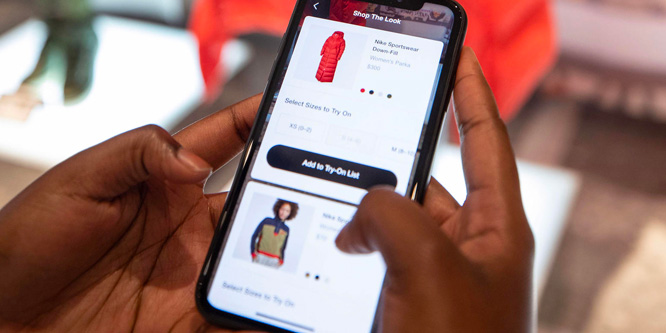

Photo: Nike

Nike heads to the wholesale exits

Nike has communicated its major “account pivots” as part of its marketplace realignment that reduced the number of wholesale partners worldwide over the last four years by more than 50 percent.

Nike last year in the U.S. stopped selling to six retailers: Big 5 Sporting Goods, DSW, Dunham’s Sports, Olympia Sports, Shoe Show and Urban Outfitters. It also no longer sells apparel to Macy’s. In 2020, cut offs included Belk, Bob’s Stores, Boscov’s, City Blue, Dillard’s, EbLens, Fred Meyer, VIM and Zappos.

For the current year, Nike’s sales will be reduced to 55 percent of Foot Locker’s sales by the fourth quarter and continue at that level into 2023, down from 65 percent in the 2021 fourth quarter.

Nike has said the overall wholesale overhaul was designed to shift away from “undifferentiated” retailers, although many industry insiders believe the main priority is accelerating growth of its direct-to-consumer business.

In the third quarter ended February 28, Nike’s direct sales grew 17 percent to 42.2 percent of sales against 38.5 percent a year ago, led by 54 percent digital growth. Wholesale sales were up one percent.

“Wholesale partners play an integral role in our future marketplace, first, to authenticate our brands, and then to create scale of distribution through a consistent consumer experience across a larger retail footprint,” said Matt Friend, CFO, last week on a quarterly analyst call.

Mr. Friend said the new structure will require Nike “to also invest with our partners in their consumer experiences so that the consumer has a premium consistent experience” regardless of where they’re shopping.

An example of elevated collaboration cited was a program introduced last fall that allows loyalty members from Dick’s Sporting Goods and Nike to link accounts. Via the Dick’s mobile app, customers can browse member-exclusive Nike product and participate in high-heat drops.

Also cited was a collaboration with the Social Status sneaker boutique to develop unique silhouettes of Jordan and Dunk products, as well as produce content on SNKRS Live, Nike’s live-streaming platform.

Mr. Friend said, “We are committed to driving growth with partners like this as they create authentic, deeply connected consumer concepts in key cities and communities around the world.”

- Nike, Inc. Reports Fiscal 2022 Third Quarter Results – Nike

- Nike, Inc. Q3fy22 Earnings Call Unofficial Transcript – Nike

- Nike (NKE) Q3 2022 Earnings Call Transcript – The Motley Fool

- Will linked loyalty programs turn Dick’s and Nike into an unbeatable force? – RetailWire

- Will Foot Locker be better off long-term with fewer Nike shoes on its shelves? – RetailWire

Discussion Questions

DISCUSSION QUESTIONS: Is the bigger reason behind Nike’s wholesale reset likely exiting “undifferentiated” retail partners or expanding direct channels? Does shrinking wholesale accounts in digital-led direct-to-consumer shifts make sense for many other brands?

“Exiting undifferentiated retail partners” seems like a euphemism for “I don’t have direct control of the customer experience in this retailer” – and every retailer should be worried about that, with Dick’s as a counter-example of how to potentially work more closely with the brand to create the sought-after differentiated experiences.

But I do question whether other brands can follow in Nike’s footsteps. This is the result of years’ worth of effort investing in brand recognition and building out its own DTC channels. Another brand, without the same level of investment, is not likely to enjoy the same success as Nike in making these kinds of moves. Don’t look to the outcome as the strategy, look to the long road it took to get here.

I think it’s a baloney idea. I get that Nike is doing well, but they have pivoted so many times in the past decade, I’ve lost track. It’s not failing fast. It’s burning money.

Same product in the same type of retailer. I can understand the rationale in cutting the number of wholesalers. I hope they can continue to work on the shopping experience to continue their growth.

The power of Nike’s branding and mass appeal allows the company to move towards a stronger DTC business. Not all companies can go at it alone with fewer retail partners so it is a playbook that should be cautiously copied. The reset of wholesale is simple: have control over product distribution and pricing, build deeper loyalty with strategic partnerships and provide better shopping experiences for the customers. Nike is a pioneer in the space of pivoting from being a wholesale brand to becoming a brand with supremacy — online, in-stores and in the metaverse. A true immersive experiential brand.

“Is the bigger reason behind Nike’s wholesale reset likely exiting ‘undifferentiated’ retail partners or expanding direct channels?” It’s both. With an emphasis on “undifferentiated” retail partners. Great businesses make tough (but well thought out) business decisions. We see that in action here.

Nike’s strategy is interesting here – on one hand, it makes sense to clean up their portfolio, particularly if they believe a retailer wasn’t serving the brand well. But in today’s days of heavy competition, consumer eyeballs on the brand anywhere and everywhere is typically beneficial.

