Photo: Getty Images/zoranm

How blemished are beauty retailers by COVID-19?

Beauty sellers are facing a double-whammy from COVID-19. Make-up has become unsafe to try on in stores and less necessary as many women shelter at home.

A survey of more than 5,100 women over the age of 13 from the Influenster product review platform in May underscored both risks to beauty sellers’ businesses. It found that if the retailers were to stop in-store sampling, 30 percent of consumers would no longer see a need to purchase beauty products in-store.

Sephora, Ulta and other beauty sellers have all paused in-store sampling and the practice may be long in returning given the risks of bacterial or viral infections from shared samples. A host of virtual alternative options, some employing augmented reality and facial recognition, offer hope of adoption by consumers.

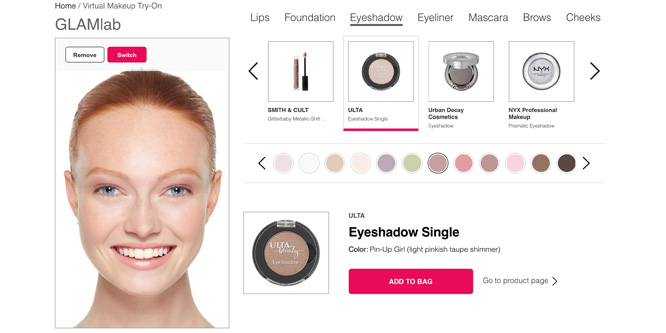

Usage of Ulta’s GLAMLab online try-on feature has increased five times during the pandemic. Ulta is also working with brands to bring safer sampling to stores. Mary Dillon, Ulta’s CEO, said at an Oppenheimer investor conference in mid-June of the reimagined store experience, “It’s just going to look a little different, but we’re going to do our level best to make sure that it’s fun and innovative and relevant.”

From a demand standpoint, the Influenster survey found 47 percent of respondents wearing less makeup, 22 percent wearing about the same and 21 wearing no makeup during “stay at home.”

Among those not wearing makeup, 31 percent said they didn’t see the point as they’re not seeing anyone and 29 percent said they would like to take the opportunity to let their skin breathe.

An Advertising Age article also noted that lipstick isn’t necessary and rubs off when wearing a mask, although some women are pivoting to eye products like mascara.

On Ulta’s first-quarter conference call, Ms. Dillon said that, while social distancing and masks are causing disruption, women have a “deep emotional connection” to beauty and will return. “Routines will continue to shift and evolve, but beauty is a platform for self-expression, togetherness, joy and self-care, all of which are even more important for beauty enthusiasts during this time of uncertainty and change,” she said.

- How the COVID-19 pandemic is impacting beauty routines – Bazaarvoice

- No testers, no problem: Ulta and Sephora have a new take on ‘try before you buy’ – CNN

- Face Masks Are Suffocating Sales Of Lip Products, Forcing Brands To Refocus – Advertising Age

- Cosmetics Retailer Ulta Beauty on How It’s Adapted to the Pandemic – Adweek

- Ulta Beauty, Inc. (ULTA) Presents at Oppenheimer Consumer Growth and E-Commerce Broke Conference Call – Seeking Alpha

- Cosmetics Business reveals 5 key insights in new Covid-19 strategy report – Cosmetics Business

- Ulta Beauty, Inc. (ULTA) Presents at Oppenheimer Consumer Growth and E-Commerce Broke Conference Call – The Motley Fool

Discussion Questions

DISCUSSION QUESTIONS: Are the difficulties of in-store trial or shifts in product demand likely a bigger challenge for beauty sellers? What adjustments may be required for the beauty category?

The absence of in-store trials of make-up definitely has a negative impact on make-up sales. However a bigger impact is the change in consumer habits. Consumers have reduced the use of beauty product due to reduced social activities, wearing masks and the shift to working from home. Once consumers change a daily practice for a month or more, it has a greater chance of becoming a habit. Beauty companies should be reinforcing a message that even in pandemic times, “the better we look, the better we feel.”

Beauty brands need to adjust their assortments – a shift from lip to eye for instance due to mask wearing. For retailers, a shift to skin care vs. color treatment. Also, those brands and retailers that utilize technology to imitate the in-store experience online will be winners. Overall, the beauty category has a very good chance of weathering the storm better than other categories like apparel and accessories.

Overall, the pandemic has been unhelpful to beauty sales. However performance is very patchy. Cosmetics and beauty products associated with socializing and the work environment have plummeted as those activities have been curtailed. However some of the more heath oriented products – such as skin care – continue to perform well as consumers are still concerned with wellness. There has also been an uplift in sales of aromatherapy products as people indulge themselves during a time of stress. And then there are hand washes where sales are off the chart.

The challenge for beauty retailers is understanding how patterns of demand will evolve so they can adjust their assortments and promotions accordingly. The good news, however, is that there are still growth spots in beauty.

