my employees next month?

Is the environment Amazon’s Achilles heel or opportunity?

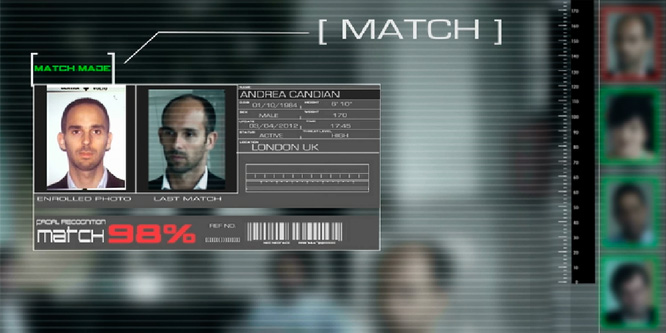

Do the benefits of using facial recognition in retail outweigh the risks?

Are people investments paying off for retailers?