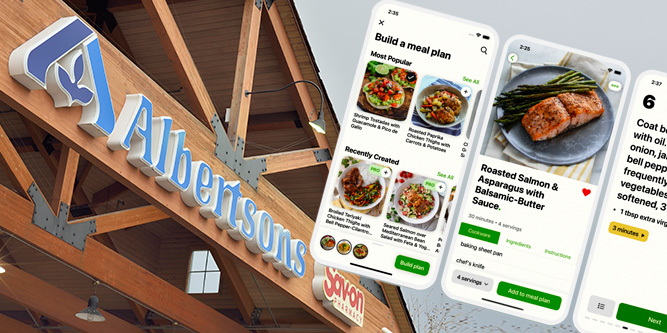

Photo: Getty Images/RiverNorthPhotography; Source: Mealine

Albertsons puts its digital transformation on the fast track

Albertsons’ digital initiatives aim to solve its unique challenges when it comes to delivering customer-centric service.

Chris Rupp, Albertsons EVP, chief customer and digital officer, speaking at the recent eTail West 2022 conference, detailed the grocer’s criteria for determining whether it will build, buy or partner to implement new solutions that make shopping easy, fun, convenient and delightful.

Build – for differentiated functionality

Albertsons uses in-store associates to fulfill online orders, so it developed its picking app internally in conjunction with pickers. Key features support offline operation to avoid unproductive movements when WiFi is not available, pick paths for multiple store layouts and order sorting based on multiple criteria such as number of orders, items in order, order pick-up time. The app has an alert feature that notifies pickers when customers need immediate assistance with locked liquor cabinets, etc., so they can multitask while fulfilling orders. Ms. Rupp revealed that there has been a 15 percent increase in on-time delivery when using the new tool.

Buy – for a specific purpose

Albertsons acquired Mealime, a recipe-intelligence platform that gives shoppers access to 1,200 proprietary recipes. The platform serves up recipes to customers based on their criteria — healthy, vegan, gluten-free, etc. All ingredients are loaded into a cart, after quantities are rationalized across recipes, and categorized as fresh and staples so consumers may determine what they need. Ms. Rupp indicated that this tool saves the average consumer up to an hour.

Partner – for complementary capabilities

Albertsons partners with DoorDash, like many other retailers. Ms. Rupp’s view was that both parties bring something to the equation to execute a local play to solve shoppers’ immediate meal needs. The company’s DoubleDash service provides 30-minute delivery and flexibility for consumers to order meals from local restaurants, items from other non-competitive participating retailers, as well as groceries, side items, alcohol and other essentials from Albertsons in one drop-off.

“Our biggest growth opportunity is to develop deeper relationships with customers — the people who live in our neighborhoods,” Ms. Rupp said.

Determining how to select and deploy digital tools to meet growth goals is helping Albertsons get to know customers better and to deliver tangible benefits.

Discussion Questions

DISCUSSION QUESTIONS: What criteria do you think grocers and other retailers should use to determine whether to build, buy or partner to implement new technology solutions? Do you find that retailers generally make the right decisions on how to proceed when deploying new technologies?

Well, this definitely resonates! My top retail trajectory for the last couple of years has been “buy, build, or bridge.” It’s a big question for retailers. The most successful retailers are employing all three strategies and reserving the right to shift between them. Buying is frequently triggered by a desire to acquire user or customer bases or to fully own data. More recently, I’ve noted an uptick on the bridge side of the equation (partnerships). It’s often the most agile choice and can serve as a runway for future building or buying. Partnerships allow retailers to test the waters prior to acquisition or to learn the ropes before building solutions internally. Those who provide bridge solutions to retailers would be wise to factor in these possibilities.

For nearly all retail applications, buy or partner strategies are usually the most economical. Most retail applications solve common business or customer problems and a vendor-built solution is a smart choice. While vendor solutions may need some customizations for some unique retailer-specific processes, hopefully 80 percent can be covered by the core solution. The build strategy is typically the best approach for large retailers that have the IT resources to handle the development or instances where the application is so unique that no vendor has developed the application for other retailers.

