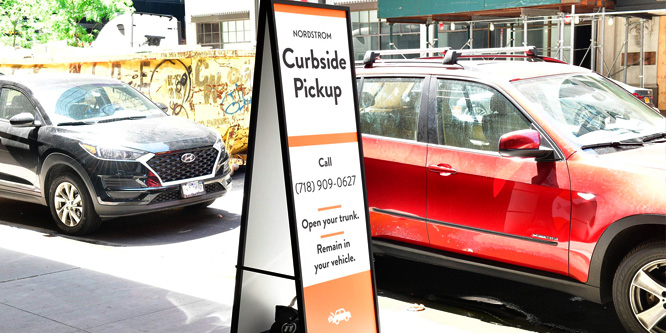

Photo: Nordstrom

Has a new, hybrid shopper emerged out of the pandemic?

A study from IBM in partnership with the National Retail Federation (NRF) shows hybrid shopping — mixing physical and digital channels in shopping journeys — is on the rise as shopping habits adopted out of necessity during the pandemic become routine.

Some examples of hybrid shopping offered in the report include buying in-store and shipping/delivering to home, and buying online and picking items up curbside. The findings also reflect how the discovery process increasingly involves multiple digital, mobile and in-person touchpoints.

A global survey of more than 19,000 respondents across 28 countries in September

2021 as part of the study found hybrid shopping is the primary buying method for 27 percent of all consumers and 36 percent of Gen Z (more than any other generation).

The hybrid preference varies by product category. So far, the home category was found to be farthest along in the evolution to hybrid shopping, with 40 percent of survey respondents saying hybrid is their primary buying method. That compares to 25 percent for apparel and footwear, 22 percent for personal care and beauty, and 20 percent for grocery.

Hybrid shopping also depends on access and comfort with digital tools. Asked about digital tools they have used and plan to continue to use, the top answer in the global survey was self-checkout, cited by 58 percent; followed by restaurant delivery, 56 percent; order online, pick up at store, 50 percent; mobile payment, 47 percent; and grocery delivery, 44 percent.

In a keynote address at the recent NRF Big Show Mike George, departing NRF chairman and former CEO of Qurate Retail, said that “the older generation reports that they are more comfortable now with buy online, pick up in-store, or pick up at curbside. They are more comfortable with online grocery ordering. There’s no turning back to the way things were pre-pandemic.”

84.51°, Kroger’s data analytics subsidiary, has similarly found that hybrid shoppers and e-commerce have doubled within the grocery channel versus pre-pandemic level, opening up opportunities to target different segments of online consumers. Barbara Connors, VP, Commercial Insights, 84.51°, said on a recent Supermarket News podcast, “This trend will continue to grow as adoption and trial continues to expand across different customer groups.”

- Retail Industry Reshapes with Hybrid Cloud and AI to Help Meet Shifting Consumer Shopping and Sustainability Preferences – IBM

- Consumers want it all: Hybrid shopping, sustainability, and purpose-driven brands – IBM

- Shifting behaviors: Hybrid shopping, purpose-driven consumers change retail’s outlook – Freight Waves

- NRF 2022 Welcome and Opening Remarks from Former Chairman Mike George – YouTube

- The 2021 US grocery shopper has adapted by embracing hybrid buying habits – 84.51°

- Tune into the podcast to learn more from 84.51° – Supermarket News

- Hybrid shopping: Retail’s big story this holiday season – Vogue Business

Discussion Questions

DISCUSSION QUESTIONS: In what ways did the pandemic inspire the rise of hybrid shoppers, and what uniquely new habits do you see? How would you define today’s hybrid shopper and what opportunities and challenges does the trend present to retailers?

The hybrid shopping model was coming – the pandemic just accelerated it. As we say at Incisiv, “digital is the front door to the store.” Because of this, retailers have to understand that their digital presence will have a major effect on the way shoppers behave. They also need to train associates to understand that a shopper will likely come armed with a lot more information on what they want and need to react to that. I see this more as an opportunity than a challenge – retailers made good progress in reaction to the pandemic, they now have to tweak and adjust to ensure the experience is consistent.

