Photo: iStock

Does TJX Have the Most Bulletproof Business Model in Today’s Retail Market?

Remember Filene’s? Lord & Taylor? Rich’s? Burdines? Foley’s? Marshall Field? Dayton’s? Kaufmann’s? Lazarus? Goldwater’s? Bullock’s? The Bon Marche? All relegated to the history books.

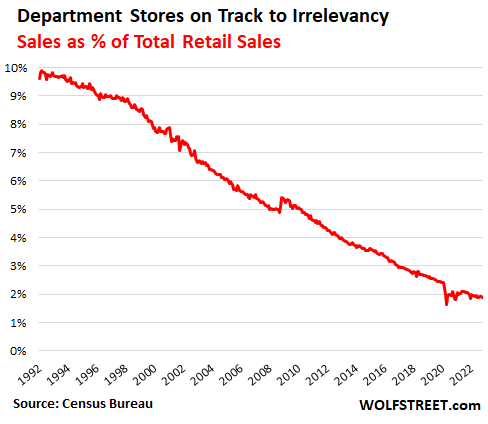

The demise of the department store has been happening for longer than many people realize. Of course, the internet has been siphoning sales from physical stores for many years now. But until I saw the graph below, I didn’t fully grasp the degree of the shift. Department stores now hold about 2% of the market for total retail sales versus the almost 10% they held in 1992. They now hold one-fifth of the market share they held 30 years ago.

While department stores were losing share, TJX Companies was growing from $9.6 billion in 2000 to $50 billion in 2022. In a recent press release, TJX’s CEO Ernie Herman said, “The third quarter is off to a very strong start and we are seeing tremendous off-price buying opportunities in the marketplace. We are in an outstanding position to continue shipping fresh and compelling merchandise to our stores and online throughout the fall and holiday selling seasons. Going forward, we continue to see excellent opportunities to grow sales and customer traffic, capture market share, and drive the profitability of our Company.” Even today, TJX is optimistic that the rest of the retail and branded world will continue to fuel its growth.

Just because TJX is doing so well compared to some of its competitors, this doesn’t mean the company is to blame for the demise of other department stores. They have only themselves to thank for their slide into obscurity. But it gives pause for thought to be reminded of the several great regional stores listed above (and more) and how they disappeared in all the mergers and acquisitions of the 1990s and 2000s.

And then came the great renaming of so many regional marquees into the Macy’s moniker. The creation of a national department store chain under one brand seemed to make sense at the time. At a minimum, the presumed cost efficiencies were just too irresistible. However, plenty of shoppers in each of the regional markets were upset about losing a local favorite shopping destination.

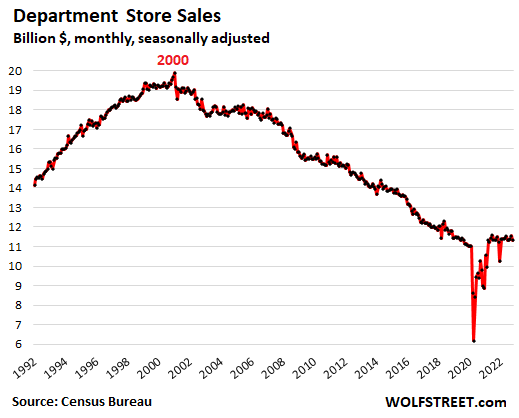

For a while, the market share erosion was masked by the fact that department store sales continued to grow. Sales in the 1990s grew even as market share shrank.

But it’s an oversimplification to say, “Oh well, it was inevitable that e-commerce would erode physical retail.” Sure, but for any given brand or retailer, it’s a matter of degree. Here’s the sales growth profile for a few off-price retailers over a similar period:

- TJX grew from $9.6B in 2000 to $50B in 2022. That’s +$40.4B.

- Ross Stores grew from $2.7B in 2000 to $18.7B in 2022. That’s +$16B.

- Burlington grew from $3.7B in 2010 to $8.7B in 2022. That’s +$5B.

Yes, e-commerce peeled away meaningful sales volume over those years, but so did the off-pricers, and they did it almost exclusively in the physical retail channel, as the off-price retailers were slow to get into the e-commerce market. While department stores were dropping $95 billion over those years, the off-price channel was happily gobbling up at least $61 billion of those lost sales.