Given its scale, Albertsons is right to focus on building its own capability in core functions like online fulfillment. However when it comes to speedy meal solutions, it makes perfect sense to partner with DoorDash. For Albertsons to build such a nimble solution for a (relative to overall grocery) low volume category makes no sense and would not be profitable. This blended, agnostic approach is the right one and it is one that more and more retailers are adopting.

Many technology leaders believe that their value comes from building something unique – this comes from hubris or ignorance. And they try to build in-house, instead of focusing their efforts on architecture and integrating stuff. In nearly every case, those tech initiatives becomes millstone and drag the entire business.

Most leaders believe that their business is truly unique or there is no product out there that does what they need to do. The critical question is – is it driving a competitive advantage? And is the advantage sustainable if it takes six to 12 months or more to build?

In our experience of over 25 years of developing technology for this industry – the track record for building internally versus buying is not good. Working with technology partners allows the retailer to get “best in class” thinking, experience, strategy and plan to implement new technology or new ways of working that have a much better chance of success.

We’ve seen technology initiatives where the decision was to build rather than buy. After two years of internal development and money spent, the internally developed tech rarely met the needs or specific use case the business needed.

This often leads to engaging with an outside partner that had the solution the business identified in the first place. Technology changes too fast for the retailer not to partner with those that have a good track record and keep up with the latest technology.

The key is careful planning and collaboration with the retailer, and not just on the technology solution itself, but in making sure the retailer’s staff is upskilled with deploying and maintaining it. Changing the culture of the organization is key as well.

Buying or partnering makes the most sense most of the time. It’s quicker, cheaper, and allows the company to focus on its core mission. Trying to build requires more resources and takes more time – neither is useful as stores strive to keep up.

it depends on the retailer and its specific needs and capabilities and, no, most retailers don’t have the infrastructure or internal expertise to make the right call without good external advice. One caveat about build; if that’s the route a retailer chooses – and it often could be the right answer – it should be built with open source tools. Proprietary systems look good, but let’s remember that Kmart was once the leader in retail tech and look where that got them.

A custom build, by its nature, is always going to be the most dialed-in approach to serving the very unique needs of an individual business. It can be time-consuming and cost more than a turnkey option but, from a competitive standpoint, this is about putting your resources toward where they have the most potential to solve for the total needs of the customer, more effectively and with more specificity than a competitor can. Maybe we’re just talking about a bespoke website, maybe we’re talking about a proprietary app like the Albertsons example. Of course, not every aspect of every business is mission critical – and not every aspect of every business is unique! Retailers don’t have to reinvent the wheel for nice-to-haves which improve overall effectiveness, like marketing software, an ERP, etc., and we’re at a point where these tools are themselves extremely customizable out of the box. Partnering with service providers, on the other hand, is inherent to every retail business. I’ve found that partner relationships are highly dependent on finding the right fit between business and provider. A partner’s scale, approach, and even brand identity must at least tangentially align with the retail business. When looking at implementing new technology, ultimately the question is always, “What’s the best solution for my customer?”

Let’s ask ourselves, what is the likelihood of Albertsons or another major retailer developing a better system than a software company whose lifeblood is based on creating the best performing and most innovative product?

Here is Target CIO Mike McNamara’s take.

Gene, You are good. You said in one sentence what I was trying to communicate in a few paragraphs. Thanks for the clarity.

Gene, great thoughts, but I would argue the opposite side as well. What software company can build a system that is perfectly in tune with the needs of Albertsons and more important, gives Albertsons a competitive edge against all the other companies that use the same product for the vendor? There’s a reason why competitors in similar retail sub-verticals will buy a different solution from a different vendor, it’s not just CIOs trying to own the build.

