©AndreyPopov via Canva.com

How Will AR/VR Transform the Retail Experience?

While augmented reality (AR) and virtual reality (VR) technologies have had relatively slow adoption in the consumer market in the United States outside of the gaming industry, their applications to retail are far-ranging and valuable today. The total AR/VR market in the U.S. is estimated to be $10.3 billion in 2024, increasing at an annual growth rate of over 10%. This is expected to result in a projected market volume of $15.4 billion in the U.S. by 2028.

The most common applications of AR/VR in retail are providing sales support to consumers, delivering product demonstrations, and enhancing employee training.

For starters, using AR mirrors in dressing rooms or at makeup counters allows shoppers to try on clothes and makeup virtually and experiment with different styles and colors without physically changing their appearance. This streamlines the shopping experience and empowers customers to make informed decisions.

L’Oréal’s ModiFace AR filters, for example, allow customers to virtually try different makeup shades and styles before buying. L’Oréal states, “Our skin diagnostic analyzes your skin condition and produces a customized beauty routine, based on scientific research combined with a ModiFace AI algorithm. With ModiFace Virtual Try-on, you can try on hundreds of looks in a matter of minutes.”

Retailers can also demonstrate products using AR or VR to transport customers to simulated environments where they can interact with products in realistic settings. For example, furniture retailers can showcase how a couch would look in a customer’s living room, while car dealerships can offer virtual test drives. This immersive experience fosters deeper product understanding and emotional connection, potentially leading to higher purchase intent.

For instance, Wayfair’s AR app Decorify enables customers to see how furniture would look in their homes before buying, which may help reduce returns and boost online furniture sales. When announcing the app last July, Shrenik Sadalgi, director of research and development at Wayfair, said, “Leveraging generative AI technologies, Decorify creates a discovery experience that provides endless inspiration and powers the home personalization journey.”

AR and VR don’t just help customers — they can also benefit employees. Companies can use enhanced VR simulation training to provide employees with realistic customer scenarios (such as product confusion or pricing issues), allowing them to practice product knowledge, customer service techniques, and handling challenging situations in a safe and controlled environment. This improves employee confidence and preparedness and fosters a more consistent and engaging customer experience.

An example of AR/VR for training is Walmart, which uses VR to train employees on store procedures and safety protocols. “We are entering a new era of learning, and Walmart continues to lead the way,” said Derek Belch, CEO of STRIVR, the company that helped Walmart launch its VR in Academies program. “The power of VR is real, and when offered as a cornerstone of learning and development, it can truly transform the way an organization trains its people.”

Here are some specific benefits of using AR and VR for retailers:

- Increased conversion rates: Recent studies show that AR product visualization can increase conversion rates by up to 250%. Shopify and Overstock.com also reported conversion rate boosts of up to 200%. Customers can virtually interact with and understand products in virtual fitting rooms before buying, leading to more confident purchases.

- Reduced product returns: Returns have grown over the past several years to be a significant issue for retailers of all kinds, with online retailers suffering the most. The use of AR in the product purchase cycle has a significant role in reducing returns since customers can see how a product will look in their homes or on their bodies before they make the purchase. Shopify reported that return rates reduced by 5% and order conversion rates increased by 40% due to AR.

- Enhanced customer experience: VR experiences can transport customers to different store environments or product demonstrations, creating a more immersive and memorable shopping experience. By replacing physical showrooms with virtual ones, retailers help customers try out and purchase products online, with high-resolution 3D images and video, overlaid product descriptions, zoom-in, fabric close-ups, and multiple experience customization options. In this way, VR showrooms can deliver lifelike experiences efficiently and economically.

- Improved training and efficiency: AR can train store staff about products and procedures, while VR can simulate real-world scenarios for better preparedness. This can lead to reduced training costs and improved employee engagement and performance.

As the cost of AR/VR continues to decline and the supporting software improves, leveraging these technologies becomes more affordable for the average retailer. Augmented reality is the best place to start since this technology is not limited to the smaller universe engaged in the metaverse. By providing some basic capabilities, such as seeing different colors or patterns of clothing in the changing room, retailers can enhance their customer engagement and determine sales impact.

Discussion Questions

Do you think that the greatest benefits of augmented reality and virtual reality will take place in retail settings, on mobile platforms, or within the home environment?

What will the impact of AR/VR be on retailer store footprints?

Aside from luxury, which retail categories will benefit from AR/VR the most?

As the name suggests, these technologies work best when they augment the retail experience. They do not work so well when they try to replace the retail experience, which is why ideas like the metaverse and virtual retail stores have never really gained much traction. I think applications like the virtual experimentation with makeup (something brands like NYX, MAC, e.l.f., and Maybelline all have) and virtual try-ons of apparel are great additions, especially to the online experience. I also think being able to design virtual rooms is great for furnishings retailers, although the mainstream technology there has a long way to go before it is really compelling.