Great comment! “digital is the front door to the store.” I will add that the store does not have to be a physical space.

The pandemic has been a large driver of changing shopper behavior and expectations, and has encouraged retailers to experiment with new tech-enabled shopping possibilities. Probably the biggest impact was increasing comfort with online search and research of products, but I expect to see many retailers adding in-store e-shopping, gamification interfaces, real-time customer service, and other new types of interactions that will give the lie to retail being a dead or boring industry.

The term “rise of hybrid shoppers” is not accurate in my opinion. What the pandemic has caused is a simple acceleration of what was already underway. Forget about the division between offline and online. Everything will merge with endless, consumer-centric touchpoints and retailers need to re-adapt their model as soon as possible. Retail will transform into “consumer commerce.” This will be the future.

I completely agree – this was well underway and many retailers were already changing their model to adapt. This will just accelerate as the blurring between physical and digital continues.

You’re right, Chris. Movement was clearly in motion prior to the pandemic, but everything was accelerated. The leap to digital was made far more quickly by consumers than most retailers imagined leaving some flat-footed. Everything is merging into a seamless, frictionless experience … and consumer commerce is arriving quickly.

Hybrid, AKA omnichannel, shopping was on the rise prior to the pandemic that accelerated these shopping journeys. The pandemic spurred the greatest acceleration of hybrid shopping in the grocery segment, which lagged other segments. Hybrid shopping will continue to increase as retailers improve the seamless integration of digital and physical shopping journeys and more consumers appreciate the conveniences it brings.

The hybrid shopper is not a new phenomenon. For a long time, most consumers have blended physical and digital on their shopping journeys. The pandemic likely strengthened this, but the real thing it propelled was the response and innovation of retailers. 2020 and 2021 saw a flurry of activity as retailers offered more omnichannel services, such as curbside, and improved technologies and systems to cope with the integration. The challenge is that, for most retailers, things are not yet fully optimized. Automation, systems, customer services, store designs and so forth are all still catching up with the reality of how consumers shop.

The hybrid shopper has existed for a long time and has been steadily growing. I have written and spoken about this for many years now. And the retailers that embraced the blur of modern retail have done far better than those that haven’t. The pandemic absolutely accelerated this phenomenon, but the real lesson for retailers is the need to pay closer attention to evolving customer behavior and be proactive, not react when it becomes painfully obvious and you find yourself playing catch-up.

The pandemic just accelerated this trend, it was already there. Consumers showed us in studies in 2015 that BOPAS was a preferred method of shopping the digital and physical combo. The issue has been the slow motion with which most (not Walmart) retailers reacted to the consumer, waiting for a pandemic to make it a “have to have” vs. a “nice to have.” It would be great to finally see retailers (like Nike) try harder to get out in front of consumers for a change, like with work from home for example: how do you best service this new lifestyle other than with sweatpants?

Is “hybrid shopper” a new marketing term for omnichannel? IBM did bring us the marketing term “cognitive computing” to refer to artificial intelligence. Maybe this piece should be a question on whether we should move away from the label “omnichannel,” instead referring to it as “hybrid shopping.” Thanks for the comedy this morning.

Grocery shopping has forever changed and why not. Digital grocery has leaped ahead at least five years as has BOPIS, BOPAC and BOSFS. Getting customers in the store to shop is the challenge we all face going forward but, if you get them in, they will buy.

As far as in-store shopping goes, shoppers have become more self-aware about the social aspects of in-store shopping. Before COVID-19 started, who paid much attention to other shoppers except for making sure they didn’t grab that last bagel before you got to it? Now, anyone who believes there’s still a pandemic will likely notice if employees are masked, and the same for other shoppers. Masked shoppers have learned to avoid “unmasked” stores, and probably the reverse is true for the anti-mask minded.

