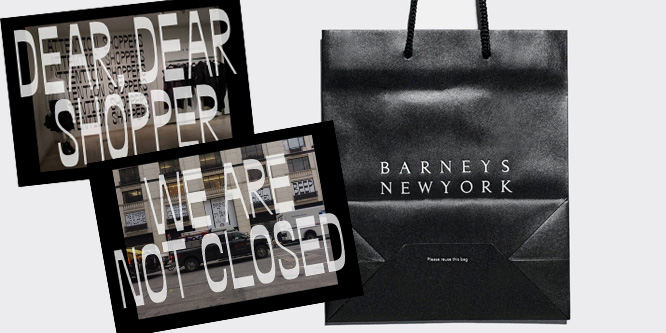

Source: Barneys New York/Facebook page

Will Barneys find success setting up shops inside Saks Fifth Avenue?

A buyer has emerged in Barneys’ bankruptcy proceedings with the intention of opening Barneys shops inside Saks.

The purchaser would be Authentic Brands Group, the licensing company that owns Aeropostale, Juicy Couture, Herve Leger, Nine West, Spyder and Frye, as well as a number of celebrity names and Sports Illustrated. The bid, worth $271 million in cash, is being done with B. Riley Financial, according to a court filing.

As part of the deal, Saks-owner Hudson’s Bay Co. (HBC) would reportedly license the Barneys name and open Barneys in-store shops inside Saks locations. Barneys is seen as hipper and edgier than Saks and could help Saks reach younger consumers. Saks just marked its ninth consecutive quarter of same-store sales and is the top performer among HBC’s brands.

HBC would also operate the Barneys website. As noted by Retail Touchpoints, the sale to Authentic Brands aligns with comments from Barneys’ EVP and Chief Digital and Technology Officer Katherine Bahamonde Monasebian at eTail Boston in August indicating the luxury retailer was seeking a “digitally focused” acquirer to guide its future.

All seven of Barneys’ remaining stores would close as part of the Authentic Brands Group plan, according to court papers, although sources told The Wall Street Journal there is a possibility that some may remain open depending on talks with landlords. A CNBC report said Authentic Brands may to carve out smaller space in top properties.

Barneys’ top source of revenue by far was its Madison Avenue flagship, followed by online and its store in Beverly Hills. Barneys traced its August bankruptcy filing to a move by its primary landlord to double its rent last year.

Authentic Brands will serve as the stalking horse bidder in the bankruptcy case, guaranteeing it will buy the retailer and setting a base offer for an upcoming auction set October 24.

Sam Ben-Avraham, who founded the hip New York store, Atrium, in the 1990s as well as the streetwear brand, Kith, and also operates fashion trade shows, has expressed interest in making a bid at the auction.

- Notice of Entry Into Stalking Horse Purchase – U.S. Bankruptcy Court Southern District of New York

- Barneys could launch more stores inside Saks in Authentic Brands deal – CNBC

- Authentic Brands Teams With Saks to Bid for Barneys – The Wall Street Journal

- Barneys nears bankruptcy deal with Authentic Brands, Saks owner: sources – Reuters

- Barneys Enters Deal To Sell Assets To Authentic Brands, B. Riley For $271 Million – Retail Touchpoints

- Barneys’ Stalking-Horse Bid Sets Stage for Suitors – Women’s Wear Daily

Discussion Questions

DISCUSSION QUESTIONS: Do Barneys-themed in-store shops inside Saks stores make sense for Saks and Barneys? Do you see a better path for Barneys to capitalize on its equity?

Demographically, this makes perfect sense. Barneys shoppers are also very likely Saks shoppers and so the connection is apparent. Making Barneys branded goods available inside Saks stores feels like a can’t-lose proposition for Saks. Given the financial difficulty that Barneys is in now (and has been for some time), I doubt that they have many good options. The Saks play at least keeps the brand alive, but that’s about it. A sad ending for a once top luxury retailing brand.

