Source: Amazon

Will Amazon cash in on the P2P payment market?

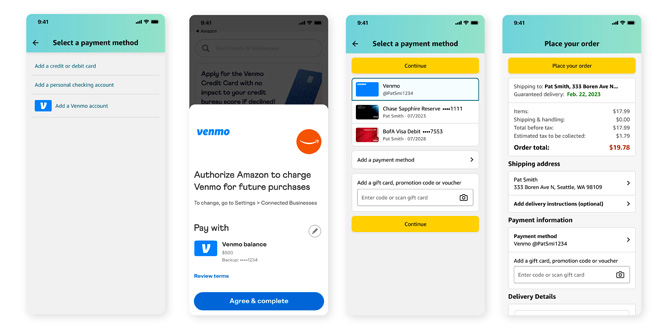

Amazon on Tuesday said that it is adding the Venmo peer-to-peer (P2P) payment service to the options it provides shoppers purchasing goods from its platform.

The company is currently rolling the Venmo option out with plans to make it available to all customers by Black Friday.

“We want to offer customers payment options that are convenient, easy to use and secure — and there’s no better time for that than the busy holiday season. Whether it’s paying with cash, buying now and paying later or now paying via Venmo, our goal is to meet the needs and preferences of every Amazon customer,” said Max Bardon, vice president of Amazon Worldwide Payments, in a statement. “We’re excited to continue to offer customers even more options when it comes to how and when they want to pay for their order.”

Using Venmo to make purchases on Amazon is pretty straightforward. Amazon customers add the option to their account and then select it for payment during checkout. Customers can also use Venmo as their default payment option once it’s been added.

Amazon is relatively late to the game in accepting P2P payments. Others, including Abercrombie & Fitch, Boxed, CVS, Forever 21, Hollister, Lululemon, Poshmark and Urban Outfitters, already accept Venmo payments. The service, which is owned by PayPal, has nearly 90 million users.

Insider Intelligence reports that Venmo is the biggest P2P payment app in the U.S. with a 52.2 percent market share. Transactions made using the app are forecast “to surpass $2.271 trillion in 2026, more than double the value in 2022,” according to the research firm.

Also competing for market share in the P2P market are Square, Zelle, Apple and Google. A report from Acumen Research and Consulting projects that the global P2P market will grow by a 19.7 percent compounded annual rate to reach $9.125 billion by 2030.

- Amazon Offers Customers a New Way to Pay This Holiday Season With Venmo — a Convenient, Easy-to-Use, and Secure Payment Option – Amazon.com

- Venmo expanding: Here is a list of stores where you can use Venmo as a payment method – MassLive.com

- PayPal leans into Venmo for payments prowess – Insider Intelligence

- P2P Payment Market Size is predicted to Reach at USD 9,135 Billion by 2030, Registering a CAGR of 19.7%, Owing to Increasing Smartphone Penetration and Evolving Digitalization – Acumen Research and Consulting/Globe Newswire

Discussion Questions

DISCUSSION QUESTIONS: What will offering Venmo as a payment option do for Amazon? Where do you see the P2P market in the U.S heading and what will it mean for retailers and consumer direct brands?

It is another customer-oriented service by Amazon. If one makes one makes the alternatives easier for the customer, Amazon wins. It is that simple.

Where is the P2P market headed? Look at China. P2P has been all-encompassing for at least 10 years since I have been going there. Those looking for a handout from people on the street passing by don’t take cash.

The Nordics and China are essentially cashless countries with cash transactions running about 1%.

Adding payment options can only help reduce friction for shoppers (and increase retailer sales). Allowing people to pay as they choose is helpful as the payment landscape continues to expand and change — this is not likely the last change for retail payments.

Offering more payment options makes purchasing easier for more shoppers. Amazon’s efforts will help legitimize more alternative payment methods, though I’m not sure anyone today is abandoning Amazon carts because Payoneer is not a checkout option.

More payment options is a good thing for Amazon and for customers. The only surprise here is that Amazon didn’t create a proprietary version — stay tuned.

Venmo is simply another payment system. There’s no reason Amazon (and other retailers) shouldn’t accept Venmo along with credit cards, PayPal, and any other form of payment. Back in 1995, Bill Gates wrote “The Road Ahead,” and shared his predictions on how people would use a mobile device to pay companies and individuals. It all came true. Whatever is the easiest way to transfer money from one person to another (or a company), will be the payment system of the future.

P2P is both the present and the future of payments. Credit to all retailers who embrace it. It may be my age, but I worry about how many apps we need to have on our phones that link directly into our checking accounts. I would prefer the industry coalesce around Zelle, but I realize that isn’t realistic…

Amazon has led the way in removing friction from shopping experiences, from free same-day delivery to one-click “buy now,” to BNPL (buy now pay later). This announcement and payment option does not surprise me. However I find two points interesting here: 1. That they did not build the functionality themselves. 2. That they chose Venmo over Zelle. Venmo and CashApp have younger user demographics and are actually a bit of a pop-culture phenomenon. Nobody says “Zelle me,” but younger users absolutely “Venmo each other.” However Zelle moves twice as much money as Venmo and the likelihood of an Amazon customer having a banking institution that is attached to Zelle is much higher.