Photo: RetailWire

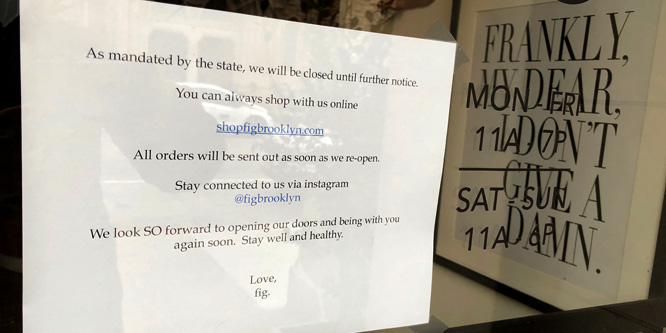

Do retailers need pandemic insurance — now?

Retailers are calling on Congress to pass federal legislation that would establish a national program to help businesses obtain insurance coverage for pandemics, similar to plans that cover losses associated with acts of terrorism established after the 9/11 attacks.

The National Retail Federation and the Retail Industry Leaders Association, as well as the International Council of Shopping Centers and National Restaurant Association, joined with other business groups in sending a letter to House and Senate Democratic and Republican leaders urging them to take action quickly to pass the “Pandemic Risk Insurance Act of 2020” (PRIA).

Two members of the House, Carolyn Maloney of New York and William Lacy Clay of Missouri, are planning to introduce similar PRIA bills. The proposed program is modeled on the Terrorism Risk Insurance Act, which passed with wide support following 9/11.

In pushing for passage, the groups pointed out that retailers have already faced devastating financial losses due to the coronavirus pandemic and that there remains a real possibility COVID-19 will return in the fall.

In an interview published on Tuesday by The Washington Post, Robert Redfield, the director of the Centers for Disease Control and Prevention (CDC), warned that the U.S. will likely face “the flu epidemic and the coronavirus epidemic at the same time.”

The CDC estimates that 35.5 million Americans got the flu in the 2018/19 season and that 34,200 deaths resulted from associated complications. Around 835,000 people in the U.S. have gotten COVID-19 to date and more than 42,000 of those have perished. The numbers of infected and deaths related to the coronavirus are widely believed to be underreported due to a lack of testing in the U.S.

In pushing for the passage of PRIA, the groups argue that pandemics are an insurable risk and that not all outbreaks result in the type of human and financial losses associated with the COVID-19 pandemic.

PRIA would create a “pre-funded risk pool” to help businesses offset losses in the case of “significant business interruption” due to certified epidemics or pandemics. Passage of PRIA would provide small, medium and large businesses with the “certainty that they need to renew leases, invest in real estate, order inventory, plan for capital improvements, and hire and re-hire workers in the coming months. PRIA would also provide a mechanism for immediate and predictable economic recovery should the nation face another pandemic — even one of lesser magnitude than COVID-19.”

- Retailers Urge Federal Pandemic Insurance Program Similar to 9/11 Terrorism Coverage – National Retail Federation

- Pandemic Risk Insurance Act of 2020 Letter

- CDC director warns second wave of coronavirus is likely to be even more devastating – The Washington Post

- Trump said his CDC director was ‘misquoted.’ Then his CDC director said he was ‘accurately quoted.’ – The Washington Post

- Estimated Influenza Illnesses, Medical visits, Hospitalizations, and Deaths in the United States — 2018–2019 influenza season – Centers for Disease Control and Prevention

- Coronavirus in the U.S.: Latest Map and Case Count – The New York Times

Discussion Questions

DISCUSSION QUESTIONS: Do retailers, restaurants and other businesses need access to pandemic insurance? Do you support the passage of the Pandemic Risk Insurance Act of 2020?

I fully expect insurance riders for a pandemic to be available, but prohibitively expensive at least for the next two years. A more generic “extended disruption insurance” probably makes more sense. There are too many unknowns as to what the next shutdown will look like. Will it affect communication infrastructure in a way that cripples online shopping?

Pandemic insurance at this stage makes little sense, and it doesn’t address the real problem. We would be better served by investing in resources to prevent and contain future outbreaks than trying to underwrite every possible failure.

The current multi-trillion-dollar government stimulus IS pandemic insurance.

“Bailout” by any other name. While I’m not an insurance expert — few on here are, I think — I understand the basic concept that it makes no sense to “insure” against something that hits the entire economy (if not equally, then broadly). How to best handle that is certainly a valid question, but let’s not kid ourselves that we can somehow eliminate the losses with insurance.