If Saks has a gap in its assortment and target market (“hipper and edgier”), why not try to develop a brand or strategy to address this void? And if Barneys wasn’t relevant enough to stay alive, is it likely to be a draw inside a Saks store? This may work inside Saks’ Fifth Avenue location (and maybe that’s all that counts) but it doesn’t feel like a viable long-term strategy.

I guess the question really is, “What caused Barneys to fail in the first place?” If it was just high rents in its flagship locations and the brand still has a lot of cachet, then sure — it’s a good idea.

BUT … the fact that all other stores are to be closed as well gives me pause. So does HBC actually sourcing the products. I mean, just because they call it “Barneys” doesn’t mean it’s going to be hip.

Authentic Brands doesn’t have much to lose, as I read this. They get some proceeds out of the license. Saks — I’m not sure they get much. They take on all the risk, and I think the brand is tainted.

What does Saks have to lose? A lot of working capital on inventory that simply might not sell. It’s not a can’t-lose situation at all.

It’s a very Shark Tank-like situation for Authentic, and I don’t love it.

Saks running the website is logical. However, a shop-in-shop concept would need to be carefully executed otherwise it would be very muddled. It’s not as if Barneys is a single-product retailer or sold a single brand: it’s a department store. That’s quite a complex thing to try and put inside of another department store!

This is a tough time for luxury brands, so all options are on the table. Let’s see if Barneys’ forward-looking styles can bring new life to Saks.

This is a step toward identifying and then capitalizing on what’s most resonant about the Barneys brand. Barneys shop-in-shops at Saks will allow Authentic Brand Group to A/B test concepts, assortments, and more with agility in environments where their target shoppers are already drawn.

Barneys has a multipart future. One part is as a store-within-a-store along the Saks model, another is in turning their flagship stores into an even greater experiential tour de force, and last is in creating a high-end cross-channel and platform experience that is more in sync with Millennials.

The outcome from the bankruptcy court can eliminate the high debt burden and allow a leaner and more focused physical and digital experiential site that leverages data to deliver on the changing expectations of a luxury lifestyle.

There has been a flood of reignited brands reemerging as a combination of online presence and physical spaces within other retailers. Barneys’ store-within-a-store concept makes sense as they tend to share a common customer base with Saks Fifth Avenue. In addition, Barneys joins the ranks of Toys “R” Us, FAO Schwarz, and now Gymboree of brands that are either making a comeback or are seeking new ways to remain relevant.

At one point, Barneys was one of the cooler NYC fashion-forward luxury brands. Let’s hope that this small step, plus some more significant other ones, can help revitalize a once-storied brand.

A licensing agreement between Barneys and Saks may not make sense to the Saks shopper. While Barneys may bring more cutting-edge designers to the Saks portfolio in hopes of driving a younger customer to the legacy Saks retailer, the Millennials and Gen Z customers were not a significant buying power for Barneys today. So taking Barneys and placing the “shop” into a department store (Saks) which is also struggling to capture this young market may not make a lot of sense. Saks and Barneys are not viewed as accessible to the mass market of young fashionistas. With that said, having Saks run the digital assets of Barneys’ business would help their business, especially if Barneys’ brand is run separately from a customer touchpoint perspective. Saks has done a great job in the digital space for luxury retail over the past few years. Being more nimble and edgy on the digital side of the business for Barneys would move the business forward.

Last night I received an email, subject line: Save Barneys New York – Sign the Petition from Sam.

I’m sorry, I don’t see that this brand had legs to begin with. It was a snooty customer experience with brands that some people liked but was dependent on their location. With HBC now saying they’re going to go private I don’t see how this adds to a strong Saks brand. It seems like more of a distraction than a benefit.

This all feels like a reach. Does ABG have the ability to get a big chunk of its money back through the liquidation process? And then it owns the Barneys IP? And Saks will sign up for the licensing minimums necessary for this to all make sense? I completely understand that Saks wants to attract a younger demographic. I am just surprised this is the best move available. I guess it all boils down to the unknown details. If it’s comfortable for ABG, I’m surprised it works for Saks. If it’s comfortable for Saks, I’m surprised it works for ABG.

