Source: Walmart

Will Walmart’s new tablet burn into Amazon Fire’s market share?

Tablet sales may have slowed down in recent years, but Walmart has apparently identified an opportunity within the category that it can leverage to drive sales. The retailer, Bloomberg reports, plans to roll out an inexpensive, child-friendly Android tablet under its ONN private label.

Apple, the undisputed leader in the category, appears least likely to feel an impact from Walmart’s new entry since its iPad fills the upper, premium end of the market. Amazon.com’s line of Fire tablets, which include models marketed with colorful, kid-proof cases, appears a more likely target. The Fire line, which also runs on Android, tends to be priced at the lower end of the tablet market.

Walmart’s move into tablets marks a significant addition to the chain’s ONN consumer electronics label. Products sold under the ONN brand include charging cables, headphones and a variety of accessories.

Walmart confirmed that it is working on a private label tablet although the company refused to share any further details after receiving queries from press outlets.

Discussion Questions

DISCUSSION QUESTIONS: Do you expect Walmart to follow an Amazon-like strategy and aggressively pursue developing its own tech products under the ONN brand? What impact will Walmart’s kids-friendly tablet have on Amazon and the category when it is introduced?

Adding tablets to its electronics line is a natural and overdue addition. But there’s nothing especially new about this – frankly, the tablet market is already mature and this addition will make no difference to Amazon or the category at large.

I can’t see this having much of an impact. The tablet market is now mature and sales growth has really slowed down over the past few years. Aiming at the market for kids is sensible in that there’s slightly better growth, but it also limits how much the tablet can be commercialized via links to Walmart’s selling functions. Maybe this is a test for bigger things, but my view is Walmart is late to the party on this.

If Walmart develops its own tablet, I don’t see it having a tremendous impact. Tablets have their place in the market for now, but in time we will continue to see less need for laptops and desktop computers as well as tablets. The phone will continue to become more of the driving force as we figure out how to put more and more information on smaller devices. The phone will continue to get faster and hold more data. The only thing the phone doesn’t provide is big screens; however, they can easily connect to a big screen via Bluetooth. Walmart is aware of all of this so how much they might invest in a short-term tablet is yet to be determined. If they can see a quick big win, they might go for it, but I doubt they will invest a significant amount of money on something that will not have long-term staying power.

Walmart is in full experimentation mode. This is both a major step forward compared to the sleeping bear they were five years ago, and refreshing. If it ends up being profitable, then I expect they will start developing more ONN brand tech products.

No. It’s not going to have an impact on Amazon’s sales in the first few months. It might not even have an impact in the first year… UNLESS Walmart does something Amazing (major price advantage, special super promo, major advertising, etc.). But if it takes off, then I expect in the long run (between two and four years), it will start to erode Amazon’s sales.

The tablet market is a pretty mature market at this point. Walmart’s opportunity is the price. They can probably sell a lot of units with an inexpensive price point, which is what consumers will expect in the Walmart stores. Will it be a contender in the long term over Fire? I don’t believe it will. Focusing on children is probably an open area that others have not. Primarily because it is a market that parents expect kids to grow out of, lose the device or break it. So the price needs to be considered a “disposable” price point.

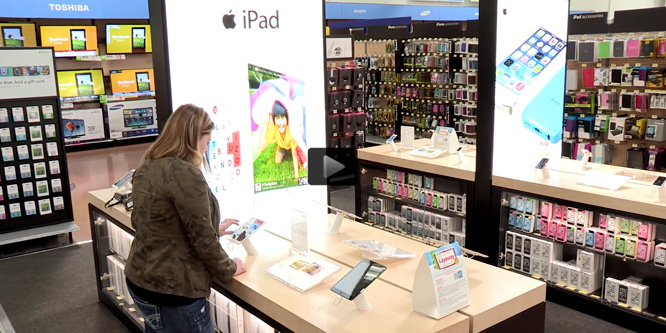

A key positive difference between the Walmart’s and Amazon’s tablet will be the ability to see and touch it in their stores rather than just read about it online. A key negative is that Walmart’s current foray into electronics is very limited and it is asking its customer to trust that it has the expertise to produce a comparable product. Amazon has a proven product in its Fire tablets. What the article doesn’t mention is the ONN tablet price. Priced right I see this as a potential winner for Walmart.

This feels like a low-profile stroll into a developed market. Certainly nothing earth shattering. It’s a way to begin to expand what the brand promise of ONN stands for. It’s a reach beyond accessories into what is probably higher margin territory. It’s a low-expectation, low-risk move versus trying to take on Apple or Samsung in a higher profile, sexier product. Sounds smart to me.

It is not surprising that Walmart is bringing out its own tablet. When kids use the tablet the Walmart ONN brand will be seen on the device for more brand awareness. The intent is for kids to think of buying products from Walmart instead of Amazon, especially when ordering online.

