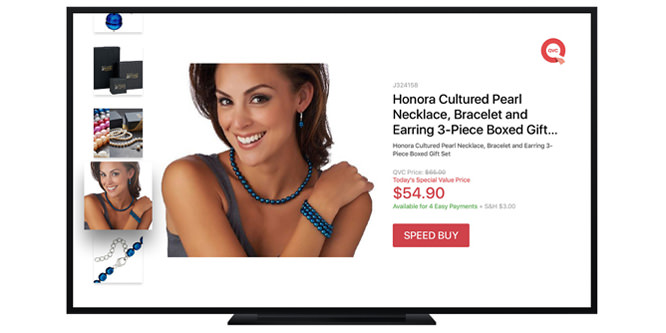

Photo: QVC

Is QVC’s acquisition of HSN more about TV shopping or e-commerce?

Liberty Interactive Corporation, the parent company of QVC, has reached agreement on a deal to acquire the remaining 62 percent of HSN, Inc. it does not already own in an all-stock transaction valued at roughly $2.1 billion.

The deal bringing the two networks under one corporate umbrella will create the largest television home shopping company in the world as well as the third largest e-commerce company in North America behind Amazon.com and Walmart. HSN and QVC will continue to operate as independent companies once the deal is finalized pending regulatory and shareholder approval.

“By creating the leader in discovery-based shopping, we will enhance the customer experience, accelerate innovation, leverage our resources and talents to further strengthen our brands, and redeploy savings for innovation and growth,” said Mike George, QVC President and CEO, in a statement.

Liberty has identified five benefits it expects from the merger of the two companies:

- Increased scale and synergies to reduce costs and drive revenue opportunities;

- Expanded development across its multiple sales platforms;

- Optimized programming across its five television networks in the U.S.;

- Newly created cross-marketing opportunities;

- Added financial flexibility due to lower debt levels.

Industry watchers say the merged company must move quickly to avoid losing ground to Amazon, Walmart and others.

“The consumers who buy on TV aren’t the ones who buy online,” Britt Beemer, chairman and CEO of America’s Research Group, told the Tampa Bay Times. “The youngest consumers don’t know who [QVC and HSN] are at all, so their interest has been minimal. They’re going to have to develop a whole new strategy to reach them if they want to expand their online discovery base.”

“Both brands already have large customer bases, but the real question will center on how they plan on locking their customers into the HSN-QVC ecosystem and stop them from going to competitors like Amazon,” said Tom Caporaso, chief executive of Clarus Commerce, in an interview with The Washington Post. “By building a premium loyalty program like Amazon Prime, the new converged brand could start to become a major threat to Amazon’s visions of total domination of the industry.”

Discussion Questions

DISCUSSION QUESTIONS: Is QVC’s acquisition of HSN more about TV shopping networks or e-commerce? Could the merged company pose a challenge to Amazon and Walmart.com? What do you see as the keys for the merger to prove successful?

The initial benefit of the QVC-HSN merger comes from economies of scale in a mature segment. (It’s the same kind of play that Macy’s made for May Company several years ago, recognizing the lack of organic growth in traditional department stores.) But it’s clear that home shopping (via TV) is not where the action is. It’s up to QVC to figure out how to translate the “treasure hunt” experience of off-pricers to its model, and especially how to engage mobile shoppers at its site. This becomes a more urgent problem as more and more consumers (especially younger ones) cut the cable cord.

I see this acquisition as a smart move. The appeal of QVC and HSN is no longer what it once was so this could help their survival. That said, how they move forward is imperative because they must bring technology into the mix. One thought about how to do this is that while watching QVC on TV, shoppers could have a real-time app allowing them to instantly order the item. Another is introducing a web-based real-time QVC network allowing the same opportunity. Visuals and live demonstrations have a great benefit but as the internet provides more video and 3-D demonstrations QVC needs to be creative if they wish to compete.

They do.

