Sources: Amazon; google.com

Amazon and Google engage in a smart speaker price war

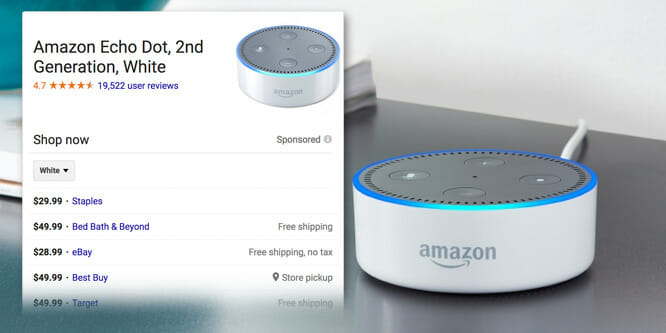

For Black Friday, Amazon.com slashed the price of its Echo Dot to $30 from $50, and the item became the best-selling product from any manufacturer in any category across the site, with millions sold.

With prices cut on all six of its Echo devices, Amazon said Echo devices were “extremely popular” this holiday — Echo Spot, Echo Dot and Echo Buttons reportedly sold out.

In sync, Google reduced prices on its Google Home Mini to $29 from $49 and the regular Google Home speaker to $79 from $129 over the holiday period. This year, Google Home was the sixth most downloaded app on Christmas day. (Amazon Alexa was #1.)

Many now believe that establishing a foothold in connected homes is more important than margins for both companies. Wrote Shira Ovide for Bloomberg. “Those companies view the speakers as a gateway to hook people on Amazon’s collection of Prime membership benefits or to lure them to Google apps and internet services.”

As The Wall Street Journal also pointed out, while smart speakers get the most attention for being able to answer questions or play music, demand for connected home features, such as lighting, heating and locking/unlocking doors, has to pick up for smart speakers.

Falling behind amid the price wars is believed to be Apple, which delayed the launch of its HomePod until early 2018. The device is coming out at a comparatively lofty price of $350. With LG and Samsung planning to introduce their own devices, smart home speakers are expected to still generate major buzz at the upcoming CES 2018.

As of now, it’s a two-player race. A November Consumer Intelligence Research Partners (CIRP) report suggested that Amazon’s market share in voice-activated speakers was 74 percent versus 26 percent for Google.

“Which is better, or which provides the most value is messy to evaluate,” Frank Gillett, VP and principal analyst at Forrester, told Advertising Age. “Ultimately, this is about Google and Amazon getting people to use their digital assistants.”

- Celebrates Biggest Holiday; More Than Four Million People Trialed Prime In One Week Alone This Season – Amazon.com

- Amazon Echo Prices Turn Smart-Speaker Market On Its Ear – The Wall Street Journal

- Apple’s HomePod is a misplaced bet in race with Amazon Echo and Google Home – The Seattle Times

- Amazon Alexa and Google Home top App Store charts on Christmas Day, implies smart speakers were popular holiday gifts – 9to5 Mac

- After a busy 2017, Alexa is still on top — and still evolving – CNET

- Google And Amazon’s Childish Little Fight Is Spilling Into Your Home – Forbes

- Google Home Vs. Amazon Echo: Who Won The Holiday Ad Push? – Advertising Age

- Early indicators of Amazon Echo and Google Home holiday sales highlight cost of Apple’s HomePod delay – Venture Beat

- Samsung Aiming to Release Smart Speaker to Compete With HomePod in First Half of 2018 – Mac Rumors

Discussion Questions

DISCUSSION QUESTIONS: Is it more important at this point for Amazon and Google to get their smart speaker devices into households than to earn a decent margin? How do you see the battle between the two affecting other brands launching in the category? Do you see an opportunity for a wide range of devices across price ranges?