The stats clearly highlight an interesting pattern, for instance, the less commoditized a product/category is, the more hybrid shopping will be involved. The pandemic forced people to work from home, which triggered a flurry of home improvement and home furnishing purchases. This activity inspired tons of hybrid shopping, as I can attest to doing this myself. Logically speaking, if someone is going to plunk down thousands of dollars on renovation or new furniture, they’ll want to conduct a lot more due diligence on product research in and out of the store vs. ordering groceries or sneakers online. This makes complete sense. Does this mean grocery retailers don’t have to invest as much on omni-experiences as a high-end home goods store? Clearly not, but WFH is here to stay and without those long commutes anymore, consumers are spending more time shopping in a hybrid fashion. Word of advice to all retailers, especially higher-end home product/category ones — always look for ways to improve and differentiate your omni-experiences.

Those retailers who spent years developing their omnichannel strategies — everything from more robust e-commerce sites to delivery options like BOPIS — were more prepared for the sudden disruptions of the pandemic. The other retailers who didn’t already adapt to a hybrid model were caught flat-footed.

The hybrid and digital-first customer movements gained momentum well before the pandemic. As we have witnessed, the pandemic served as a significant acceleration of emerging digital, social commerce, touchless, QR codes, microfulfillment, BOPIS, curbside, and same-day delivery solutions. A hybrid customer experience may be perceived as a challenge for retailers or brands. However this is a paradigm shift and a significant opportunity to shift a company’s operating models to a digital-first strategy.

Retailers and brands have become far more agile to accelerate their customer experience strategies across platforms. This has required an acceleration in shifting their operating models to meet the evolving and shifting consumer landscape. Time is of the essence, and business and digital transformations have become the top imperative to compete in the new landscape.

The hybrid shopping model has been here since the first time a shopper checked online for a price comparison in a store.

COVID-19 was the great accelerant. Especially for grocers. But this has been coming and actually present for a long time.

A long time? I have told the story before. Back in the 1950s, my aunt would order her weekly groceries by phone during the week. Every Saturday morning John Standard would come, from his grocery store, to her kitchen and unload the order on her kitchen table. (He would also have a cup of coffee.)

As with so many things in retail and otherwise, the pandemic has just accelerated what would be happening anyway. Without the pandemic, it would have developed slowly. The pandemic compressed that development and discovery for the shopper.

The trend is not necessarily BOPIS. The trend is time-saving and convenience. Anything to avoid going into the store. The retailers who recognize that will be the retailers of the future.

The pandemic inspired hybrid shoppers which was the catalyst that forced retailers of all sizes to take e-commerce seriously. In March 2020, my home wasn’t in Walmart’s delivery zone for e-grocery. Now Walmart and Instacart often save my caboose with same-day service.

Uniquely new habits include expecting more companies to cater to our instant needs. Food apps and now rapid delivery players shrink the gap between placing online orders and the arrival of goods at our doorsteps.

Hybrid shoppers are empowered to get what they want, when they want it and wherever they want it. Retail power has shifted to consumers.

The pandemic didn’t give rise to the hybrid shopper as much as it gave rise to retailers waking up to the fact that in order to remain relevant, they had to decisively up their game with frictionless e-commerce capabilities, delivery and curbside or in-store pick-up options, with each element intentionally designed around an optimal customer experience.

As many others have noted, the pandemic simply accelerated the trend that was already happening. It did, however, change some channel behaviors more than others – curbside being a good example of something that exploded with the pandemic and completely transformed the ways that a lot of retailers operated. It also impacted different retail verticals differently. One good example is grocery where people rarely compared prices online — now people can easily shop two grocers at once from the comfort of their homes and always select the better price. In all cases, the rise of the hybrid shopper offers greater flexibility for consumers and better opportunities for retailers to meet their needs. With the right analytics and strategies that better understand their evolving customer base across multiple channels, retailers have a greater opportunity to gain share and meet the challenges of this new reality.

Two years is a long time in retail. In such a dynamic area of business, many things change in that time. It is also a long time in terms of consumer behavior patterns. People may try something once and either like it or not. But after two years of having to buy in a different way, habits form and people get used to the new way of shopping be that online, buy online pick up in-store or curbside.