Here’s a beautiful omnichannel retail play opportunity. Leverage the HSN and QVC physical stores and make sure that the e-commerce websites and call centers market that customers can place an order and pickup their product at a nearby store. Then QVC has a fighting chance. Posing a threat to Amazon or Walmart.com is a stretch target for the future. The important part is to change up the game, leverage their strengths and grow their business. Focus on customers first, and competitors second (then don’t get these two mixed up)!

TV shopping is being disrupted by online just as brick-and-mortar is. I believe QVC’s acquisition is primarily about e-commerce and how it remains relevant in the era of online and Amazon. Consolidating efforts will make QVC a stronger player enabling it to more effectively compete against Amazon and Walmart, but it will need to evolve to meet the needs of a changing market. Younger consumers are cutting ties to TV and so the base of TV shoppers is declining. Ultimately, QVC will need to find ways to attract new customers and this will require significant changes to the way they have historically done business.

Television shopping is one of the great selling mediums and is often overlooked. Just think about the fact that combined, these two companies will have the third largest e-commerce platform behind Amazon and Walmart. That is a huge business.

This type of shopping has fantastic benefits for brands because it provides an opportunity to tell your story and demonstrate your product directly to the viewer. For the user it is shoppertainment.

The viewers of shopping channels form emotional bonds with both the hosts and brand presenters. Viewers will wait to watch a Wolfgang Puck or a Jennifer Flavin launch a new product. And the demographics of these viewers would make Amazon and Walmart drool. It is not someone in middle America, like most people think.

This acquisition is entirely about e-commerce using TV as the selling medium.

Having used this channel to launch brands, I can tell you it is a great method for building national awareness very quickly. But it has limitations. It is great for beauty products, fashion products, jewelry and niche food items. Problem-solving household products do well also. In those categories TV definitely can outflank both Amazon and Walmart.

Agreed, Phil. The fact that television shopping “gets no respect” is one of its biggest competitive advantages.

Discovery-based shopping is exciting to consumers. QVC has to translate this to new content and experiences online in order to maximize the potential that younger shoppers offer. They will need new talent, new offerings and a sense of humor. Let the current TV platforms pay the bills of investing in innovation for the future.

Half of sales from QVC and HSN are currently from e-commerce, and the threat from Amazon is clearly front and center for both companies, so e-commerce is clearly in focus. The biggest opportunity in this merger is for the two brands to strategically differentiate each from the other. Slice data shows that there is high overlap between QVC.com and HSN.com shoppers and that the shopper demographics are virtually identical. Greater differentiation will expand the customer base and allow each to become more relevant to its customers.

Or go the other way and reduce the cost of marketing to the shared audience by only having one site and brand?

I think it’s about both. QVC has done a better job synchronizing e-commerce and TV. The audience is aging out, so consolidating makes all the sense in the world.

Good move.

Home shopping TV programming offers consumers something Amazon can’t: the opportunity to discover surprising new products that add value to their lives.

After all, when Amazon has a new, exciting product they’ve developed, they put it on TV and put it in stores (Alexa, etc … ). Amazon and online buying sites are poor places for discovery, surprise and engagement with new things.

Rather than get lost in a “how do I compete with Amazon” style strategy, they will need to leverage this strength to grow. Assuming they continue to do so, the combined networks will do quite well no matter what Amazon chooses to do.

I think television-based shopping is a generational phenomenon and its target generation is rapidly fading away. Sure, there is a “push” element to QVC and HSN you don’t have on pure-play e-tailers, but I’m not sure its allure is enough to save any television-based model.

Could the merged company be a serious threat to Walmart.com and or Amazon.com? I’m more than a little skeptical that it could and I think its threat diminishes significantly over time.

So if I’m right the merger is a hedge against the inevitable at best and the initial death throes of a channel at worst.

Unless QVC/HSN has some online treasure hunt rabbit in their hat that no one else does, I think you nailed it Ryan. But there may be one as they use their pitch-person videos to replicate the TV show persona online. We all say the audience for this concept is dying — but I think my sisters were in their 30s when they got hooked on HSN. Millenials just might be as susceptible to a digital delivery of the same old pitch today. But I doubt it, too.