The real problem for beauty sellers is that there is no end in sight for COVID-19. Our too-little, too-late response means that we could be having this same discussion a year from now — with the only difference being that some of the players might have gone under.

This is the time to reinvent and reimagine the customer engagement experience. I’m seeing retailers shift quickly to tele-consult in many areas, and beauty is a natural fit.

Boots UK is a large retailer of cosmetics and recently launched cosmetic virtual consultations. That provides for one-to-one appointment-based personalization, and allows for employees with expertise to engage wherever they are (from the home, the back office, or the cosmetics counter if they aren’t helping someone in-store).

It’s a new day. Meet the customer where they are and reinvent.

While “make-up” has taken a hit, “personal care” definitely has not. If a retailer or brand is defining themselves too narrowly, then they will feel the pain of these consumer shifts. But if a company is taking a broad view, they should be making internal shifts to center more on skin health than on “beauty products” per se. The challenge of consumer shifts is a way bigger problem than the challenge of in-store trials. Beauty boxes and trial boxes had a heyday and then kind of faded away, so maybe it’s time to start those up again, but I would definitely focus on care over beauty. Will that change when people start going back to the office? I’ve seen beauty influencers do things like emphasize eye makeup, since that’s what you can see over the mask, so I don’t think it’s a total loss for makeup.

Certainly the in-store experience will change but now is the time to look at other options for make-up demonstration – such as Ulta’s GLAMLab online try-on feature. And with less make-up being worn, maybe now is the time to emphasize skin care products.

Sephora and Ulta are already well positioned digitally to embrace and optimize new consumer behaviors in the beauty business. E-commerce is actually well suited for the make-up business because its consumers generally know exactly what they want — daily routines breed deep loyalty and category knowledge.

There is a deep emotional connection to make-up with older female consumers but our younger generations may see “no or minimal make-up” as a new paradigm in social expectations. Google “2020 stars with no makeup” and you’ll be amazed by the trend — many find it liberating.

That said, in-store trials will need to be “single serve” and may become more expensive to implement. It’ll be the cost of doing business for the brick-and-mortar beauty stores — because seeing is believing…

I don’t have an emotional connection to make-up and I used to work for Lancôme. I don’t wear it unless I’m giving a presentation. I don’t agree that most shoppers know exactly what they want when buying treatment products and make-up. In a store, surrounded by so much possibility, it’s easy to be swayed to try something new. This year’s “have to have” cream or color palette is what’s tempting. An associate who shares how to choose colors and how to apply products is a gazillion times better than buying these things online.

What’s the point of putting on make-up when you have to wear a mask? That aside, the fun part of shopping for a new look is testing the products and you can’t do that right now.

QVC and HSN have no problem selling make-up virtually but that’s because both demonstrate how to use the products on a variety of diverse models. Drug stores also sell packaged goods without testers with no problem, but stores like Sephora and department stores depend on the sales associates’ knowledge and shoppers being able to try and play with products.

Cosmetic companies need a new plan. Focus on skincare, eyeshadows, liners and mascara, and offer individually sealed testers. If Costco was able to find a way to sample food items, and Las Vegas was able to relaunch the buffet, retailers will figure out how to sell cosmetics again.

I will not be so presumptuous as to predict beauty market trends. I can only reflect several second-hand comments by women I know. Paraphrasing the most relevant ones: “I haven’t worn make-up in three months. It is so freeing.”

If this is a trend, it does not bode well for the beauty business.

Both issues are challenges to be sure, but both can be addressed; some companies have already made timely adjustments. Besides Ulta’s online try-on, Bobbi Brown’s virtual consultations are quite popular and address the gap that the make-up counter used to fill. Beauty sellers will need to recreate that experience online in order to draw in consumers — both the loyal, engaged segment and new or casual shoppers. As virtual reality and e-commerce continue to see innovation and online shopping becomes even more regular, beauty companies that are willing to test creative solutions can benefit. Those who have relied on a single or traditional sales model will have to invest in omnichannel, and fast.

As far as product demand, beauty companies may be surprised to find that where typical makeup products have seen a decrease, others more suited to an at-home lifestyle may be exactly what consumers are looking for. Where the old demands have dropped off, savvy sellers can meet — or create — new ones. Assortment is the key. Take the 29 percent of non-make-up wearers who are letting their skin breathe — what they really “need” is a quality skincare regimen to go barefaced confidently. As for the 69 percent of shoppers who haven’t entirely quit their make-up routine, show them your tinted moisturizers and “barely there” products in addition to others.

My two cents worth is that the close proximity of clinicians (to people’s faces) is the real danger here — as opposed to surface transmission — but anyway: “47 percent of respondents wearing less makeup … 21% wearing no makeup.” So apparently, somewhere between a quarter and two thirds decrease in demand. I can’t imagine anything being more of a challenge than that … a true OMG! moment.