Photo: RetailWire

Are legacy retailers on the right track or heading off the tracks?

Walking both the floor at NRF and the city stores of New York last month, it was hard for me not to look at our industry through the lens of “Retailing 2020: Winning in a polarized world,” a 2011 report by PWC and Kantar. Eight years later, it was fascinating to see how close their forecasts came to hitting the mark.

The report talked about the impending challenges of properly positioning retail brands to master a highly dynamic marketplace. The primary focus was on a view of an increasingly polarized world — and how that translates to our sector. Their view was that retail would fragment into low price/low experience versus high price/high experience. The authors didn’t predict the hyper-speed with which Amazon.com would spread its tentacles, but they sure nailed the basics of most everything else. Their message to those in the middle was: differentiate or die. Many didn’t heed the advice, and they’ve either died or are in the slow agonizing process doing so.

Thinking about this further, the polarity within retail’s leadership attitudes came to mind. PWC never expected that so many would fail to react decisively to both disruption and opportunity. Wall Street certainly hasn’t supported retailers taking confident risks to bullet proof their company’s futures. Stunningly, many retailers have chosen to go out of business rather than make the good decisions necessary to survive.

Pulling back the microscope, I realized that the retail phenomenon we’re currently enduring is nothing more than life on its typical course of evolution. Our world is changing, culture is ever-evolving and technology is altering almost everything about how we live, shop, communicate, create and problem solve. We must evolve accordingly or get left behind. So, why are certain leaders refusing to embrace this and move into the future? Is it ignorance, arrogance or bonus-oriented motivations for short-term, short-sided results? Maybe it’s something else, but what?

Discussion Questions

DISCUSSION QUESTIONS: What do you see as the biggest challenges facing legacy retailers today? Why are retailers failing to take decisive leadership actions when recent history suggests that being unwilling to do so may lead to their own demise?

The stark reality is that legacy retailers cannot survive on the horse they rode in on. Customers keep moving the goal posts. What was extraordinary yesterday is ordinary today. Size and legacy won battles in a product-centric retail world. The winning the race today means winning relationships with customers, however and whenever they want to shop. Yes, it is hard to change. However, today’s customers don’t reward effort. They vote with their wallets and digital pays for retailers that create the most relevancy for them.

There appears to be a knowing-doing gap — retailers know what to do, but they just don’t do the right things. The level of distraction among retailers is acute. This is particularly the case for the application of technological solutions that they hope will drive their business along with paranoia of Amazon and market pressure to find a way to out-compete Amazon. Ultimately, it comes down to leadership or lack thereof. There are some very capable and brilliant people running retail operations, but part of the challenge is how they are incentivized — not on long-term growth or customer experience but rather, quarterly results, comp-sales and stock price which can easily be boosted by stock-buy backs and other financial engineering.

All retailers need to keep up with the times, and it’s obvious the ones that did not are gone. However, when we look a little further as to the reasons why more often it’s less of them knowing what to do rather than being able to do it. Look at Toys “R” Us for example. It doesn’t take a rocket scientist to see the problems with their stores. They became dated, tired and old school and lost their edge. Modern stores with technology and an indoor playground for kids to come and play with one another while trying new toys would have been a big help. I’m sure the leaders of the company knew that. However, when companies like Toys “R” Us are loaded up with vast amounts of debt due to a private equity purchase and ALL profits must go toward that debt there’s little they can do.

Look at how many retailers fell by the wayside because they sold their companies only to find themselves trapped paying off debt rather than reinvest in their business. I see that is a big part of today’s problem. Then there are other companies that could invest in rebuilding their brand, but due to poor leadership, they refuse to bend. HHGregg was one of those retailers who insisted on continuing their 1980s approach to business. Retailers need to have leaders that are innovative, progressive, willing to take risks and backed by the necessary capital. Look at the success of Best Buy as an example because Hugh Joly has been that type of leader. The opportunities are there, and it just takes the right leadership!