I think without question earning market share is the name of the (long) game here. For companies like Google and Amazon, higher margins today are insignificant compared to the opportunity to establish a dominant foothold in all the places voice technology (including conversational commerce) will go. The speakers are really a gateway to so many other places voice will soon go (cars, home security, appliances, etc.) and once consumers build up skills and capabilities on one platform, as they expand to other voice technologies, the likelihood of switching to a competitor’s platform will diminish.

I have to agree with Dave and would only add as more competitors begin to fill this space I would expect products to begin to vary in price, quality, and functionality. I wouldn’t be surprised if one of these big tech companies partners with a home decor/ cooking show and launches a custom product line of smart speakers targeted to their niche audience.

Yes, it is way more important as they will be the gateway and gatekeeper for a significant amount of the commerce that will be the bigger source of profit in the long run.

The battle for smart speakers is really a battle for the connected home and digital wallet. Whether it is Google, Amazon, Apple or others, the smart speaker — and the supporting ecosystem — that wins will reap long-term benefits. This means that cutting margins — or even going into the red — on smart home control centers (what the speakers really are) will not be an issue for those playing the long game.

This is just like the old days — who ever bought a razor? The companies gave away the razors hoping you’d stay with them and their blades. The question will become, in the long run, what else are they good for? And no, I don’t see a wide variety of price ranges making sense — they’ve set the bar at less than $100.

Neither Amazon nor Google sees speakers as a profit generator; rather they see them as devices that help drive sales and profits from other services and products.

In essence, this is all about getting consumers into the ecosystem of the brand. The question is: how do non-technology focused traditional retailers respond?

If the goal is to win the war then profit is not essential, and it’s apparent that Amazon and Google are in aggressive competition. However, the long-term benefits matter the most. Once the customer has the Amazon or the Google smart speaker, there are many opportunities for the brand to get the customer hooked on additional services and selling merchandise.

Sacrificing the short-term profit to set yourself up for the big long-term win makes sense. Other companies have done this before with great success and it makes sense now.

Undoubtedly it makes sense to carve out market share. In the case of Google and Amazon, both companies (I believe) can throw gross margin dollars at this for the sake of securing a foothold in this space.

Today, voice commerce and digital assistants are starting to take off. At this point in the evolution of the market, market share is paramount. Amazon has a natural lead, yet Google has much to gain. Google’s success means retailer will continue to have a viable alternative to Amazon.

For retailers and brands: it is important to be on both platforms to maximize your omnichannel impact. Leverage Amazon for its customer base and general main-street acceptance. Leverage Google for direct access to customers coming directly to your site, allowing you more direct customer connections.

Interesting battle. For the good of the market, may both win! (There’s no room for monopolies in retail.)

Market leaders control categories. The adoption of these smart devices has moved past the starting gate. Alexa and Amazon have the lead.

To keep that lead, they MUST get the devices into the hands of more consumers quickly. Margins don’t matter now. Usage is the name of the game.

It’s about gaining a bigger share of profitable home services, not just smart speaker sales. For both Amazon and Google, there are long-term, continuous profit streams from home services which are analogous to the the old razor and blade scenario. For other brands to enter this category, it will require a different strategy than price to gain share.

Possession is nine-tenths of the law. This old adage definitely describes the battle for households between Google and Amazon speaker devices. Google’s business model has historically been to develop and present applications that people value and use. At that point, Google then begins to implement a business model around the application. The same holds true for getting the smart speaker into the household. Grab and hold the real estate first — then implement a sustainable business model and value where users will continue to pay you. We are now in the “land grab” phase of smart speaker devices.

Both Amazon and Google can afford to sacrifice margin to get their smart speaker devices into households. These devices are the next battle zone for both companies. Apple has its loyal fan base, but will the company offer a device so different that it can command such a high price? And how will it integrate with other Apple products? LG and Samsung are about to be left behind, unless they can leapfrog Amazon and Google in technological development or completely undercut them on price.

I concur with my colleagues. The most important strategy today is to get into the home. Get people used to using the devices and be connected with the potential customer. Because the future isn’t in the specific device, it is in the connection.