It is not great surprise therefore that these new hybrid shoppers have formed. Will their numbers continue to grow? That is a different matter. Certainly will they grow as fast as the last two years. We are now getting to a level where the ones not engaged in hybrid shopping are the diehards who will take a lot of convincing. That will change over time as a new generation grows up with it but that will not happen in the immediate future.

The pandemic didn’t “inspire” the rise of hybrid shoppers. It forced people to become hybrid shoppers. Consumers that had never bought “local” online started using their computers to order groceries, dinners, etc. This was going to happen eventually, but the pandemic forced early adoption of the concept that was already trending.

The opportunity for retailers in the hybrid world is to find ways to connect both in-person and online for the hybrid shopper. Data on these hybrid consumers will become more important than ever, and the technology that delivers that data is getting better.

Hybrid shopping was already on the rise pre-pandemic. The pandemic didn’t really accelerate much – outside of preventing customers from going to “non-essential” stores, forcing retailers to offer customers online options more substantively. Some shoppers bit. I expect to see a slight dip in online shopping rates – but still higher than pre-pandemic and a continued increase in hybrid shopping. Customers have been buying in-store after visiting a website for years now. Grocery and specific segments are where there may be some new shopping options. For instance limited-e-commerce focused categories such as jewelry might find new options where shoppers would be more open to influence from online – making the shopping experience more of a hybrid one.

We are on our way toward true Unified Commerce, where you treat the channel secondary to the transaction and experience. The pandemic drove heightened engagement with touchless retail — aka, mobile interface. What started as self-checkout and downloadable menus is now just part of the consumer option to shop where and when and however they want.

Retail has a way to go in defining hybrid shopping. Checking inventory/availability online and participating in drive-thru retail will remain and digital price checking in stores will continue to excel. The main challenge will be for retailers to maintain a reason for their store base and how they personalize merchandising and drive impulse.

Hybrid grocery shopping didn’t emerge out of COVID. It was already taking place before the pandemic.

Folks shopped in the supermarket, but also signed up for Amazon’s Subscribe & Save program. For example, with a few key strokes folks had household items, pet supplies, paper goods, and some non-perishable grocery items shipped to their home on a monthly schedule. That is hybrid shopping.

No question, there is no turning back. The consumer has shown themselves to be highly adaptive and willing to opt-in in order to get their needs met. Mobile apps will continue to be the channel of choice for consumers to shop, order and support their fulfillment needs.

The retail as well as food and beverage sectors must continue to offer differentiated value based on their mobile app downloads and reinforce continued use in order that it remains a highly relied upon access point.

I am troubled by restaurant chains that give benefits exclusively to diners who frequent their chain only if they order and pay through the app. Offering value to the exclusion of others primarily driven by mobile app adoption is on the face of it exclusionary and, from a recognition and reward standpoint, foolish. Those who do not opt-in should not be penalized or get less from the chain — they could easily be of equal or more value than their mobile-engaged counterparts.

Hi everyone! I’m one of the co-authors — great to see all your comments. JSYK, we agree that hybrid shopping has been around for a while, and we don’t claim to have coined the term (IMO, Steve Dennis deserves the HT for that). Our study attempted to quantify how consumers shop today — globally, across age groups, and within key product categories — in a manner that hadn’t been done before. We were a bit surprised to see that hybrid (defined as a means of buying that involves both digital and physical, e.g. BOPIS/BOPAC) was the primary buying method for so many — especially the 20% who primarily groceries this way. And similarly, that Gen-Z appear to be the first hybrid-native generation (36% primarily buy “hybridly;” the highest of any age group).

As a response, retailers and brands need to work on their omnipresence (The Everywhere Store more than The Everything Store) and make it easier for customers to research, shop, buy, receive, and return across touchpoints/channels. And many have a lot of work to have their stores be a bigger part of omnichannel and catch up to customers’ expectations.