To view Walmart’s entry into the tablet market simply as a literal attempt to grab gadget sales misses the point. Just as Amazon’s stable of devices are gateways to its e-commerce, entertainment and service ecosystem, Walmart tablets may serve the same purpose. Walmart can pre-load any number of Walmart-friendly apps onto the devices that encourage shoppers to expand their relationship with Walmart. At the same time, private brands aren’t as prevalent in consumer electronics as they are in grocery, apparel, home and other categories so Walmart does have an opportunity to offer value. In general, Walmart is smart to swing attention back to consumer electronics once again. It’s an exciting category that never sleeps so retailers have to stay on their games if they are going to play.

The tablet market is more or less taken now, so while they will sell a lot of tablets Amazon probably won’t — if you’ll excuse the obvious pun — set the category on “Fire.” But there is a lot of money to be made pursuing a strategy of creative niche filling — targeting underserved subsegments of the technology market, rather than trying to storm the category.

And yes, Walmart is putting its toes in a lot of opportunity pools, so I expect them to keep experimenting around the edges of the tech product market, but again in a targeted, calculated way unlike say an Amazon.

The difference? Technology is Amazon’s business and profitably serving underserved markets is what made Walmart what it is.

If this just about tablets, it really isn’t a concern for Amazon. As we continue to meld our personal devices together, tablets as such won’t be a category. The concern should be focused on all electronics manufacturers.

Is this the first (and easiest) step for Walmart to test its way into their own electronics products? Each of us could go to an electronics manufacturer and market our own private label tablet. Phones, laptops and interactive devices are more complex. Is Walmart simply starting with something easy to determine if they have the resources and talents to play organically in this field?

Charles has the right point — it’s all about experimentation. You have to wonder, though, how Walmart will balance the upside against the low margins in hardware, the constant imperative to innovate, and the drag of product support. It may be disruptive, but lucrative? I doubt it.

Since so many of Walmart’s consumers have children, the market for the product would be there. Since so many of the families shopping at Walmart are on a budget, the price of the new tablet will need to be very low to entice these shoppers to purchase. Do these shoppers want their children spending time on a tablet? If yes, there is a market. If no, then the sales will be very low.

While I see this as part of a continuing foray into developing its own tech products under the ONN brand, the questions that remains are what significant differential does the Walmart kid-friendly tablet offer and what is the market maturity. Unfortunately, it appears that this is basically a me-too brand in a relatively mature market.

Have we forgotten that brand lives in the hearts and mind of customers — not in executive minds? Will customers give Walmart any value for creating this? No. Nothing about experiences with Walmart lead to the idea “they’re a great group to be making new electronics.”

As a result, Walmart is unlikely to make even a tiny dent in the market with this move. Many private labels can be very strong at Walmart but they have no consumer credibility when it comes to creating electronics.

This move, in fact, raises considerable concern for Walmart in my mind. They’ve made some smart moves recently. Not this one.

It’s pretty clear that Walmart is taking a “try-it-and-see” approach to innovation with lots of new initiatives being tested. As ever I’m sure this will be another learning exercise. I’m not sure the intention is to set the tablet market alight, but more using it as a testing ground. If customers respond favorably to a tablet under the ONN brand then we may well see other, more substantial items, follow. Likewise, Walmart may be exploring how it can automatically bring people into its ecosystem via electronics that tap into its services. What will be interesting to see is if the ability to try out the tablets in person before buying will have an impact on how many are sold, especially if it’s for kids. No-one knows instant gratification like a child and if they get their hands on one and want it then why would they want to wait for Amazon’s to be delivered?

Agree with others that have stated it’s all about experimentation (test & learn). Even if it fails (as Amazon has done many times), there will be insights and lessons learned that will provide valuable inputs into other areas of their business, or future plays. Hey, beyond children’s games, why not incorporate a Vudu app on this device, provide limited use downloads of content, movies for kids and families as well?

As many here have said, this is about experimentation, not for the tablet market, but for something greater that has yet to be revealed. The tablet market is a mature market. (Really it’s an iPad market with small leftovers — Amazon Fire tablets take up a special corner of this market and are all about consuming media/content from Amazon’s ecosystem than anything else).

Walmart will not make a dent in tablet market share at any price point as consumers are not going to associate real value to a Walmart branded tablet. This has to be about experimenting with broader electronics via private label, and/or be about future media offerings Walmart may pursue to build their own ecosystem. Watch for Walmart to introduce these devices with some sort of content play to make it interesting.

An interesting move. Tesco launched their own branded tablet called “Hudl” about 6 years ago. I believe it did OK, but it was never clear what differentiated it from other cheaper tablets, in addition Tesco did not seem to monetise it (via ordering, content or data collection) in the way Amazon does. It would be interesting to understand if they have attempted to learn lessons from Tesco’s experience.