I love this deal in the works between Authentic Brands and HBC. It looks like a win-win and a great opportunity to optimize a small retail footprint with a Barney’s store-within-a-store format in select Saks locations. (This is a format nicely used by Kiehl’s Since 1851, as one example.) The Barneys brand in the luxury space has always been strong and a Barneys store-within-a-store should resonate with a younger, hipper demographic by offering direct interaction with merchandise and ease of purchase. It also offers discovery for the typical Saks shopper who may not yet shop at Barneys.

A Barneys store-within-a-store could be interesting, possibly at SaksFifthAvenue.com. Within a physical Saks store, the Barneys editorial viewpoint of hip and modern may be lost among the many “mainstream luxury” brands. Careful curation and PR may engage those who are curious about Barneys. Long term? A roll of the dice.

Barneys’ brand name has value. It is synonymous with luxury, youth, cutting-edge style and sophistication. If Authentic Brands Group buys Barneys’ brand and Saks (HBC) buys the licensing rights, it could be a real benefit to Saks.

There is a caveat, however. Young people, as a trend, are not buying luxury clothing. Even young professionals earning six-figure salaries do not have the discretionary income necessary to purchase an $800 cashmere sweater for example. Rising urban rents, college debt and stagnant wages have changed the dynamics and priorities of Millennial and Gen X shoppers.

I don’t understand this. Simple problems: a.) Barneys wasn’t popular enough to maintain a profitable business; and b.) Saks is having issues keeping up with younger consumers without compromising its existing — and aging out — customer base. Solution? Put two failing models under one roof and hope for the best? I don’t think so. If Saks could — and, by the way, I see no reason why it can’t — find a way to operate and merchandise stores in a way that serves multiple targeted consumer cohorts, how will things change by essentially co-branding a store inside a store? It reminds me of those odd fast food combination stores. The world really wasn’t waiting for a place where you can buy donuts and pizza at the same time. Better for Saks I think to solve its current problem on its own and for Barneys to scale back and rebuild its brand equity in a fiscally responsible way. Otherwise, I worry both brands may suffer.

Other than being a concession that Barneys is no longer viable as an independent retailer, I can’t see this making sense. It would be confusing to shoppers, and a dilution to both brands … pass (big time).

This makes complete sense — as long as they execute it quickly. The more shoppers are confronted with “Barney’s Closed” the less brand value there will be to set up something new.

I expect we will learn that Toys “R” Us missed the boat in this way. Certainly someone will open stores with the same brand name — but it’s going to be very clear that customers are engaging with a different company.

The question in my mind is what value is the Barneys brand as a product offering inside Saks versus a retail experience? Certainly people shop at Barneys New York and Beverley Hills for the assortment and customer service. With those flagship locations, Saks can get the assortment itself by opening to the vendors that supplied to Barneys. I guess the other part of the value of Barneys would be the customer base data — I just don’t know how well Barneys collected/managed them.

The issue is not whether a themed store can be successful. Of course it can if it’s the right fit. That is a question with Barneys. Saks is trying to attract younger customers, but will the Barney customers be interested in Saks’ products or vice versa? That is the question. Success depends upon how well the parties have done their due diligence and whether there is actually a customer fit.

Shop-in-shops can be a successful model if their execution makes sense on both sides, but for Barneys to exist within Saks may just cause confusion and I see this strategy poised to go sideways. I think a lot of younger shoppers do not really even differentiate between some of the staple luxury stores like Saks, Barneys, Bergdorf, or Neiman. Some of the folks going in Saks would have also shopped in Barneys, but now they really will not be able to differentiate between the two since both are massive department stores offering a wide variety of product. The path for Barneys to capitalize on its equity may very will be teaming with a stronger luxury name everyone respects (in NYC anyway), but I am skeptical this is the silver bullet. How is it a long-term strategy? For starters, Barneys has always been the “hipper” retailer because they feature some of the “unusual,” but when they started selling $1,100 bongs it was the beginning of the end for them. The high-end head shop concept was a failed attempt at some sort of connection to its perceived youthful customers, but they should have just focused on being themselves and quit trying to prove they are something they are not. Hopefully their online presence can keep them alive, but I am afraid this could be just another misfire for old Barneys!