Photo: @criene via Twenty20

Which data sources should be driving personalization?

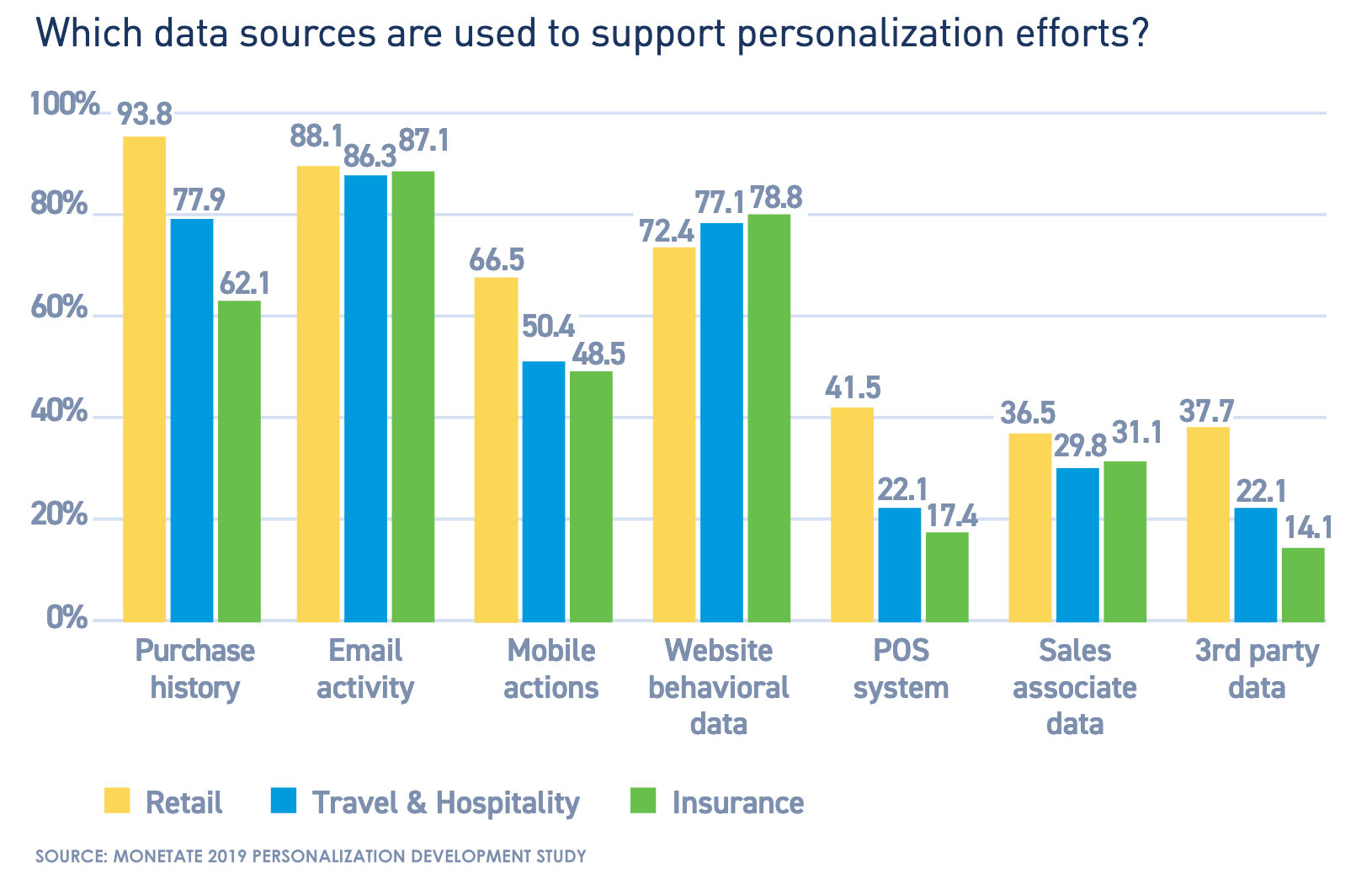

Purchase history, email activity and website behavior remain the three primary data sources retailers are tapping in their personalization efforts, according to Monetate’s third-annual “Personalization Development Study.”