Please email or DM me on LinkedIn if you’re interested in a deeper dive.

BTW, the other two themes (Purpose-Driven Consumers and Sustainability) also had some notable findings and implications.

This sounds like a new way to coin something that has been happening long before the pandemic: omni-channel shopping. This is not new behavior. Leading retailers have long acknowledged that the omni-channel shopper is their most valuable shopper.

Perhaps today there are more channels. Still, consumers move seamlessly between channels now more than ever before. When the point of purchase is wherever you want it to be, whenever you want it to be, omni-channel — or hybrid — is the new normal. It has been for some time.

Some of these hybrid campaigns were already being tested, such as Amazon lockers, but the pandemic has certainly fast tracked consumer adoption. It remains important to focus on convenience and meeting customers where they are. Smaller format stores, like Target city stores, and even brands like Bonobos with the try in-store are also tied to this trend and will continue to expand.

For grocery shopping, shoppers are leading and retailers are playing catch up. Once you teach shoppers they don’t have to stand in line for their stock up order, they won’t. I compare it to visiting a bank. You don’t do it unless you absolutely have to.

In the case of supermarkets, the store visits of hybrid shoppers are often for fresh and other self-selected items. The heavy lifting (sometimes literally) is done online. Online baskets are larger. But don’t get too excited. That higher spending is often more multiples, more larger sizes, sometimes a higher percentage of premium items and less frequent purchasing. So it’s a convenient stock up task, not a shopping trip.

Supermarket retailers are playing catch up on getting basic ecommerce right. Something that we take for granted in ecommerce — order 27 grocery items and get the 27 items you ordered delivered — is still a dream for supermarkets to execute. The inability to fulfill orders is created by fulfilling orders from the ever changing store floor. You just don’t know what will be there when those pickers hit the store.

A closed automated fulfillment system solves the known available inventory issue but some grocer’s online ordering apps don’t have a place for inventory available. That’s a problem. The, “only 2 left order now” message isn’t possible. Neither is removing known out of stock items to prevent disappointment. Consider the upside if every only supermarket order was completely fulfilled as ordered. 10 – 20% more sales in just getting that right.

And then there’s online promo. If the hybrid shopper profile is re-order online, promo items will be a pleasant surprise not a purchase influencer. In store still offers more and more impactful ways to make an impression.

Much to do in e-grocery. Shoppers are providing the clues.

We all knew hybrid shopping was the future but the pandemic has accelerated it in a myriad of ways.

After the pandemic, customers (be it Gen Z or Millennials) find digital channels increasingly convenient. They enjoy ordering products from the comfort of their home and expect more retailers to bring the stores to them and offer unified retail experiences like self-checkout, digital fitting rooms, etc.

Sitting at home, customers got into the habit of browsing more and discovering new products and brands every time they are on their mobiles. Brands, by showing more diverse products in customers’ feeds, are able to acquire new customers and increase conversions.

Increased browsing by customers also led retailers to improve their targeted ads and hyper-personalize their recommendations. This triggered customers to try new products and visit stores to build meaningful relationships.

Today’s hybrid shoppers are more informed and aware of the products. Before shopping, they verify from reviews on eComm, websites, and social media communities. This, in turn, provided retailers with the opportunity to initiate impactful marketing campaigns, reduce marginal costs and increase net worth and drive transparency and trust.

Speaking of challenges, quite a lot of retailers are still engaged in the legacy sales approach and not adapting to the marketing-led approach. To sustain the competitive advantage, these brands must be digitally native brands and adopt omnichannel initiatives like BOPIS, curbside pickup, etc. It’s no longer a choice.

The pandemic really accelerated hybrid shopping — giving scale to a trend that was already in its infancy. It’s important to note that this isn’t an either/or situation. Rather, we’re seeing a blended modality in which shoppers might be discovering products online and going in-store to purchase them or vice versa. Really, what’s interesting now is the way discovery and shopping are linked between on and offline platforms. As brands learn how to better facilitate discovery online, that’s where we’ll see the true opportunity emerge.