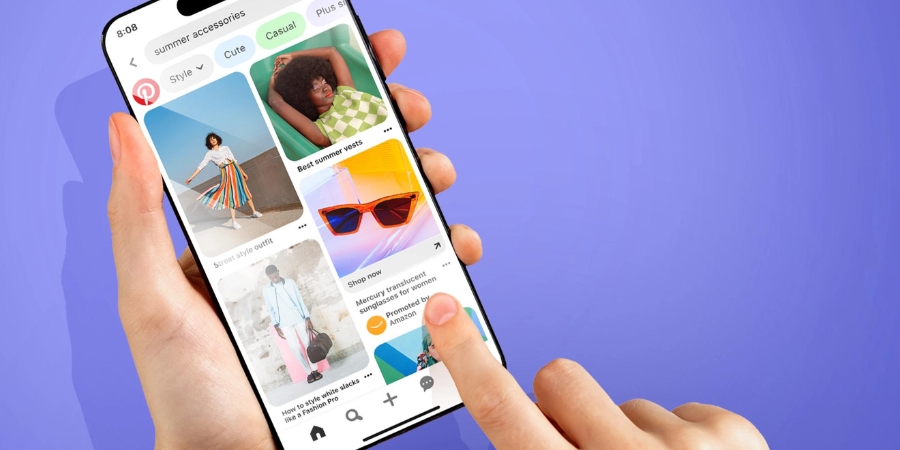

Photo: Amazon

Will Amazon Expand Its Retail Media Lead With Off-Site Ads?

Amazon is expanding its ad offerings by extending Sponsored Products campaigns to other sites, including Pinterest, BuzzFeed, and Lifehacker. The offsite ads will still link to a product page to enable one- or two-click buying and only appear for products that are in stock to ensure a seamless, frictionless experience for customers who make a purchase through the ads.

Sponsored Product ads will automatically appear on contextually relevant pages based on both the campaign and the cost-per-click parameters set by the seller. The e-commerce giant plans to start small with the expanded version of the program before taking its learnings to further grow the options.

Retail media networks are increasingly important across retail, and Amazon’s services are among the biggest of them all. Amazon received 37% of the total investments in retail media made in 2022, according to data from MediaRadar. In total, over 14,000 companies promoted more than 17,000 brands on the platform, and now many of these brands will be appearing in other highly viewed spaces across the web.

It’s hard to overstate the power of the Amazon retail media network, even compared to its major competitors. Walmart, which has a retail media network befitting a retailer of its size, generated $2.7 billion in ad revenue for all of 2022. That’s significant, and well ahead of competitors like Target that have yet to crack $2 billion, but puts it in a distant second place.

Amazon isn’t just maintaining its lead, but looking to expand further. The e-commerce giant has reported advertising revenue growth of over 20% for more than four quarters straight. The retailer reported 22% year-over-year growth to $10.6 billion for Q2 2023 — somewhat slower than the previous few quarters, which topped out at 30% growth in Q3 2022, but it’s still proof that the offering is going strong.

The power of this growth becomes especially obvious when compared to one of Amazon’s other major non-retail investments, AWS. The web hosting service is still an enormous moneymaker, bringing in $22.1 billion in revenue for Q2 2023 alone, but growth has been on a steady decline for some time. AWS recorded a 12% year-over-year increase in its latest quarter, compared to 33% growth in Q2 2022.

Amazon’s ad-based efforts go beyond offering the same purchases on different platforms. The retailer has released studies to help its advertisers better reach specific audiences and offers guidance for how brands can use AI to power their campaigns. The retailer is also building out a team that can further develop its in-house AI offerings and help the company keep pace with tech rivals like Microsoft and Google in the rapidly changing world of marketing.

Return on ad spend for Amazon Sponsored Ads declined somewhat in 2023, according to data from Jungle Scout, but expanding reach to new platforms could help reverse that trend. Amazon recognizes that it is operating from a place of strength, and pushing ads on other platforms could help it grow even further.

Discussion Questions

DISCUSSION QUESTIONS: Do you think Amazon Sponsored Products will prove as successful off of Amazon as they have been on the site? Will the expansion of ads outside Amazon’s home site threaten the seamless experience customers expect?

Amazon is a powerhouse in retail media, largely off the strength of its own platform and the traffic it generates. However, it is now playing more of a role in the wider digital media market. Amazon already has a technology offering that some third-party sites use to fulfil ads, but it is now using this to push ads for products sold on its own marketplace. This is a double win. It increases traffic and sales for Amazon, and it means more opportunities to generate ad revenue. The integration with Pinterest is interesting as people searching the site for particular brands or products will be served relevant Amazon ads. This is like another search funnel driving people to Amazon.

Amazon Sponsored Products looks like it will be a solid ad revenue generator for Amazon. Expanding ads outside Amazon’s home site will significantly broaden reach which will be highly attractive for advertisers and if implemented well, will have minimal impact on customer experience.

Adding Amazon Sponsored Products to digital media sites will make consumers accustomed to seeing ads everywhere. Limiting expansion will help Amazon test and optimize the experience before rolling out to more sites to drive growth.

This move makes the experience more seamless with relevant marketing, in-stock items and one-click buying.

Amazon is theAdTech beast I predicted it would be in a blog 7 years ago. Walmart should have better data assets to compete with Amazon as AdTech but they were very late to the game…not sure if it is too late.

People think Amazon is a retailer, but their really a marketplace + media company that derives a lot of revenue from advertising. Just like people think of Google as a search company, when at the end of the day, they’re really an advertising company.

As for the expansion impacting CX, Amazon is super data driven. If it works, they’ll continue with it, if not, they’ll pull the plug. But given we see ads everywhere, from everyone, I don’t believe it will have a negative impact on CX.

The key to off-site ads is relevancy and context. If they appear to the right consumer, at the right time, and in the right context (based on their browsing & buying behavior), they certainly have an opportunity for significant growth.

The emergence of AdTech has been a win-win for retailers and brands, as it extends the scale, reach, and relevancy of products across digital channels. Amazon has quickly become a dominant force in retail digital media and has generated significant revenue in this space. This is attributed to their competitive advantages with their highly scalable and flexible eCommerce platform and the sheer amount of volume that flows through their site daily.

Another competitive advantage for Amazon and its marketplace brand partners is that their digital advertising can be tied directly to perpetual real-time inventory availability. The ability to provide the consumer with accurate and real-time “available to promise” product availability capabilities that are fully integrated with digital advertising is a competitive advantage that other online retailers and marketplaces will be struggling to keep up with.

Additionally, Amazon’s strategy of extending the Amazon advertising capabilities and product offerings with Pinterest, BuzzFeed, and Lifehacker is yet another win-win. Amazon’s digital advertising business brought in $10.68 billion last quarter, which represents a growth of 22 percent compared to the previous year. That puts it well ahead of its two biggest competitive advertising platforms, Google and Meta.

Much like Costco uses product sales as a vehicle to generate membership subscription revenue, Amazon is evolving into a media company that uses product sales to generate ad revenue.