WBR Research in December 2018 reached out to more than 600 senior marketers across the retail, travel and hospitality and insurance sectors in the U.S. and Europe to explore their personalization progress.

Asked which data sources they use to support their personalization efforts, nearly all retailers indicated purchase history (93.8 percent), a similar finding from the prior year’s survey. Close behind was e-mail activity, 88.1 percent; followed by website behavioral data, 72.4 percent; and mobile actions, 66.5 percent.

Compared to the travel and hospitality and insurance sectors, retailers are using purchase history and mobile actions significantly more and using website behavioral data to a lesser degree.

The fifth most used data source for retailers was POS systems, at 41.5 percent. That was also significantly higher than travel and hospitality and insurance and likely tied to access to in-store purchase history. Sales associate data was used by 36.5 percent of retailers.

Somewhat controversially, 37.7 percent of retailers indicated they are using third-party data for personalization, well above marketers in other sectors. The practice of using third-party data has drawn wide attention amid a sea of data breaches, with many calling for more transparency and regulations.

The study also found that integrating third-party data was the second biggest obstacle to personalization. Monetate believes that was likely due to challenges adapting to GDPR, the EU’s data protection legislation that became effective in May 2018.

Generally, however, the report showed personalization gaining traction. Other findings:

- Building a sustainable data architecture replaced data quality as the top obstacle.

- The majority of retailers (57.7 percent) are generating two times ROI or greater from personalization efforts.

- Thirty-eight percent of retailers are planning to implement a personalization strategy (20.2 percent are just beginning their implementation), 27 percent have nearly or fully implemented a strategy, and 6.5 percent are in advanced stages. Only 8.3 percent have no plans to implement a strategy.

Discussion Questions

DISCUSSION QUESTIONS: Ideally, which data sources should guide personalization efforts for retailers? Will in-store sources (i.e., POS systems, sales associates) become more integral in the years ahead? Is third-party data too risky?

Ideally, all sources should feed personalization for the customer. Past purchase behavior is indicative of choices made at different places/channels and different points in the customer journey. My purchases in-store rarely overlap with my purchases online. Yesterday’s purchase of consumable ink for printing does not reflect preferences for a new camera. Retailers’ single greatest challenge is compiling a household profile across time. At the most basic level each retailer must focus on those sources where they are most likely to engage with core customers — and never forget their increasing potential to cross-shop in multiple ways.

How about the data that customers are willing to share? I’m continually amazed at how reluctant retailers are to just ASK their customers about their preferences. Customers understand the quid pro quo – you track my data, but in return I get personalization and relevance. The only reason why consumers would be reluctant to share is because they’re not seeing enough value out of the relationship. And that should be a warning sign to retailers that they’re not doing enough to keep customers engaged for the long haul. Which means rather than shy away from asking consumers what they’re willing to share, retailers should embrace it – if a lot of consumers opt out, then you’ve got a much bigger problem than those opt-outs. You have a value proposition challenge.

I do think in-store data will become part of the data that is used, beyond transaction logs. But retailers will have to be careful about tying PII to in-store visits beyond the purchase – that definitely seems to cross a threshold into “creepy.”

This is a key missed opportunity for retailers. Why can’t I post that I’m looking for a dress to wear for a certain occasion, then have retailers suggest items? If you’re planning to replace your kitchen, why can’t you state dimensions and preferences and have retailers bid? And then, after the item is purchased, turn off the notification?

Yes, Cathy, I’m with you and Nikki on this. Personalization means making it personal for what I am looking for now. Often when I shop, It is for other people. I am just as, if not more, frustrated when I start getting all the pop-up ads for days after I have been shopping for my nephew. I am so not interested. If you can make a composite of who I am over time or just ask me, you have a better chance of delighting me. And that’s my 2 cents.

Oh Nikki, you seem to think that “personalization” is actually about being personal. People talking to each other, showing genuine interest in the customer and that sort of thing. That is so old-school. We’re in the “Give me data or give me death” age. Sadly many retailers will get both because they won’t listen to you. I just wish I’d made my contribution today as eloquently as you did! Thank you!