It will not be too many years before the devices disappear and we will just walk around the home and talk to the wall and our wishes will come true.

My wife already does that, Gene, but we suspect it’s a mental health condition. 🙂

Steve, I am sitting at Starbucks, laughing out loud!

I think there are two different battles happening here. There’s the battle for information and the battle to sell product. It’s critical to get households because that’s where the information is, and the money follows the information.

Speaker sales themselves shouldn’t matter a lot — margin made on the actual speaker shouldn’t matter — almost giving these away right now is going to pay off later.

As for Apple, the issue is going to be finding a reason to be. These speakers are a reasonable build quality with reasonable sound quality — what’s Apple’s reason for putting out a home speaker? Even Sonos has the ability to connect to Alexa now.

It’s critical to get users hooked on the service, this is way more important than the device itself. All companies will want the ongoing recurring revenue streams the devices provide a gateway to. For those coming to the market late, they set themselves a challenge, but Samsung and Apple have a bank of registered users of other cloud services they can call upon so they should not be underestimated. Pricing, ultimately, will converge and Apple maybe able to get a premium at the early stage but I suspect that will not last long.

I’m surprised it’s not free yet. All Prime members should have one, why screw around with a couple of bucks? Also that’d put some pressure on the Google/Walmart guys, for sure. They’re supposed to make a profit.

On the surface this appears to be a smart speaker war, but this is really about establishing a presence in every consumer household that the smart speakers are placed. Each placement represents continual promotional forays into the household, as well as ways to present a unified front into consumer purchasing behavior. Short-term, each placement offers users the ability to upgrade to the next generation speaker, followed by associated electronics and other similar appliances. Most importantly, especially for Amazon, this is an entry point to using their shopping site, smart calendars, reminders, entry into the smart home, etc.

It is a customer acquisition cost for these companies to sell additional services or merchandise and win the customer for life. I wouldn’t be surprised if these devices are free in the near future.

It’s not about speakers, it’s all about which platform, and therefore ecosystem, consumers will adopt. Amazon has a significant first mover advantage for now thanks to their Prime program. Echo devices and Alexa are becoming the natural window into Prime services. Google lacks an appropriately well-defined ecosystem of services to make a significant dent and they are hoping for two things — one, by adding major retailers like Walmart and Target they can deliver a similar shopping experience as Alexa, and two, that the power of Google’s AI and search engine will better embed their assistant into our lives by answering almost any question we ask.

The dark horse candidate here is Apple who seems to be taking a very cautious approach similar to their approach with Siri since the beginning. They’ve clearly focused on the music experience and don’t seem terribly interested in the rest — yet. No doubt they are waiting to see what consumers care most about and then hope to identify a better, more seamless way to deliver it.

Voice platforms will be very sticky the more services a household uses so it will be difficult to switch platforms. As hard as it will be for Apple to gain share (even with their loyal customer base) it will be even more difficult for any other brand to step in and gain market share without a native ecosystem that interests consumers enough to buy in.

There’s another way to look at this. Both Google and Amazon seems to believe they can only sell a lot of these at lower prices. That means consumers don’t value them as highly as the PR for the products suggests.

In fact, the people I know who own one (full disclosure — I don’t … yet) primarily use them to control their music. Consider, too, that the BEST lead Amazon could find for it’s TV ad was “Alexa, turn my lights blue.” Yeah. I’m just going to run out and get me one of them … Oh. And the system for turning lights blue. And the special bulb. And after 3 weeks of tweaking … I’ll give up and use the switch.

All this to say, there are threads and glimmers of “possible” high value. But price is suggesting shoppers quite accurately see these products delivering minimal user value at this point.

Smart speakers are loss leaders for Amazon and Google. The value these companies get from them is increasing stickiness to their brand, a link to shopping and, more importantly, data collection about consumers. I am not sure how many smart speakers a home can have, though I have heard amusing stories of Google Home and Amazon Alexa talking to each other. 🙂