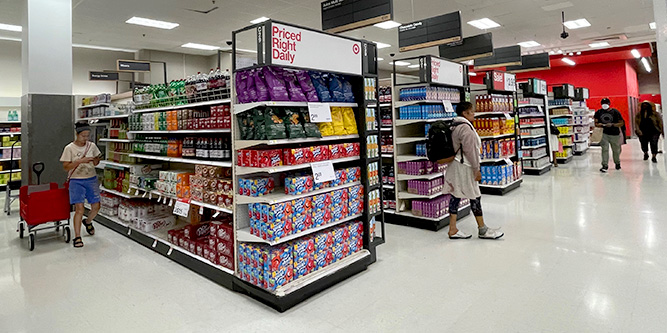

Photo: RetailWire

Will Target’s ‘commitment to newness’ continue to drive growth?

Target’s fourth quarter was not as strong as Brian Cornell and company would have liked, but the retailer did post its twenty-third straight quarterly same-store sales gains.

The retailer needed discounts to achieve its 0.7 comp gain even as traffic grew 2.1 percent. That experience, paired with the concern that inflation and other economic variables will continue to focus consumers’ attention on purchases of lower-price necessities, led Target to temper its expectations for 2023.

Mr. Cornell, speaking this week on a call with analysts, touted Target’s flexibility and core business strengths as reasons to believe that the retailer would continue to outpace the competition.

He pointed to Target’s continuing investments in private brands, store-within-a-store partnerships and customer loyalty as differentiating factors for the chain.

“We believe our commitment to newness is a key reason why we continue to generate traffic growth and why we drove broad unit share gains last year,” said Christina Hennington, Target executive vice president, chief growth officer.

“Our owned brands have long been a source of pride and differentiation for Target, offering great style and quality, all at incredible value. So, it’s no surprise that our owned brands have continued to outpace total enterprise growth and why we have plans to launch new or extend assortments in more than ten owned brands this year,” she said.

Target’s partnerships with Apple, Disney, Starbucks and Ulta Beauty have succeeded, and the chain continues to expand the store-within-a-store concepts.

“Last year’s sales from Ulta Beauty at Target were more than four times higher than in 2021, and this growth was almost entirely incremental,” said Ms. Hennington.

The retailer believes it is only scratching the surface of the potential of its Target Circle loyalty program. Circle members spent three times more than non-members during the holiday season.

“Whether searching for an item or browsing for inspiration, we continue to elevate their (Circle members) experience, providing personalized and relevant content using our incredible data and guest insights. This will include more customized home pages, improved search functionality, and even more personalized offers,” said Ms. Henington.

Discussion Questions

DISCUSSION QUESTIONS: Do you agree that Target’s “commitment to newness” is critical to its shopper traffic and sales growth? Where do opportunities for the chain to build upon existing strengths to make incremental gains?

I agree that Target is better than most at generating newness, especially through the development of its own brands. However I do not agree that Target has been consistently great on newness for the past year. In some areas like beauty and parts of apparel, it has done a sterling job with the introduction of new brands and collections. These areas have outperformed. However in other categories – such as home and menswear – the offer has not really evolved and Target is simply churning out modest variations of products that have been produced before. From our data, satisfaction and interest in these areas have fallen and sales are also very sluggish. Hopefully Target will get fully back on track in the year ahead.

Neil,

I agree on the menswear comment. I used to go to Target to find cool and new clothing for work purposes but in the past few years it has been a rehash of items in different colors or fabrics. I do hope they address this in the future.

One more comment: I don’t know how much the newness will help overcome the decrease in discretionary spending that retailers are seeing from shoppers. I see that as a major hindrance of their new direction — at least for the short term.

Despite the uncertain and shifting market, Target has continued to perform well – this will continue. The commitment to newness is an important part of the strategy as it is an important catalyst to drive traffic into their stores. Traffic creates sales opportunities. As noted, remaining committed to their private brands, strategic partnerships and focus on execution are the keys to their continued success.