This could be a really LONG post but I will try to boil it down — there are several challenges and reasons for lack of decisive leadership (debt, old systems, short term thinking) but I’d boil it down to one primary thing. Many legacy retailers have legacy mindsets and legacy cultures. It is shocking that study after study is released and failure to embrace change still ranks at the top for laggard retailers. If by this point, legacy retailers haven’t woken up to the need for culture change — it’s time to get new leadership that will.

Well said, Dave! Managing — and embracing — change is, in my opinion, far and away the most critical challenge facing our industry as we look ahead.

Great article, Laura! By looking back in order to illuminate the way forward you have given an excellent perspective on our current state, and how retail needs to evolve to thrive. And as Chris mentions, change is the centerpiece of the challenges we face. The pace, frequency and scope of change facing all of retail, in my opinion, will remain the key threat — and opportunity — for retail for the foreseeable future. Success will require enterprises that thrive on change, rather than merely tolerating change.

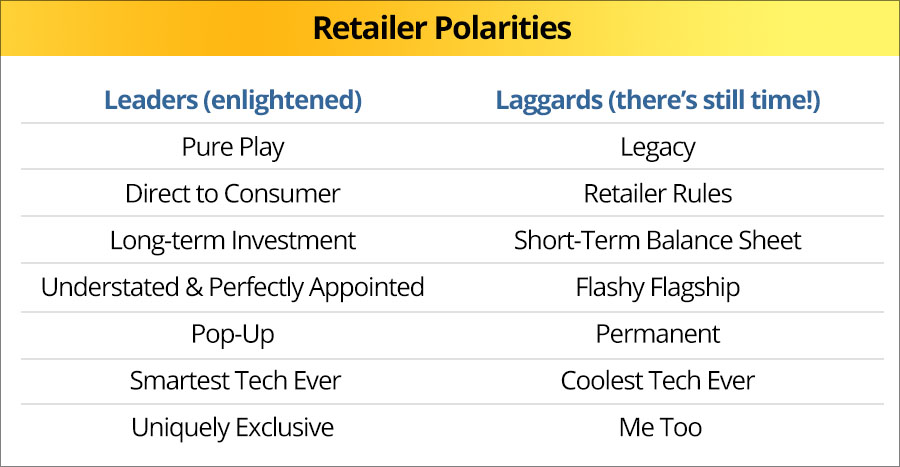

Most retailers are trying to change. But what I see is a slow pace associated with the right strategies, and often a focus on the shiniest new object. It highlights the need for the “smartest tech ever” rather than the “coolest tech ever.” An exceptional example of the slow pace of strategic adoption is omnichannel retailing. We have talked about this to no end, in retail. Yet our latest research (Omni-2000) showed that only 27.5 percent of U.S. retailers have it in operation today. This despite claims from other reports that 63 percent of retailers have it — or are working on it.

Meaningful change requires innovation and innovation requires taking risks — all of these live in the shadow of fear, uncertainty, and doubt. The FUD factor is further amplified by Wall Street’s need (or greed?) for short-term financial rewards. One fiscal quarter isn’t enough time to innovate anything. Meaningful innovation takes commitment and hard work at every level of a corporation. It requires constant and relentless energy to have any chance of success. It is far easier to make cosmetic PR changes (e.g. robot greeter) and stay the course. When CEOs are paid tens of millions of dollars each year, there is little or zero incentive to change. If you’re completely pessimistic you may believe that some leaders actually want retailers to fail as it may be to their financial advantage (Think Sears?!) And while all these leaders are comfortable in the status quo, Mr. Bezos and Amazon forge and innovate forward every single day.

Laura nails it. “Our world is changing, culture is ever-evolving and technology is altering almost everything about how we live, shop, communicate, create and problem solve.” The changes, if not beyond the comprehension of the legacy retailers are beyond their business model to adjust.

When you spend 30 or 40 years solidifying yourself in a shopper’s mind, no matter what you do you are not going to change that image. The history of retailers (and most successful companies) is relatively short — 30 to 50 years. Those that go beyond that is quite astounding.

