Source: instacart.com

Unilever uses grocery delivery service to ‘test and learn’

Through a special arrangement, presented here for discussion is a summary of a current article from the monthly e-zine, CPGmatters.

Unilever is one of dozens of CPG partners finding Instacart to be more effective in certain ways when promoting their brands than traditional shopper and in-store marketing in the brick & mortar environment.

“The big dilemma for brands is how do they affect the consumer in that ‘last mile,’” Dan Bourgault, head of brand partnerships for Instacart, told CPGmatters. “Well, we’re the last few inches, with people sitting with the phone in their hand selecting where they want to shop and what they want to buy.”

Unilever remains in “test-and-learn phase” with the online grocery delivery service, Ajay Salpekar, director of e-commerce and new business development for Unilever USA, told CPGmatters.

Free-delivery promotions “have worked very well for us,” Mr. Salpekar said, particularly with ice cream since it’s an impulse item. Shoppers have to spend at least $10 on the brand to waive Instacart’s $5.99 delivery fee. Said Mr. Bourgault, “It doesn’t diminish the price for the brand, but it provides a huge incentive to consumers.”

Free-delivery testing in other categories has been more mixed.

“Hero placements” across a category banner page on Instacart so far “doesn’t produce as significant spikes in consumption as the free-delivery promotion,” Mr. Salpekar added.

Unilever has tested sampling, which includes added products dropped off with deliveries, with Degree deodorant and is looking at the technique to support new product innovation.

“You can get a lot of answers at Walmart, but you don’t have a one-to-one relationship, and there’s a disconnect between the brand between manufacturing and the time it takes to get into the brick-and-mortar channel,” said Mr. Salpekar. “Then it sits on the shelf and you don’t have direct feedback. But with Instacart, you get the numbers the next day.”

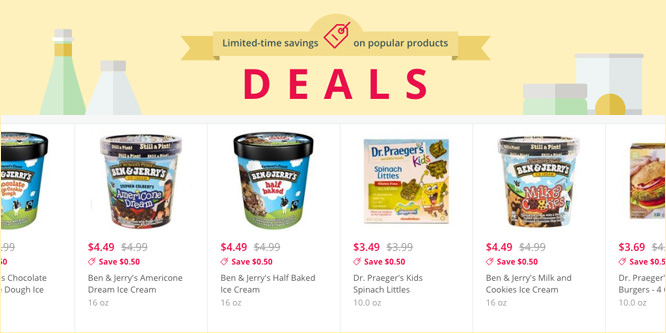

Finally, Instacart Deals, by which shoppers view and redeem coupons on the spot, promise more efficiencies than the traditional coupon distribution model.

“We’ve flipped it to a redemption-based model,” Mr. Bourgault said. “Brands don’t pay for the coupon program unless we’ve delivered a physical sale of their product. They already know what the ROI is before they place an order for us to run an offer.”

Discussion Questions

DISCUSSION QUESTIONS: What might brands gain from digital promotions through grocery delivery services that they can’t tap with traditional retail marketing? Which of the promotional vehicles being offered by Instacart seem most beneficial to brands?

Digital promotions get brands much closer to the consumer by allowing them to quickly and easily test the impact of different promotions relative to each other. The cool thing is that brands really don’t need to guess which of the promotional vehicles will work better (i.e., sampling, deals, free delivery, hero placement) … they can just test and then roll with those that work best.

The biggest advantage for manufacturers is the potential for enhanced customer intimacy. The opportunity to connect directly with a customer without going through a retailer, either brick-and-mortar or online, is a significant shift in the paradigm of who owns the customer. I suspect other CPG manufacturers will follow closely with this concept.

Agreed and CPG companies need to strengthen their consumer engagement as retailers turn to promoting their private brands across transactional channels.

This provides a way for CPG companies to not only gain quick data on which promotions work best but also gets them much closer to the customer. It will be interesting to see how this works and who else tries a similar approach!

One advantage of doing it with delivery companies for CPG companies is that the reaction is faster and it is closer to consumption (people who order delivery generally are looking to consume something now rather than stock up), plus you remove some of the store-based variables such as placement and stock. For test-and-learn it is a great way for CPG companies to gain insight quickly and test multiple items/offers.

One obvious benefit to manufacturers is that it eliminates both the need to secure retailer cooperation and it eliminates the “slippage” inherent in promoting through brick-and-mortar retailers. One prediction — if this catches on, watch for retailers to start shifting their delivery models back in-house to avoid losing promotional funds.

There has always been a manufacturer-direct option available, but most manufacturers selected the education, not the delivery path. Their rationale includes their limited product range (largest manufacturer only sold less than 10 percent of a store) and a desire not to compete with their customers.

The problem is that the manufacturer is now separated from the consumer in two supply chains. Manufacturers must now utilize the customer-direct option or watch their market share decline. Third-party home delivery will be their best option. The key question is how to position product for home delivery at the lowest accumulated cost without significantly increasing the finished goods inventory. Picking from store shelves satisfies a need but is not cost effective.

I love the direct connection that programs like this are able to offer brands, if the merchant (in this case, Instacart) provides rich reporting. While the merchant might be uncomfortable, or unable, to identify PII of customers that have taken advantage of the offer, they should provide profile points in order to maximize the brand’s program value. For example: Was this purchase of Ben & Jerry’s the customer’s first? Did they order subsequently? What is the overall share of ice cream wallet among those that took advantage of the promotion after the promotional period ends?

Traditional retailers have as much or more data on customers and their responses to pricing and coupons than Instacart (think loyalty data, POS data, digital data, etc.). They’ve been challenged to make sense of that data for themselves, much less brand partners. Instacart is starting to force their hand.

Retailers need to tread carefully to avoid being disintermediated. The fundamental danger for working with 3rd party branded apps like Instacart is that the merchant is losing control over their customer. Mobile is the future of interacting with businesses, and if the merchant doesn’t own the install, they are living on borrowed time.