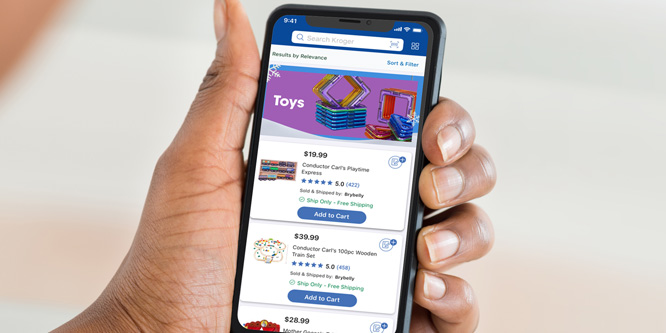

Photo: Kroger

Kroger’s marketplace sets out to ‘deliver anything, anytime, anywhere’

Kroger has announced that it will add an online marketplace in the fall designed to allow third-parties to sell products via its website.

The nation’s largest supermarket operator plans to add sellers in complementary categories, including housewares, international foods, organic products and toys, to its Kroger Ship digital platform.

The grocer launched its Ship program in 2018 to deliver online orders of shelf-stable grocery products to consumers in and outside of markets where it operates stores. At the time, many saw the effort as an answer to Amazon.com’s Prime Pantry and Target’s Restock programs. Orders over $35 are free; $4.99 for smaller purchases. The retailer uses sales data and analysis from its 84.51° digital intelligence group.

“Our customers are increasingly turning to our e-commerce solutions provided at Kroger.com for their grocery and household essential needs,” said Jody Kalmbach, Kroger’s group vice president of product experience, in a statement. “To better serve our customers, we’re continuing to invest in technology that enables us to expand our digital services to deliver anything, anytime, anywhere.”

Kroger, like many other retailers deemed essential during the coronavirus pandemic, has seen online sales spike in recent months. The company reported in June that its first quarter digital sales increased 92 percent. At the time, the company also reported that digital sales for the second quarter were up significantly, including triple digit gains for the first three weeks of the period.

“We fundamentally believe that long-term trend will continue where people will continually depend more on e-commerce. We certainly have seen that being accelerated. We don’t think it will stay at the accelerated — at higher level where it is today permanently, but we do think fundamentally the growth has been accelerated and will be higher than where it started before COVID-19 and then grow from there,” said Kroger CEO Rodney McMullen on the June earnings call.

Kroger continues to be bullish on its partnership with Ocado to build and operate automated customer fulfillment centers. The exclusive U.S. deal, announced in 2018, is expected to come online early next year with the first warehouse in Monroe, OH. Kroger has announced nine locations for the centers in the Mid-Atlantic, Midwest, Pacific Northwest, Southeast and Southwest regions.

- Kroger Ship to Integrate a Marketplace this Fall – The Kroger Co.

- Kroger Reports First Quarter 2020 Results and Provides Update on COVID-19 Response – The Kroger Co.

- The Kroger Co. CEO Rodney McMullen on Q1 2020 Results (Earnings Call Transcript) – Seeking Alpha

- Kroger Ship to take on Amazon’s Prime Pantry – RetailWire

- Ocado to automate Kroger warehouses in exclusive U.S. deal – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: How will adding third-party sellers in complementary categories affect Kroger’s online business? What is your evaluation of Kroger’s online operations to date?

The online marketplace is the modern equivalent of the shopping mall, minus the food court.

It’s a good move for Kroger and others, as it requires little investment, and reaps the rewards of a larger basket size while placing the burden of inventory and fulfilment on other partners.

Agreed, David Leibowitz. However the “seamless” consumer experience must prevail.

I like almost everything Kroger does — except this. Kroger absolutely needs to offer attractive e-commerce solutions for its core markets. The risk in this one is that Kroger is unable to limit its definition of “related categories” and yields to the siren song of “incremental volume.” The result will be a very long tail of ancillary categories that most shoppers would never think of Kroger for, and an unprofitable e-commerce business overall. Sometimes it really is best to “stick to your knitting.”

During the pandemic, Kroger has been a leader in the grocery segment by quickly adapting their operations and accelerating online delivery and curbside pickup. Kroger’s e-commerce infrastructure has become more robust and now they are looking to capitalize on this asset. Expanding to third-party sellers sounds like a great way to generate incremental revenues, but they need to proceed with caution. A bad experience with a third party can tarnish Kroger’s reputation and controlling third-party vendors is a challenging task.