The oxymoron of legacy retail, the love-hate relationship of change. Nineteen years into the 21st century, most legacy retailers fear technology, lacking the courage to take a deep dive into enlightenment. Focused solely on quarterly earnings as the life raft of living another quarter. Lip service is the measurement of a lack of interest or awareness of technology and how it has changed the retail environment is now on full display.

It’s a customer-centric world and they are in complete control as to how they shop, engage with brands, and choose to spend their money. Legacy retailers used to dominate the scene by piling their assortments high, and by offering everything they believed the customer would need based on historical and market trends.

Legacy retailers who do not adapt, evolve and take the necessary strategic risks to drive innovation and better customer experience will get back on track. It all begins with the right corporate culture of innovation and taking risks. The biggest anchor to being a legacy retailer is a “legacy” mindset, that allows outdated strategies, technology debt and siloed thinking prevent them from moving forward.

All is not lost, however, as we have seen Macy’s drive innovation via the STORY acquisition. Story’s unconventional concept of a complete makeover with a new design, product assortment and marketing message every four to eight weeks is all about innovation. However, contrastingly, if the innovation strategies are not at the forefront, then as Neiman Marcus has experienced, you will not derive any benefits.

Retailers need to think like the customer does. Is the website intuitive? How does the store look? Strategizing won’t do any good if the music is too loud and the clothes are on the floor. Chris is correct that customers are moving the goal posts — and they’ll continue to.

First, the polarities table is brilliant.

No retailer can escape the inevitable lifecycle. The retail idea is born, it emerges, becomes established, matures — and dies. No exceptions. The only escape strategy is to jump to a new curve and reinvent yourself — or what Laura called “differentiate.” The problem is that most organizations see the handwriting on the wall far too late. Jumping the curve is extremely difficult; a dance between chaos and order. Few do it well.

Then there is the leadership factor. It is extremely rare that any one leader is capable of or suited to lead an organization through all the life stages. Some are great at launching an enterprise but pathetic at building it. Others are useless at maintaining the status quo in the maturity phase but come alive when asked to lead the jump.

I think retail executives should specialize in ONE phase of the lifecycle and then move around to help retailers who are about to experience that phase. Everyone would be so much happier and more successful.

I see two super large impediments to making the changes necessary to survive. Digitization (of everything from the store experience to the supply chain) is ground stakes for even being able to make the change much less willing. To do that both the CFO and Wall Street have to shift views from a predominantly CapEx model to an OpEx model. Amazon spends 10 times the average legacy retailer on digitization using an OpEx model (through AWS). The second big challenge is around a change of attitude at the top. Years ago Blockbuster had reached an agreement in principal to acquire Netflix for $100 million. The top leadership at the company pulled the plug because they were retailers (i.e. store guys). Customers don’t care. Until legacy retailers pivot from a product-centric worldview to a customer-centric service and experience worldview they won’t make the right financial and operational decisions to keep up with customers.

Approaching evolution as a “me too” and expecting similar results as the true innovators is a failure to recognize that they are following another retailer’s playbook. The best possible result is catching up, the worst is unnecessary cosmetic fixes akin to organizing the deck chairs while the Titanic sinks.

First, it’s interesting that this discussion is on the same day as the one about JCP exiting the appliance business (speaking of a legacy retailer that can’t figure out what to do).

Retail Darwinism isn’t a new concept and Laura’s article makes some great points, especially about the two clear classes of merchants. There have always been dynamics in the marketplace though clearly the rate of change has increased.

At the same time there is and will always be one constant: customers. Retail leaders who are customer focused generally win. Today and tomorrow they win bigger. Pay attention to them, treat them accordingly (how we define loyalty marketing).

The retail laggards are mostly a function of poor leadership and the decisions they have made and continue to make, their willingness to invest and take risks and their ability to move fast and remain relevant. We live in a world that is rich with data if you know where and how to look so “customer ignorance” is not an excuse. Does it really take a genius to be obsessed with customers? Where else does your revenue come from?