Nike is one of the very few iconic brands in the world that have the resources, clout and cachet to make this kind of shift in strategy and still grow in revenue and brand equity among consumers. I’m sure their leadership has conducted exhaustive analysis and they believe there is more upside in the future with a direct approach vs. legacy wholesale. Can other brands copy this strategy and win? I think the list of those who can is a very short one.

I’m with Nikki. Nike has spent years reinforcing its brand identity, reimagining stores, and connecting with customers through the app. It has cemented its reputation as an icon, and it is hard to imagine its competition achieving the same.

Cathy, the problem is that it has reimagined its stores about four times in 10 years. I don’t think that’s failing fast. I think it’s burning money.

Nike has the brand clout to be able to stand alone, but I’m not sure other brands have that luxury unless they started that way, like a Lululemon. Even features on social media from Nike, like Instagram shop ads, when clicking direct you to download the Nike DTC app versus redirecting to a store. They are working to build their DTC channels.

Nike’s move is smart and aligned with their strategy of getting closer to their customer. Learning about what they want, how they want to engage with the brand, why the wholesaler is important to them, etc.

It’s all about the data and driving insights to make better product decisions. It’s the right move and other brands should start to do the same – to revisit their wholesale partners, to help connect customer data and to engage in deeper shopper relationships. Shrinking wholesale accounts makes sense for other brands if their brand is diluted in the market and if wholesale accounts are not true partners (sharing customer insights).

Nike’s continued shift to DTC is allowing them to move faster with introducing new and fresh styles into market; however without the tyranny of multi-tier wholesale supply chains to reach retail customers. Their customization capabilities have undoubtedly provided many lessons on small batch profitability and manufacturing speed, which will support their DTC shift. Very few brands, outside of luxury, could pull this off.

Nike controls their own destiny. Brand love, experiences, exclusivity and yes profit margin are the driving forces. Undifferentiated is a nice way of saying we don’t need you and you cannot satisfy our brand experience standards. Unfortunately, for many brand lovers they have to work harder to get the product they want unless making a shift to direct from manufacturer order placement – which is exactly what Nike wants.

Nike’s expanded wholesale world is a gigantic, impossible to control grab-bag of branding, marketing, pricing, availability, distribution to consumer, and on and on. DTC is the only way to fully control customer experience, and the only way to align Nike’s spectacular marketing machine directly with shoppers. The concept of a wholesaler or “middleman” pre-dates the public’s ability to interface one-on-one with a brand, and is increasingly less important for manufacturers who can use e-commerce to close that gap.

The key move is clearly a shift to “direct” channels, where Nike has more control, more profits, and offers a clear marketing package. At the end of the day, this translates into a better online exposure and presence for Nike, which is where retail is moving both now and in the future.

It’s much harder to answer the first two questions — only Nike knows their true motives (and not even they are 100% sure how things will turn out) — than the last: very few brands have such equity that they can afford to give up their wholesale channels in a DTC effort.

Nike’s arrogance to dismiss traditional retail outlets (as wholesalers) on one hand, is not unfounded based upon perceived brand strength — they are the only brand that could legitimately attempt this drastic move.

On the other hand, what they are really signaling is a move to be come a luxury brand, not an everyday, commodity item. That is in essence of what a luxury brand is all about — limited access, availability, personalization, perceived value — in this case in the sneaker and sports apparel market.

Otherwise, it could be seen as a foolish move to expect that local sports teams will bend a knee to Nike and cutting off easy access to BASIC soccer, football, baseball, volleyball, shoes, jerseys, gloves, etc. Leaves lots of room for Under Armor, Wilson, and others to pick up the “everyday sporting goods and apparel” Nike exit.

I’m an investor in Under Armor today, not Nike. 😉

Seems like they are strongly pivoting to become a luxury brand (and honestly have at some level, been for years) – BUT NOW acting like one – exclusivity, less sales revenue, but at higher prices and steeper margins.

Regardless, it is a bold and risky move to abandon soccer moms and the middle class to seek exclusivity and scarcity status to appeal to the few, not the many.

Nike’s model is not sneakers for everyone, but sneakers for those who want to be someone. All their merchandise and branding alliances with sports celebrities are driving them that way. Switching to mostly direct sale plus special collaboration with specific retailers that bring something to the table other than volume make sense for Nike.

I feel that it will be wrong to put Nike’s moves in either “exiting undifferentiated retail partners” or “expanding direct channels” basket. The brand has always focused on identifying the needs of the customers and then doing whatever it takes to meet them. Through their constant experiments, Nike not only knows their customer’s preferences but also things they particularly despise. But unfortunately, ensuring a consistent and differentiated customer experience when customers shop with the wholesalers is harder than it seems. So the only logical way out is to expand their direct channels and continue with partners who are as customer-centric as Nike.

Speaking of D2C expansions, it does make sense for all those brands who are dedicated to understanding their customers and are capable enough to come true to the expectations of their customers.

Nike as a global super brand occupies a unique space, and it’s simply taking control of the brand’s narrative by disrupting its relationship with consumers before another entity — or consumer behavior, does it for them.

Very few brands live in that unique space and fewer have the variables that would allow them this type of “reset.”