Again, it would be an oversimplification to say that consumers were just demanding better value from typical department stores. There had to be inventory to feed that demand, and that inventory came from the department stores and brands that were ceding market share in the process. With the simple act of selling excess inventory to the off-price market, retailers and brands were in effect feeding the beast that was eating their very soul. Season after season. Year after year.

Thirty years ago, this all seemed like an efficient — and harmless — liquidation process. Time, along with the incredible difficulty in projecting demand and managing the supply chain accordingly, has produced a level of competition that brands and retailers would never have wished upon themselves. And now department stores have one-fifth of the market share they enjoyed 30 years ago. Where does it stop? And how?

It begs the question: Does TJX have the most invincible, bulletproof business model in today’s retail market? What would cause the off-pricer to have a no-growth moment?

TJX has played the hand they’ve been dealt very skillfully. But it’s past time for retailers and brands to be smarter about aligning demand and supply. I don’t think it’s healthy for retail overall for the market to keep handing TJX market share on a silver platter. Retail is in the process of reinventing itself, and department stores may or may not survive that process. This 30-year snapshot of department stores tells a sad tale. It used to be about storytelling and theater — experiential retail before it was called experiential retail. The other word for reinventing might be evolving. And evolution is not very understanding, or patient, of those that cannot adapt.

Discussion Questions

What actions do department stores, or any store in the mall for that matter, have to take to stop the market share drift to off-pricers? What is preventing retailers and brands from being able to better manage their demand projections and their constant overbuying?

TJX’s business model helps it perform in both good economic times and not so good economic times. During the former, its core customers have more to spend and splash out. During the latter, it attracts more customers trading down – which is what’s happening at the moment. However, it is not fair to attribute TJX’s success to the business model alone. Another reason for outperformance is because it has an excellent team. TJX buyers are some of the best in the business and know where to find great product that will fly off the shelves. Store management are highly motivated. And the senior team has overseen sensible expansion in the US, Europe and elsewhere. All these things are why TJX has not just outperformed the retail market but has also outperformed other off-price peers.

Oh, and as for department stores, as Jeff says, they were not killed by online or off-price. They committed suicide by failing to invest and evolve. There are many occasions when players like Macy’s and Kohl’s present the consumer with merchandise which is displayed worse than off-price, isn’t as interesting as off-price, and costs way more than off-price. It’s a losing proposition.

Jeff Sward’s assessment is spot-on. The demise of department stores has been years in the making. Bad merchandising decisions and over-buying produced a glut of product that no one wanted, except off-pricers who were more than happy to absorb these unwanted goods, jammed them into stores at 50% off. Department store leaders grossly underestimated the impact of off-pricers and the consumer. And as sales started to decline, department stores cut costs, including store labor which further exacerbated the problem by taking away one of the past benefits of shopping in a department store – knowledgeable staff and great customer service. But just as department stores created the problem, they can fix it – if they can survive long enough. With all due respect to TJX and the other successful off-pricers, they have one major Achilles heel – merchandise. Without a strong supply of cheap goods, they have nothing to offer.

If only there was something brands and retailers could do to dampen the flow of excess inventory into the off-price channel. Oh, wait……

The business model of TJX isn’t the bullet proof part, every model is can be made bullet proof on paper but it is the execution of merchandising and supply chain that makes a difference. As a famous boxer once said “everyone has a plan until they are punched in the mouth”, TJX has managed to execute well during the good times and the bad and it is a credit to their merchandising and supply chain teams.

What can the rest of retail learn from TJX? Buy product every single day. Having an in season open to buy allows brands and retailers to react immediately to customer trends and shifts in the market. Stores will continuously have newness and repeat footfall – which means customers are coming back to the stores, sometimes more than once a week. Buying just enough depth and limiting excess inventory results in higher profits.

Jeff hit so many great points in this piece. Reducing overbuying is sadly not a priority for brands and retailers today. More supply just does not equal more demand. Better understanding what the customer wants, when they want it and in what channels is critical in reducing overbuying.

No matter what the state of the economy is, customers are always looking for ‘brands for less’ and the thrill of the treasure hunt at TJX keeps them coming back for more. The off-price model will continue to thrive and department stores will get left behind unless they innovate their processes on buying/planning.

Great article Jeff! I don’t think anything was handed over on a silver platter. TJX found white space and weak links and capitalized on it. It wasn’t hard to find though.

As my colleagues noted, TJX has a great team, and department store management has something to be desired. But there is more. As Jeff noted, other off-price retailers have grown at a significant clip. Add to that online with Amazon and Walmart leading the way, and you have a massive preference for price shopping, not just since the onset of inflation but for more than two decades.