When i think of buying something, anything, online, where do I go first? Amazon. Myself and 65 percent of all Americans. Then Google. Then Walmart, which is a distant blip on the radar. Kroger? Never. Why does scale somehow create the fantasy of permission in the minds of those leading huge companies that are late to a game already fairly well played out? It has to be ego, obliviousness or desperation. Pick one (or two) in this case and you’d be close to home.

Although I applaud Kroger’s decision to open up their online business to a broader group of suppliers and third-party sellers, the overall shopping experience and consistency of images, descriptions, and navigation concerns me (such content maintenance happens to be one of our company’s sweet spots). If consumers cannot easily, conveniently, and seamlessly shop the site, frustration will mount. I’m eager to see how Kroger will differentiate this experience from others who have already ventured down this path.

As a result of this initiative, Kroger is clearly positioning itself to satisfy expanded consumer need states and purchase interests. Their online operations have been satisfactory to date … and the jury is out as to how this extended assortment will help or hinder that foundation.

I like the idea. I think from a point of view it makes sense. When you expand your business outside of your core, you play dominoes. This is a domino move.

My concern is the logistics. I am trying to imagine how this would work. If the third party is shipping separately, I don’t see any efficiencies. And if they don’t meet the customers expectations it reflects poorly on Kroger. If they are shipping together I see so many chances for error in coordinating inventory and products. The downsides concern me for the core Kroger business and satisfaction of the customer.

Go look at the Sears website and the Sears marketplace for how I expect this to turn out.

So Kroger wants to play in the sandbox with Amazon? This is an interesting play. My first thought was about Amazon but, as I think about it further, Kroger has the distribution and fulfillment system in place. So why not partner with others? Kroger can make extra revenue from their partnership and the customer can order a wider variety of merchandise. It could be a win/win. We’ll see!

Kroger has always been a leader in technology and innovation in the areas of supply chain, operations and customer experience. This is the next logical step to leverage a large loyalty base and a built-in recurring shopper base. To be successful they will need to set and maintain a high level of standards for the vendors they allow into the marketplace.

Leveraging their BI for a recommendations engine combined with allowing regional and local vendors in the marketplace, they could have a very strong community-centric story. I do not see them replacing Amazon as a first thought for general shopping. However in many cases they may already be the first thought for groceries and ready-made food. If they can maintain their standards it should be a growth engine.

Marketplaces are all the rage these days, even Satya Nadella highlighted them during his keynote at this year’s NRF show in January. However it’s not for everyone. It sounds simple enough to turn on a third-party marketplace on your e-commerce site, and Kroger likely sees this as a way to help sustain e-commerce growth in a post-pandemic world. The tricky part is in getting logistics, customer experience, and order management right from the customers’ perspective. If a customer orders a native Kroger product and a third-party product at the same time, are they shipped independently with the third-party seller shipping directly to the consumer? I assume Kroger isn’t interested in warehousing these complementary products. Then there is the issue of returns. As long as Kroger manages all of these things in a way that feels seamless to the customer this is a win for them, otherwise customer satisfaction will suffer. Kroger is one of the few brands I believe has the ability, skill, and scale to make a marketplace work.

Marketplaces have proven to be a viable strategy for retailers to grow their online digital business. Studies have shown that successful marketplaces experience increased customer lifetime value through improved user experience, and average order value (both through increased basket size and average unit retail). Kroger’s ability to rapidly adapt to the changing consumer behavior toward online shopping for groceries (evident from their Q1 sales results), in my opinion, speaks to their strength of delivering on their digital strategy — both currently and into the future.

Kroger already has a format, Fred Meyer, that sells all categories and all items. Kroger has been seriously cutting SKU count in the non-food side of Fred Meyer for the past few years but still has some stores with a full, large SKU count. They could have put their own online marketplace up 20 years ago sourced through Fred Meyer and its suppliers, but they didn’t.

So now they do this. This is nothing but a catch up move.

Lots of other retailers have online marketplaces. Amazon, Walmart, Sears, etc. Some more successful than others. Kroger will have to have a compelling value format here not only for the customer but for the reseller as well.

Given Kroger’s upcoming heavy dive into online grocery sales via the Ocado warehouses they probably figure offering additional goods may lead to a few additional sales.

We will see how it goes. I have little confidence in this being successful.

The success or lack thereof of the experiment will hinge on how carefully Kroger vets the sellers, and how closely those sellers’ standards match Kroger’s own.

In a store environment, with a third party-seller which presumably would be in the form of a leased department (think pharmacy or meats), issues like hours and physical appearance are, of necessity, matched to those of the main store; issues like personnel, return policies, and integration with other departments are more of a wild-card, but at least everything is in plain sight.

Online is more problematic, since the oversight is virtual, and the room for error — or really divergence from the core “experience” — is much greater.