If you build, then you must maintain. If you partner, you must manage relationships. If you buy, you must know what you’re buying and do so at the right price. Control is a good tool in assessing the buy/build/partner decision. However when combined with a dynamic risk assessment framework unique to the strategy and situation, retailers can make more informed decisions that withstand the test of time.

Generally, grocers and all retailers should use the following criteria to build, buy or partner:

Excellent summary points on strategy, Shawn. Couldn’t have said it better.

I love that they’re firing on all cylinders to create a harmonious shopping experience. The build piece is especially smart in my opinion – leveraging internal employees, who are closest to the customer, to drive omnichannel efficiencies is key. They took out a lot of friction for shoppers by doing this.

I’m still surprised by all the positive views of “partnerships.” Sure it’s easy and initially cost effective. But why share your data, and lose your brand identity to a third, possibly competing, party?

It depends on the retailer. Those with sufficient technical expertise can build their own solutions, but there are not many of those companies. For most, and for more sophisticated solutions, partnering makes the most sense.

Build, Buy or Partner is a solid framework for implementing new technologies. Where many retailers may be overly ambitious is thinking that they can or should build everything. There is certainly value in proprietary IP, but building is not always the most efficient route. Often the most efficient and effective path to digital transformation is acknowledging and accepting someone else’s expertise rather than trying to craft your own every time.

It seems we’ve reached a point where either buying or relying on an outside partner is “best practice.” Yet in situations like these, we need always be aware we might outsource our profits or end up dependent on a vendor whose vision changes and leaves us weaker.

Valuable perspective, Doug. And I would add, be ready for some tech vendors to sell sooner than you’d expect (VC led), which means your data and processes could land in places you don’t like. Gotta know the possible outcomes before partnering.

To determine whether to build, buy or partner for retailers is a multifaceted question. In general, partnering will be the fastest to market, but has the downside that the retailer is dependent on the partner’s service level and there may be restrictions to accessing customer data. Buying technology eliminates the service and ownership issues, but may require extensive modifications to pre-existing processes and formats of the technology that is purchased. If the underlying processes are too substantially different from the retailer’s, the buy decision could end up actually taking longer and costing more than building from scratch. I agree with Albertsons that building custom applications should be used when the process itself is highly custom.

There is in fact a middle road. We have often found the purchasing and configuring components rather than purchasing entire software applications allows us the flexibility to mix-and-match and gain the benefits of buying with the flexibility and customization of building your own.

While the Build argument always does hold risk in cost, upkeep and effectiveness over the strategies to Buy or Partner, the case for Albertsons creating their own internal picking app appears to be paying off.

Differentiation, better picking, communication and labor savings look like their edge against the alternatives. Good for them.

New tech solutions continue to be a challenge for retail, especially retailers focused more on retail than tech applications. In many cases, 3rd party SI partners are doing the legwork of evaluating tech solutions. However, prioritization of tech is a full time function and options to build, buy, or partner will vary and more important, remain dynamic, i.e. changing with the times. For example, certain tech such as touchless self-checkout may have become even more valuable after the pandemic than pre-pandemic.

Prioritization still falls into the broader organization strategy — whether it’s focused on growth, immediate returns, long-term customer acquisition, or overall customer experience. Build, Buy, and Partner will cater differently in each case and with the different technologies.

In Albertsons’s case, the internal tech effort for picking has seen direct results with immediate returns. The purchase of the recipe solution had potential long term localized value and fits within the ecosystem. Which one is the better option? Which one is a good investment? The criteria will vary based on the retailer, and the decision will vary based on the conditions.

As for retailers making good decisions when deploying new tech — usually not, because most retailers are still experimenting with new tech and are unfamiliar with the nuances relative to their business. But that doesn’t mean experimenting isn’t the right decision.

The challenge with all of these partnerships, DoorDash for example, is that they are taking a pretty significant cut of what little margin there is to be had. Over time, I have to believe build will win over buy if they take the long road.