I think that’s a good point Ben. No doubt some Millennials may jump on the television sales bandwagon, but the real question is will there be enough of them to keep the “treasure hunt” profitable. I guess time will tell.

The customer base for both of these businesses is literally dying. A merger/consolidation in a declining business makes sense — add some scale, cut costs, maybe generate a few top-line synergies between the two channels. But this should be just the first step. Next they have to find a way to engage a new, younger (Millennial) customer, which will hinge on the ability to transition from cable TV to the phone and tablet.

Big fish in a small pond or small fish in a big pond? The move by QVC to acquire HSN will make QVC the biggest fish in a shrinking pond. But the good news here is that the size of the pond can be expanded to thinking about screens and not being restricted to TVs that are hard-linked in living rooms.

The two companies bring expertise and solid history in sourcing/buying and a ton of data on their customers that is valuable for future assortment decisions and more personalized offerings.

The current setup in the market suggests this is a last gasp for air by a once mighty giant. I see it as an opportunity to capture market share and recast it in a more expansive business model that offers consumers more choices and does not rely on traditional TV couch potatoes; high risk, high potential rewards.

This is really about consolidating audiences in a declining market. It’s true that both firms have seen a majority of their orders shift from phone to e-commerce, but the overwhelming majority of purchase intent for both firms is their TV content. What they sell online is what’s promoted on the show, not what’s in their deep catalogs.

The challenge for both firms is that neither firm is very successful at acquiring new shoppers. So this acquisition helps in the short term by aggregating audiences but doesn’t do much for the longer term. Millennials and Gen Z are pulling content they are interested in rather than letting TV networks push content to them.

A somewhat obvious and I think solid move. Will it compete with Amazon and Walmart? I don’t think so but still will serve a very large niche and one that many people have claimed to be dead for a long time.

While not the powerhouses they one were, they still command attention and will now be more about expectations of growth. They also have a massive customer database and can get better at using that data to target people digitally.

They will need to find a way to beat Amazon to OTT shopping dominance somehow and would benefit from finding exclusive products that are not available on Amazon or Walmart.

You can shop at the mall. You can shop online. You can shop on TV. QVC and HSN is a different experience than online or instore. It is its own separate channel (no pun intended). I’m sure savvy shoppers will compare prices online while being pitched on TV. So, no threat to Amazon or Walmart.com. Just more competition, which is good for the consumer.

This acquisition makes sense for both brands. Their audience is aging on the TV side, and younger shoppers are less and less interested in television as a medium altogether. While they are both seeing over half their sales come from ecommerce, they’ll need to find innovative ways to blend all their channels to find a younger audience for the long term with a special emphasis on mobile commerce. The combined QVC/HSN should be in a good position to combat Amazon and carve out a unique customer base in certain product categories. Perhaps the best strategy for them will be to focus on categories not dominated by Amazon or Walmart. Overall a good move for both.

My thoughts on QVC/HSN merger on Forbes.com, re it’s a perfect storm for retail….

The combination of QVC and HSN will generate a combined force that is bound to impact Amazon at several levels, bringing television shopping into the game of ecommerce giants in a big way. A disruptor at work here that may ultimately dissolve Amazon’s near monopolistic power is the ability to identify what shoppers want to buy next. QVC and HSN have worked diligently to accomplish this by understanding each unique user’s taste, wants, likes, tendencies, inspirations, and influencers, combined with purchasing history. It’s a matter of deep cognitive understanding of the unique shopping related attributions of a single shopper, and then having the right platform to serve this individual shopper with the relevant inventory where it is mostly effective, i.e. where a specific user is bound to see the recommended product and immediately enter a shopping funnel. Also, the visual element of TV allows for much more shopper engagement and demand creation than the more catalog approach of Amazon.