While AR/VR continues to evolve, broad consumer acceptance and use are still aspirational. Practical use-cases that deliver quantifiable outcomes like improvements in conversion rates, will encourage other retailers to continue to experiment and invest in the domain. That said, the adoption of VR devices for consumers remains slow, and the tepid launch of Apple’s pricey Vision Pro is the latest example. I remain optimistic that AR/VR will become an increasingly important tool for some retailers, but it will take much more time before this becomes a key initiative for most retailers compared to the many other technology investments that they might consider.

This all sound wonderful..so what’s going wrong? One possibility is that the results aren’t as advertised: a pair of glasses or makeup may have little room for error, but clothing will look as it does in a virtual fitting only to the extent that it’s properly sized. It’s also possible, of course, that there’s little enthusiasm from the public b/c they’ve had little exposure to it. Still, before we get too carried away, it would be great to have some ballpark figures on what industries are likely to be impacted, and by how much; I can’t see – say – grocery being all that affected, whereas something like cosmetics could be impacted significantly (not necesarily in overall sales, but how and where the product is sold); other industries, like travel or entertainment may simply see a shift in mediums , away from already exiting video./audio.

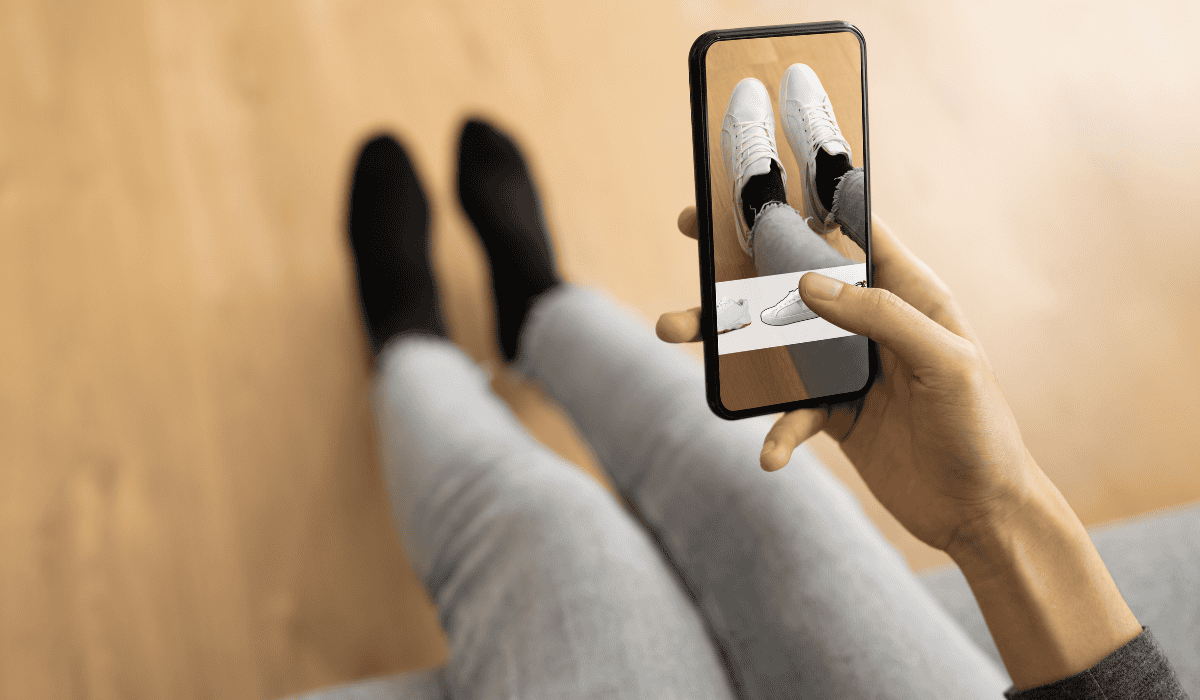

AR-driven virtual try-ons work best for e-commerce efforts in beauty (cosmetics and hair care), apparel and eyewear. The technology offers convenience and personalization by allowing online shoppers to try before they buy, which boosts consumer confidence and sales.

Most see “VR” and assume clunky goggles and stumbling around with arms outreached. Given this, VR having enough of a meaningful impact in shopping is not there yet – the tech may be there, but consumers are not. Training for associates may be a different opportunity. For consumer shopping, if we boil AR/VR down to what it can mean to consumers – what can be done virtually to enhance the shopping experience, to show or demonstrate more than what a static image can show, then this will certainly take hold in home or mobile shopping settings. It can work in the store as well, but the technology can be costly to implement and maintain.