Time-relative consumer feedback/requests really should be #1. How can you be more relevant than that? But I don’t think this is just about data sources. It’s about the quality of the personalization. Making two or three segments for offers is far different “personalization” than a more advanced AI that customizes offers and even prices for everyone. I’m with Nikki here that all of it is a value prop — if there’s enough perceived value, consumers will engage and respond.

In-store sources, or real-time data streams, are vitally important. The elements mentioned above are historical data streams. These are important for identifying buyer personas, but real-time data streams – albeit somewhat controversial – are the future. This is where AI takes rise.

Obtaining first party data to drive personalization is now table stakes. Unfortunately, most brands still don’t have a fully thought-out strategy for collecting, vetting and using. E-mail and mobile number/ID are critical as they are the “match points” for many sources. Especially if appending third-party data or using to target across digital channels. But purchase history and engagement activity (email activity, store visits, etc.) are also very important.

The more store data, the better. We have to keep investing in ways to maximize the value of every store visit. Most categories still see 80 percent of their sales flow through the store, and we have just scratched the surface of the data available to us from those visits. Transactions are of course important pieces of the puzzle, but so are shopper behaviors and sentiments. High-tech solutions like video traffic analysis need to be deployed. Low-tech solutions, like having associates talk to shoppers and simply ask them for feedback, must also be incorporated to develop a holistic shopper persona.

Personalization needs to be driven by the CX a retailer is trying to execute. My sense is that it’s becoming table stakes to personalize on transactional and behavioral data where the outcome is a more tailored sales offer. The contrast with travel, hospitality and insurance sectors that rely less on transactional data is interesting. I think about how these other service industries use personalization throughout the customer relationship (your life stage, family situation, interests, etc. – relying on a lot more than just transactional and browsing behaviors). The challenge retailers have is determining the role of personalization beyond offers to really delivering a differentiated CX – I think too many fixate on marketing offers. That’s an analytics problem requiring a good data foundation and strategy.

When we get into topics like this one about “data” and retail’s desperation to understand the human being, every cell of my body cringes. I do try to understand, I really do. It’s just that nothing could be more opposite to being “personal” than this kind of thinking.

This is not a criticism of Tom’s article at all, he’s reporting very clearly on what is actually happening. We need a “personalization strategy?” Really? Isn’t personalization an innate part of being human? Who would say to someone “I’d really like to get to know you. Please tell me about your recent purchases, email activity and mobile actions.” Some are moving as far from being personal as possible by going to third-party data. And look at what you get: “a sea of data breaches, with many calling for more transparency and regulations.” Not feeling the love here.

What is really sad is that counting on your sales associates to have a personal focus in serving your customers and looking at how you’re organizing your own POS are among the least-used strategies. In other words, since we’re pathetic at actual human effort and relationships, let’s turn to technology!

If we’re all going down this road, let’s call it a “mass marketing strategy” and stop pretending that it’s “personal.”

Ian is raising an excellent point here. The reason retailers “need” personalization strategies is because they have let analytics drive the purchase process and have therefore underrated the benefits of the human factor. Like Ian, (I think) I’m not anti-data, but I am pro-human. What’s personalized about purchase history? If you think about it a minute you’ll see that the underlying assumption is that since you bought an item before, you will buy it or another item like it again. In other words it assumes that human beings are predictable most of the time and rarely evolve or change their preferences. What these systems track is historical activity — but all great salespeople know the value of in-person suggestion and impulse or capturing customers when they are in a “time for a change” mood. And Ian is also right that, almost by definition, system solutions aren’t really individualized or personal. Algorithms look for patterns. They function by grouping and making assumptions based on frequency and proximity to a pre-determined model. Individual deviation is the enemy of the algorithm, but it is at the essence of what it means to be human. Technology can show us the “what” of a purchase, but it can’t begin to plumb the depths of the “why.”