Though the quarter wasn’t as strong as desired, a consistent growth story is especially impressive during these tough economic times. Target has a long, successful history of aspirational collaborations and innovative brands, so it’s smart to continue to lean into that. There’s a widespread brand affection for Target that is pretty much unmatched and the private labels plus the collaborations are a key aspect of that. I would also expect Target to build its app up even more given how crucial its loyalty program is to retention and growth. The app is one of the few shoppers really understand the value in, so why not elevate its capabilities even further?

“Twenty-third straight quarterly same-store sales gains.” That’s a perfect mic-drop!

Yes! Absolutely! It’s one of their best differentiators from Walmart and a must to attract young shoppers used to an ever changing digital world. Target has done a great job of forging strong partnerships to provide new product and brand experiences, particularly in key consumable areas such as personal care and beauty. I look forward to seeing more growth in this space.

Yes, yes, yes. Customers are always looking for inspiration, so assortments need to be refreshed and new merchandise needs to come in. Target has been accomplished at this. Keep up the great work.

Tempered expectations are simply the responsible approach in this market. It would be beyond foolish to overbuy — again — in this environment. Target is protecting their profitability while also delivering on their brand promise of continually offering both most-wanted national brands and well-executed owned brands. The skill with which Target executes their owned brands is building them a deep and wide moat between them and their competitors. Kohl’s has an almost impossible task in trying to catch up.

Commitment to newness, being trend-right in its segment of the retail business — these have always been central to the Target brand. (The nickname “Tar-zhay” began sixty years ago when the company only had stores in the Twin Cities.) I wouldn’t expect every new initiative to succeed, especially in a challenging economic environment, but I would expect Target to stick to its cultural roots.

Let’s be realistic about Q3. A dollar gain of 0.7 percent in same-store sales in a quarter of 7.7 percent inflation is no gain at all. Can we start being realistic about performance?

I wonder how long it took for Mr. Cornell’s team to come up with what sounded like a positive call.

Target’s commitment to newness is embedded in its merchandising strategy for food and home. This strategy needs to be clearer across apparel.

In some categories there is too much newness like in women’s apparel. Women’s athletic has a clear POV but fashion has always been a “let’s be everything to everyone” strategy. Menswear is light in SKUs and needs some excitement. It would be ideal to see more consistency in the merchandising strategy from a seasonality perspective. Seasonless core products that customers can count on trickled with newness that delights the shopper. Learning why the guest shops Target apparel and what they want to buy from the brand is critical. This guest-centric merchandising strategy seems clearer across food and home.

“Menswear…needs some excitement” = understatement. Target menswear is taking too many merchandising cues from Gap.

I literally just gave a presentation on the newness mandate. At its core, Target’s brand is newness and that’s why inventory pile-ups and supply chain snags are so deadly for the retailer. Target was smart to take strong action, even though it dinged results. The good news is that Target has diversified beyond designer partnerships to keep things fresh. Solutions and services, private brand revamps, and non-fashion hookups are fueling a new era of newness for Target that should pay off for the long term.

The updated Target store near my house had its soft reopening in November 2022, “new” is a good way to describe it. Everything inside its four walls was renovated, and for the first time Target played music.

Four months later new is still the best way to describe the store. Merchandise, displays and products are continually changing. This, of course, makes it a fun place to shop. It’s also the key to keeping shoppers interested. When the store and what it sells looks this good people tend to want to come back more frequently.

Target is an outstanding retailer. A problem in their stores seems to be busted assortments and out-of-stock goods, creating too much empty counter space that is holding odds and ends leftovers. It looks sometimes as some individual departments are out of business.

Target has aligned its offerings for the customer segment looking for best value for their money. The products offered by Target are of reasonably high quality available at much lesser prices than its competitors.

In my opinion, Target’s recent move with the store-in-store concept and other partnerships is a good strategy. Big brands have a strong presence to pull customer traffic on their own, so Target has an opportunity to generate more revenue with meaningful partnerships with these brands.

Additionally, a store-in-store concept will also allow Target to make available high-end items from other brands at one location, giving customers a premium in-store experience.