I’m a little more bullish on this tech for the future, even though we aren’t there today. With the U.S. AR/VR market expected to soar to $15.4 billion by 2028, these technologies will continue to grow. As costs decrease and technology advances, AR and VR could be significant innovations in retail, bridging the gap between online and physical realms to create a more interactive, personalized, and engaging shopping journey for customers.

This technology makes a lot of sense in specific categories- thinking eyewear at the moment. My issue, and the reason I suspect that adoption has been very slow, is that this tech adds friction to the retail transaction and consumers have been very very clear; anything that makes it even a little bit more difficult or adds another step to their process to find products and check out, will have a difficult time with mass adoption.

Gary, you make an excellent point about “friction.” With or without technology, retailers that focus on reducing friction will be the big winners. If we observe overall lifestyle trends, the movement is toward less friction and more convenience.

Great observation. I do think that these devices will become less obtrusive, especially AR glasses, which will reduce the friction and increase the adoption. More immersive tech, like VR, will use pass through modes but isn’t really geared to use while walking around (although it hasn’t stopped some people).

Good point. I recently shared an aisle on a flight with a person wearing Apples new Vision Pro googles. Not for me, I get seasick after a few seconds of VR anything. But they were enjoying and clearly had a different flight experience than I did.

I spent a number of years at Kantar with their retailer VR systems. We used an enviable library of global retail environments, fixtures, assets and products. Those assets in our VR tool plus testing allowed us to verify a wide range of changes to anything in store. Quickly. Inexpensively. Frequently. And with shopper testing.

What we tested with clients ranged from overall store layout through shelf tests and signage down to packaging and shelf. With our brand partners we developed and executed tests for concepts in our virtual stores that no retailer would ever authorize for a store test. Many of these were extremely clever and unlocked sales gains through validation of new thinking and some surprising discoveries.

The results we measured were comparable to expensive testing in actual stores. Yet no competitor or retailer was aware of any test. No expensive physical changes. No prototype products, displays or fixtures to create. No labor to reset stores. No long timelines.

Test results gave our brand partners something truly unique to share with their retailer partners. A new approach, supported by shopper data, that had not been considered or attempted. Something they likely would not have authorized as a store test. Multiple concepts that moved the needle and were later implemented.

Being able to deliver a fresh perspective based on unique data has become rare. A game-changing use cases for VR and an underused efficient growth through change opportunity for brands and retailers.

There is a valid use for AR/VR that is not customer facing, which reduces some of the adoption issues. Store Layouts, Virtual Style Outs, Product Design/Refinement are all activities where the “vision to shelf” lifecycle can be shortened, and better decisions can be made prior to ever placing a purchase order.

The first mistake in assessing these technologies for retail is clumping VR alongside AR/ER.

True VR requires a headset and is not yet a practical use for retail. Where as Augmented Reality and Extended Reality can be experienced through a phone or in-store tech installations. That said, there is room for physical stores to have VR headsets for specific use cases that don’t require a consumer to purchase a head set.

The key reason for slower than expected adoption in AR/VR is retail’s tendency to be a laggard in embracing change and innovation. The KPI’s for those who are using AR/VR, 3D product images, and v-commerce are there.

Its simple. Make digital commerce more immersive > make in-store more immersive > connect the two.

The greatest benefits of augmented reality and virtual reality will likely occur in retail settings, especially on mobile platforms. These technologies enhance customer experiences by allowing virtual product trials and immersive demonstrations. They reduce returns, increase conversion rates, and improve employee training, ultimately enhancing the overall retail experience.

Retailers can offer virtual showrooms, enabling customers to explore products remotely. This could lead to smaller physical locations focused on customer service, while transactions increasingly occur online. However, some retailers may still value physical spaces for experiential purposes.

Besides luxury, retail categories such as furniture, fashion, footwear, cosmetics, and automotive are likely to benefit significantly from AR/VR technologies. These sectors can leverage virtual product try-ons, immersive demonstrations, and interactive experiences to enhance customer engagement and decision-making processes.

In my opinion, the greatest advantages of augmented reality (AR) and virtual reality (VR) are likely to be most pronounced on mobile platforms. These technologies have the potential to offer immersive experiences that can greatly enhance customer engagement and decision-making. Consequently, they are ideally suited for both in-store and online use, enabling customers to browse products via websites or QR codes.

However, as virtual experiences become more prevalent, AR and VR could potentially change the preferences of customers to visit a physical store for buying items. Beyond luxury items, sectors such as furniture, home decor, and beauty stand to reap significant benefits from AR/VR. This is because customers would have the ability to visualize products in their own homes or on themselves before making purchases. Ultimately, this will enhance the overall shopping experience and contribute to reducing returns.