The trend likely has everything to do with the product life cycle. Just as Woolworth boomed and died, just as Sears boomed and died, today’s trends will continue to boom and die. What is the next trend? I don’t know. It is probably something only Elon Musk is thinking.

Don’t forget that TJX stores are clean and well-merchandised. Too often, in department stores, the music is too loud and the clothes are on the floor. TJX is thriving for a lot of good reasons.

Very solid analysis. But it’s simply not the case that e-commerce in general, or Amazon, in particular, can be blamed for department store woes, most obviously because nothing prevented department stores from having a compelling online offering. Far more share has been lost to off-price, discount mass merchants, and concepts like Ulta than has gone to online only players. Their value proposition is better on the merchandise side but the big issue is their off-the-mall go-to-market strategy. Winning retailers are far more convenient.

I certainly remember Dayton’s in Minneapolis — my first retail job, before joining Kohl’s, and a pioneer of trend merchandising whose fingerprints are all over Target years later. The decline in department store market share is irreversible and has been going on for decades. And it’s not just off-pricers like TJX responsible for the trend, but also discounters like Target and online powerhouses like Amazon.

The period of consolidation that began in the 80’s and 90’s may have started as a cost-efficiency play, but the loss of local nameplates began these stores’ long slide into irrelevance. Department stores could not duplicate the low-cost model and more nimble retail estate strategies of their competitors, either.

With few exceptions operating on a national or super-regional scale (Macy’s in particular, nobody’s idea of a dynamic place to shop), it’s no wonder that the drop in market share was bound to happen.

And really, couldn’t we say that Dayton’s evolved into Target – the true department store for the first half of the 21st century? (Even the widget logo survives for the All in Motion house brand.)

In a sense, yes: the department store heritage of Target’s management has been cited as a reason for the store’s relative sophistication and success.

(I’d be less likely to say the format itself evolved, since department stores had a far larger share of sales/floor space devoted to clothing.)

It is fascinating to read through circulars from the 50s and 60s, however, to see just how much floor space went not just to hard goods and automotive (Sears of course being famous for that, but Penneys and even Dayton’s had automotive sections) but also for sundries like washing powders and paper towels. Target’s evolution from Dayton’s basements into standalone stores was not unique; I’m just old enough to remember actual Kresge stores before everything became K-Mart. If anything, the traditional department stores started losing serious market share when they became /only/ clothing, accessories, and cosmetics – long predating the rise of national-scale liquidators like TJX.

Department stores were squeezed by a variety of factors: E-Commerce, Off-Price, Mediocre Management, & Boring Assortments/Bad Merchandising. I often think about the Treasure Hunt & wonder if it can be digitized. Having worked at a digital tooling company where consumption is measured (and billed), large off price brands lag their retail peers in consumption, but they are consuming at a great clip year over year. Very curious to see how digital & off price evolve over time.

It seems bizarre to cite the disappearance of names as equating to the disappearance of the stores (themselves), since, with the sad exception of L&T, every one of those companies became part of macy*s…as Jeff himself point out. (How we view that absorption, of course, is another matter !)

But the broader point is correct: department stores are withering (had the graph covered the past century , rather than the past 30 years, we would have seen a similar pattern…it’s that old). I don’t have a solution; nor am I particularly confident there is one: the stores were designed for a world of full price and full service – and limited options – that seems unlikely to return.

As for TJX, while they’re clearly better off, I’d hardly say “bulletproof”: we’ve already seen their difficulty in moving offline, and the eventual saturation of the off-price market will certainly have losers; it’s not impossible they will one day be one of them.

Good point about department stores being designed for the world of full price and full service…and long before the shopping options available today. Truly the good old days. But since you mention it, I do think that the disappearance of the names does somewhat equate with the loss of stores and the drift of the business to off-pricers. Because with the disappearance of those regional names, we also lost all those regional planning and buying teams. I think those regional teams did a much more surgical job of populating the stores with the right product than centralized buying will ever do. At the end of the season it doesn’t matter if it was overbuying or bad buying. Bad buying = bad sell-thru. And that = abundance for the off-pricers. Retail can do better.

Thanks Jeff,

Point noted …and perhaps anticipated: my paranthetical on ‘macyization’.

Speaking of which, I’m surprised we didn’t hear from Georganne: Chicagoland still has a thing or two to tell us about dropping a storied name!

Thanks Craig.