Retailers in general are getting much better with personalization efforts, often a core business strategy. What tends to differentiate leaders is the ability to create deeper insights via differentiated customer engagement (data). Think about websites that are tailored with relevant content and messages (beyond recommendations) and mobile apps that customers actually use, will happily opt in and open while in-store because the retailer is providing value-added services.

Driving better penetration and use of such customer engagement platforms allows the retailer to ask occasional (smartly crafted and brief) questions which in turn enable the retailer to create and leverage new data sets and observations that go much deeper in understanding customer tastes and preferences.

More (and differentiated) observations = better insights and actions.

The #1 reason people BUY a product: human emotion driven by individual sensory-preferences. Ecommerce is represented by multi-billion dollar verticals of products purchased based solely on human emotion and individual sensory preferences like clothes, shoes, accessories, home furnishings, homes, art, cars and the like.

Current personalization solutions operate on principals of binary and linear logic. While humans operate on a cognitive, INVISIBLE system of individual human preference, controlling purchase behavior & product decisions.

In the area of e-commerce, products are devoid of sensory cues available in the physical world. To understand an individual shopper’s sensory preferences, sensory-profile her/his purchases. Especially those products purchased and not returned. Purchase history is the roadmap of individual human preference intelligence. Yet, still today, purchase history is locked in retailer data silos, useless, subjected to antidotal interpretations by systems “solving for” various forms of segmentation.

This will soon change. Human Preference Intelligent enabled APIs leveraging AI/ML are opening up new ways of thinking, creating cognitive applications to “solve for individualized sensory-preference personalized” solutions. Subjective variables beyond human computation “solving for” invisible and complex human sentiment intelligence. Eliciting human preference to solve for the invisible. Explicit vs. implicit human behavior, currently the dichotomy of computer science and human-centric abstraction.

Retail analytics has always been a combination of art and science; even before the data scientist buzzword. The main premise is the combination of quantitative (science) and qualitative (arts) data. If the collection process has been thorough you would have many data points for both, going back in time. Customers rarely ever do what they say they are going to do. Hence the importance of POS, transaction data to see what they actually did.

In todays vernacular this equates to a “journey.” The 360 degree cycle of single or multiple shopping trips. This data is critical to define customer preference segments; communication channel preference and transactional channel preference. With the recent advent of digital channels for both shopping and communication the preference segments are not just nice to have, but a requirement to stay in business.

Add to this the X,Y,Z and Millennial generation that will far surpass the baby boomer in shopping disposable income and their preference for anytime/anywhere shopping. If you get it wrong, they will delete your app without a second thought. There are too many alternatives.

Understanding the customers’ “why before the buy” is not a nice to have, it is a matter of retail survival.

Chris said it well: “All sources should feed a personalization for the customer.” One step further, this data needs to be held in a centralized database.

Retailers should be using any and every data source that helps paint a complete picture of a consumer’s preferences and what is in their closet/garage/pantry. It is a little surprising how few retailers report that they are incorporating POS system data and information from sales associates. Retailers should also incorporate external data points such as context like weather and trends that may impact consumer purchase intent.

Customer context considers environmental conditions such as current and forecasted weather, time of day, time of year, media (news), social media, traffic, holidays, events, and other conditions that impact a consumer’s purchase decision.

To be successful, information must be instantly accessible to store associates in real-time. Without real-time data, information provided internally and externally is out-of-date and risks being inaccurate and out of context. Retailers must collect, analyze and respond, in real-time, to their customer’s interactions across all touch points.

With real-time customer context, sales associates can offer customer intimacy and enhanced services like guided selling and personalized offers that are relevant to the individual customer.

Asking customers what they want is never a bad idea, but they are already telling you everything you need to know when they shop. Not just what they buy, but when and why they buy the products they do, what discounts they require and so forth. Truth is, an individual shopper has interest in only a small fraction of the 30,000+ skus a store carries or even the 300 or so items currently being featured on “deal” so the biggest problem shoppers have is cutting through the clutter to find items relevant for them during a particular week. Using the full range of shopper data, not just the “did they buy this previously” metric so common, to determine which items in the weekly ad feature should be highlighted to each individual, actually delights shoppers and drives both incremental visits and sales each week.