Laura has nailed it in this article. How hard should it be for a retailer to put themselves in the customer’s shoes? I am still surprised by the reactions I see when I ask a room full of retailers when was the last time they walked their own store as a customer? Or better yet, when was the last time they walked a competitor’s store? Distilling what so many others have said here, it comes down to two things:

1) The desire to really fulfill “change.” Many retail execs talk about change, but how many are actually following through in a way that’s visible in their stores? There is a definite gap in what they say vs what they do. Until this changes, legacy retailers will continue to watch the “new guys” pass them by. Those that adapt, and embrace continuous change, will end up creating stores like Nike’s House of Innovation, and deliver impressive sales results like Target.

2) In-store execution. In the rush to deploy new technology on the assumption that will save the day, too many retailers forget the fundamentals of serving customers in the store as well as ignore the underlying technology infrastructure needed to make those “shiny object” technologies work properly! Many who know me know that one of my in-store execution mantras is that “poor Wi-Fi is worse than no Wi-Fi at all” — and it’s true! Nothing frustrates both customers and associates more than poor performing Wi-Fi. Why? Because we’re all so used to fast Internet speeds at home. Why would we expect any less at a store? What’s worse in this example is that it’s not a Wi-Fi problem, it’s a capacity problem with the store’s wide area network and Internet access that someone forgot to upgrade and manage along the way. Little details like that quickly ruin in-store experiences!

Unfortunately, retailers who fall into these traps need to experience failure before they see the light and understand how to move forward.

In general terms — if not precise detail(s) — they’re the same ones that have always been faced: guessing what the future might bring (and the perils of guessing wrong).

For example, a few days ago we had a discussion about Trader Joe’s dropping delivery. There was a lot of opposition to this move, though not a monolith of it, ostensibly because that’s what grocers are “supposed” to do nowadays (“…or you’ll be sorry”). But Tony O — you know, the one among us who actually sells things [in a grocery story] for a living — pointed out the obvious: it’s appears hopelessly unprofitable. So why this seeming abandonment of common sense? It’s someone’s (a lot “someones) guess as to what the future will be.

So if I were to describe the challenge in simple terms: not to forget fundamentals in following someone else’s paradigm.

The greatest challenges facing legacy retailers in today’s environment are two: developing and executing on an omni-channel strategy, with customers truly receiving the same products, pricing and benefits; and the challenges of developing and maintaining a superior customer experience in-store that clearly differentiates that retailer from other brick and digital alternatives.

The failure to invest behind these two initiatives has led retailers to where they are today. There is no easy answer anymore; retailers must invest to catch up, which inevitably will depress short-term profits for long-term gains. Balancing that with investor pressure is the hidden challenge for retailers today.

This BrainTrust is amazing. Thank you for all of your thoughtful comments…it’s always enlightening to hear from peers about topics this pressing.

Retailers are compensated based upon performance versus a year ago. Everyone in the organization gets paid based upon last year. No one is incented to do anything meaningfully different. The organizational inertia carries it to failure. Look at the list of failed retailers in the past two years. They kept trying to beat last year by doing what they did the prior year.

Investors make money based upon last year. So there isn’t change. How to return shareholder value with an out of date business model?

Whether you buy Johnson’s performance at J.C. Penney, he did see a future and knew J.C. Penney wasn’t going to make it. He made drastic changes that now Soltau is considering. Cutting appliances was easy, there was no “legacy” in it. But made to measure window treatments? That’s what knee-capped Johnson. Internally, they resisted.

Mall anchors are doomed. Reducing the store count to one-tenth is a start. But what investor will tolerate that topline loss? Business leaders know what to do. Shopko was in a perfect place, but the selling model was woefully inappropriate for the changes in rural economies. Sun Capital couldn’t tolerate a new selling model, it was better for shareholders to shut it down.

To me, the big challenge legacy retailers face is avoiding the tendency to try and be all things to all customers. Finding (or refinding/re-inventing) the niche is critical. There are things that are becoming “table stakes” or things you MUST have — an ecommerce offering is one of them — and the list of must haves will continue to grow over time, and most of these will be technology driven and enabled. Consequently having a hyper flexible approach to technology adoption is critical — something that seems to be a constraint in many legacy retailers today.